View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Global Investment Outlook • Eric Lascelles • Daniel E. Chornous, CFA • John Richards<br />

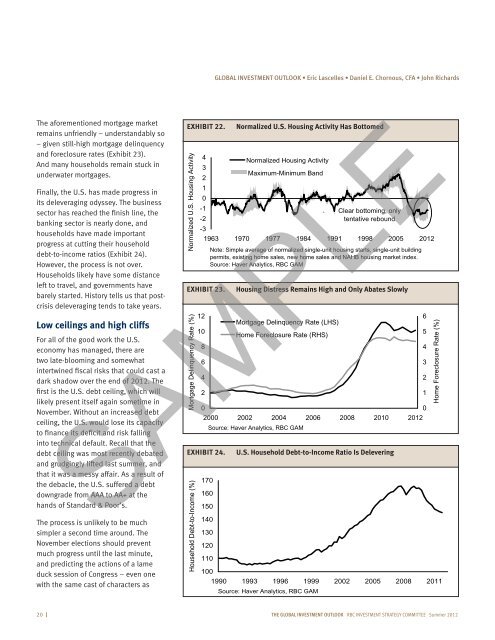

The aforementioned mortgage market<br />

remains unfriendly – understandably so<br />

– given still-high mortgage delinquency<br />

and foreclosure rates (Exhibit 23).<br />

And many households remain stuck in<br />

underwater mortgages.<br />

Finally, the U.S. has made progress in<br />

its deleveraging odyssey. The business<br />

sector has reached the finish line, the<br />

banking sector is nearly done, and<br />

households have made important<br />

progress at cutting their household<br />

debt-to-income ratios (Exhibit 24).<br />

However, the process is not over.<br />

Households likely have some distance<br />

left to travel, and governments have<br />

barely started. History tells us that postcrisis<br />

deleveraging tends to take years.<br />

Low ceilings and high cliffs<br />

For all of the good work the U.S.<br />

economy has managed, there are<br />

two late-blooming and somewhat<br />

intertwined fiscal risks that could cast a<br />

dark shadow over the end of 2012. The<br />

first is the U.S. debt ceiling, which will<br />

likely present itself again sometime in<br />

November. Without an increased debt<br />

ceiling, the U.S. would lose its capacity<br />

to finance its deficit and risk falling<br />

into technical default. Recall that the<br />

debt ceiling was most recently debated<br />

and grudgingly lifted last summer, and<br />

that it was a messy affair. As a result of<br />

the debacle, the U.S. suffered a debt<br />

downgrade from AAA to AA+ at the<br />

hands of Standard & Poor’s.<br />

The process is unlikely to be much<br />

simpler a second time around. The<br />

November elections should prevent<br />

much progress until the last minute,<br />

and predicting the actions of a lame<br />

duck session of Congress – even one<br />

with the same cast of characters as<br />

EXHIBIT 22.<br />

Normalized U.S. Housing Activity<br />

Normalized U.S. Housing Activity Has Bottomed<br />

4<br />

3<br />

2<br />

Normalized Housing Activity<br />

Maximum-Minimum Band<br />

1<br />

0<br />

-1<br />

Clear bottoming, only<br />

`<br />

-2<br />

tentative rebound<br />

-3<br />

1963 1970 1977 1984 1991 1998 2005 2012<br />

EXHIBIT 23.<br />

Mortgage Delinquency Rate (%)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

Note: Simple average of normalized single-unit housing starts, single-unit building<br />

permits, existing home sales, new home sales and NAHB housing market index.<br />

Source: Haver Analytics, <strong>RBC</strong> GAM<br />

Housing Distress Remains High and Only Abates Slowly<br />

Mortgage Delinquency Rate (LHS)<br />

Home Foreclosure Rate (RHS)<br />

0<br />

0<br />

2000 2002 2004 2006 2008 2010 2012<br />

Source: Haver Analytics, <strong>RBC</strong> GAM<br />

SAMPLE<br />

EXHIBIT 24.<br />

Household Debt-to-Income (%)<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

U.S. Household Debt-to-Income Ratio Is Delevering<br />

1990 1993 1996 1999 2002 2005 2008 2011<br />

Source: Haver Analytics, <strong>RBC</strong> GAM<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Home Foreclosure Rate (%)<br />

20 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012