View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Investment Outlook • Eric Lascelles • Daniel E. Chornous, CFA • John Richards<br />

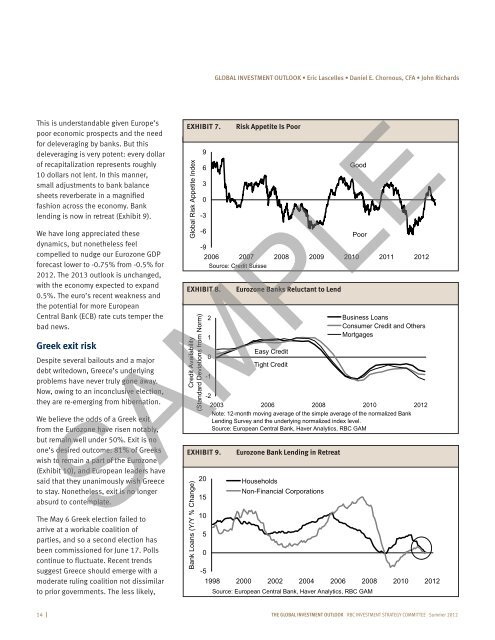

This is understandable given Europe’s<br />

poor economic prospects and the need<br />

for deleveraging by banks. But this<br />

deleveraging is very potent: every dollar<br />

of recapitalization represents roughly<br />

10 dollars not lent. In this manner,<br />

small adjustments to bank balance<br />

sheets reverberate in a magnified<br />

fashion across the economy. Bank<br />

lending is now in retreat (Exhibit 9).<br />

We have long appreciated these<br />

dynamics, but nonetheless feel<br />

compelled to nudge our Eurozone GDP<br />

forecast lower to -0.75% from -0.5% for<br />

2012. The 2013 outlook is unchanged,<br />

with the economy expected to expand<br />

0.5%. The euro’s recent weakness and<br />

the potential for more European<br />

Central Bank (ECB) rate cuts temper the<br />

bad news.<br />

Greek exit risk<br />

Despite several bailouts and a major<br />

debt writedown, Greece’s underlying<br />

problems have never truly gone away.<br />

Now, owing to an inconclusive election,<br />

they are re-emerging from hibernation.<br />

We believe the odds of a Greek exit<br />

from the Eurozone have risen notably,<br />

but remain well under 50%. Exit is no<br />

one’s desired outcome: 81% of Greeks<br />

wish to remain a part of the Eurozone<br />

(Exhibit 10), and European leaders have<br />

said that they unanimously wish Greece<br />

to stay. Nonetheless, exit is no longer<br />

absurd to contemplate.<br />

The May 6 Greek election failed to<br />

arrive at a workable coalition of<br />

parties, and so a second election has<br />

been commissioned for June 17. Polls<br />

continue to fluctuate. Recent trends<br />

suggest Greece should emerge with a<br />

moderate ruling coalition not dissimilar<br />

to prior governments. The less likely,<br />

EXHIBIT 7.<br />

Global Risk Appetite Index<br />

Credit Availability<br />

(Standard Deviations from Norm)<br />

9<br />

6<br />

3<br />

0<br />

-3<br />

-6<br />

Risk Appetite Is Poor<br />

Good<br />

Poor<br />

-9<br />

2006 2007 2008 2009 2010 2011 2012<br />

Source: Credit Suisse<br />

EXHIBIT 8.<br />

2<br />

1<br />

0<br />

-1<br />

Eurozone Banks Reluctant to Lend<br />

Easy Credit<br />

Tight Credit<br />

Business Loans<br />

Consumer Credit and Others<br />

Mortgages<br />

-2<br />

2003 2006 2008 2010 2012<br />

Note: 12-month moving average of the simple average of the normalized Bank<br />

Lending Survey and the underlying normalized index level.<br />

Source: European Central Bank, Haver Analytics, <strong>RBC</strong> GAM<br />

SAMPLE<br />

EXHIBIT 9.<br />

Bank Loans (Y/Y % Change)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Eurozone Bank Lending in Retreat<br />

Households<br />

Non-Financial Corporations<br />

-5<br />

1998 2000 2002 2004 2006 2008 2010 2012<br />

Source: European Central Bank, Haver Analytics, <strong>RBC</strong> GAM<br />

14 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012