View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Currency markets • Dagmara Fijalkowski, MBA, CFA<br />

U.S. dollar didn’t give back much of its<br />

strength.<br />

Why is the dollar a safe haven? Broadly<br />

speaking, because U.S. portfolio<br />

managers invest more money abroad<br />

than foreign investors invest in the<br />

U.S. Exhibit 7 shows a comparison of<br />

net international investment positions<br />

excluding reserve assets and liabilities,<br />

which are considered sticky assets.<br />

The U.S. is one of the three countries<br />

with net exports of investment capital.<br />

However, the other two, Japan and<br />

Switzerland, have been actively trying<br />

to limit the strength of their currencies.<br />

This means that in times of stress,<br />

U.S. investors bring their money home,<br />

strengthening the greenback in the<br />

process.<br />

The euro<br />

Despite the euro’s resilience early<br />

in the year, our base case for the<br />

currency remains bearish. For the time<br />

being, the stress manifests itself in<br />

intra-EMU flows, which lead to the<br />

outperformance of bunds versus bonds<br />

of peripheral countries. We have,<br />

therefore, seen relatively little impact<br />

on the value of the single currency. By<br />

March of this year, yields on 10-year<br />

bunds fell to unprecedented levels<br />

below 1.5%, and yields on 2-year<br />

German notes fell below comparable<br />

securities issued by Japan. We believe<br />

this resilience is temporary. With<br />

Eurozone problems heating up after<br />

the failed Greek elections, the ECB<br />

will likely find itself easing monetary<br />

policy, while the probability of the Fed<br />

engaging in QE3 has declined along<br />

with improvement in the U.S. economy.<br />

Two-year interest rate differentials<br />

reflect these expectations and suggest<br />

the euro will fall further (Exhibit 8).<br />

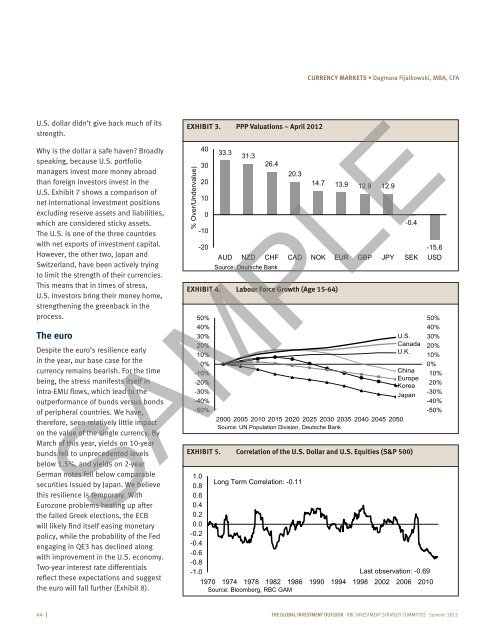

EXHIBIT 3. PPP Valuations – April 2012<br />

% Over/Undervalue)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

33.3<br />

31.3<br />

26.4<br />

20.3<br />

EXHIBIT 4. Labour Force Growth (Age 15-64)<br />

14.7 13.9 12.9 12.9<br />

2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050<br />

Source: UN Population Division, Deutsche Bank<br />

-0.4<br />

-15.6<br />

AUD NZD CHF CAD NOK EUR GBP JPY SEK USD<br />

Source: Deutsche Bank<br />

U.S.<br />

Canada<br />

U.K.<br />

China<br />

Europe<br />

Korea<br />

Japan<br />

SAMPLE<br />

EXHIBIT 5. Correlation of the U.S. Dollar and U.S. Equities (S&P 500)<br />

1.0<br />

Long Term Correlation: -0.11<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

-0.2<br />

-0.4<br />

-0.6<br />

-0.8<br />

-1.0<br />

Last observation: -0.69<br />

1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010<br />

Source: Bloomberg, <strong>RBC</strong> GAM<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

44 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012