View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Currency Markets<br />

Dagmara Fijalkowski, MBA, CFA<br />

Head, Global Fixed Income & Currencies (Toronto & London)<br />

<strong>RBC</strong> Global Asset Management Inc.<br />

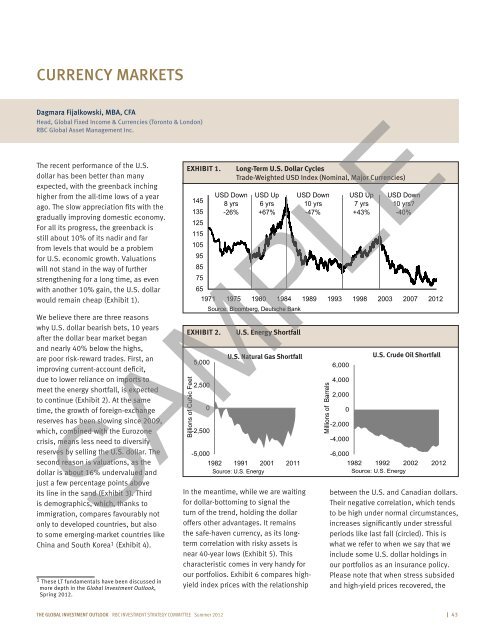

The recent performance of the U.S.<br />

dollar has been better than many<br />

expected, with the greenback inching<br />

higher from the all-time lows of a year<br />

ago. The slow appreciation fits with the<br />

gradually improving domestic economy.<br />

For all its progress, the greenback is<br />

still about 10% of its nadir and far<br />

from levels that would be a problem<br />

for U.S. economic growth. Valuations<br />

will not stand in the way of further<br />

strengthening for a long time, as even<br />

with another 10% gain, the U.S. dollar<br />

would remain cheap (Exhibit 1).<br />

We believe there are three reasons<br />

why U.S. dollar bearish bets, 10 years<br />

after the dollar bear market began<br />

and nearly 40% below the highs,<br />

are poor risk-reward trades. First, an<br />

improving current-account deficit,<br />

due to lower reliance on imports to<br />

meet the energy shortfall, is expected<br />

to continue (Exhibit 2). At the same<br />

time, the growth of foreign-exchange<br />

reserves has been slowing since 2009,<br />

which, combined with the Eurozone<br />

crisis, means less need to diversify<br />

reserves by selling the U.S. dollar. The<br />

second reason is valuations, as the<br />

dollar is about 16% undervalued and<br />

just a few percentage points above<br />

its line in the sand (Exhibit 3). Third<br />

is demographics, which, thanks to<br />

immigration, compares favourably not<br />

only to developed countries, but also<br />

to some emerging-market countries like<br />

China and South Korea 1 (Exhibit 4).<br />

1 These LT fundamentals have been discussed in<br />

more depth in the Global Investment Outlook,<br />

Spring 2012.<br />

EXHIBIT 1.<br />

Billions of Cubic Feet<br />

145<br />

135<br />

125<br />

115<br />

105<br />

95<br />

85<br />

75<br />

65<br />

-2,500<br />

USD Down<br />

8 yrs<br />

-26%<br />

Long-Term U.S. Dollar Cycles<br />

Trade-Weighted USD Index (Nominal, Major Currencies)<br />

USD Up<br />

6 yrs<br />

+67%<br />

USD Down<br />

10 yrs<br />

-47%<br />

USD Up<br />

7 yrs<br />

+43%<br />

USD Down<br />

10 yrs?<br />

-40%<br />

1971 1975 1980 1984 1989 1993 1998 2003 2007 2012<br />

EXHIBIT 2.<br />

5,000<br />

2,500<br />

Source: Bloomberg, Deutsche Bank<br />

0<br />

U.S. Energy Shortfall<br />

U.S. Natural Gas Shortfall<br />

-5,000<br />

1982 1991 2001 2011<br />

Source: U.S. Energy<br />

In the meantime, while we are waiting<br />

for dollar-bottoming to signal the<br />

turn of the trend, holding the dollar<br />

offers other advantages. It remains<br />

the safe-haven currency, as its longterm<br />

correlation with risky assets is<br />

near 40-year lows (Exhibit 5). This<br />

characteristic comes in very handy for<br />

our portfolios. Exhibit 6 compares highyield<br />

index prices with the relationship<br />

Millions of Barrels<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

-2,000<br />

-4,000<br />

U.S. Crude Oil Shortfall<br />

SAMPLE<br />

-6,000<br />

1982 1992 2002 2012<br />

Source: U.S. Energy<br />

between the U.S. and Canadian dollars.<br />

Their negative correlation, which tends<br />

to be high under normal circumstances,<br />

increases significantly under stressful<br />

periods like last fall (circled). This is<br />

what we refer to when we say that we<br />

include some U.S. dollar holdings in<br />

our portfolios as an insurance policy.<br />

Please note that when stress subsided<br />

and high-yield prices recovered, the<br />

The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012 I 43