View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Currency markets • Dagmara Fijalkowski, MBA, CFA<br />

have been much more meaningful had<br />

the loonie traded at cheaper valuation<br />

levels.<br />

Since many foreigners have added<br />

Canadian dollars and Canadian assets<br />

to their portfolios over the past few<br />

years, scrutiny of Canada’s fiscal<br />

position is now intense. Last year,<br />

Canada’s current account dipped into<br />

deficit for the first time in 20 years.<br />

While short-term portfolio inflows,<br />

mostly bond purchases, have more<br />

than offset the deficit, the inflows<br />

peaked eight quarters ago and the<br />

stability of the funding depends on<br />

whether Canadian bonds remain<br />

attractive to foreign buyers (Exhibit 13).<br />

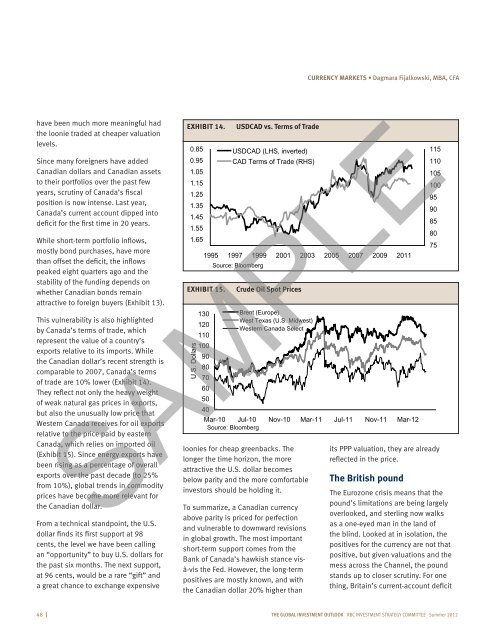

This vulnerability is also highlighted<br />

by Canada’s terms of trade, which<br />

represent the value of a country’s<br />

exports relative to its imports. While<br />

the Canadian dollar’s recent strength is<br />

comparable to 2007, Canada’s terms<br />

of trade are 10% lower (Exhibit 14).<br />

They reflect not only the heavy weight<br />

of weak natural gas prices in exports,<br />

but also the unusually low price that<br />

Western Canada receives for oil exports<br />

relative to the price paid by eastern<br />

Canada, which relies on imported oil<br />

(Exhibit 15). Since energy exports have<br />

been rising as a percentage of overall<br />

exports over the past decade (to 25%<br />

from 10%), global trends in commodity<br />

prices have become more relevant for<br />

the Canadian dollar.<br />

From a technical standpoint, the U.S.<br />

dollar finds its first support at 98<br />

cents, the level we have been calling<br />

an “opportunity” to buy U.S. dollars for<br />

the past six months. The next support,<br />

at 96 cents, would be a rare “gift” and<br />

a great chance to exchange expensive<br />

EXHIBIT 14.<br />

0.85<br />

0.95<br />

1.05<br />

1.15<br />

1.25<br />

1.35<br />

1.45<br />

1.55<br />

1.65<br />

U.S. Dollars<br />

USDCAD vs. Terms of Trade<br />

USDCAD (LHS, inverted)<br />

CAD Terms of Trade (RHS)<br />

1995 1997 1999 2001 2003 2005 2007 2009 2011<br />

EXHIBIT 15.<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Source: Bloomberg<br />

Crude Oil Spot Prices<br />

Brent (Europe)<br />

West Texas (U.S. Midwest)<br />

Western Canada Select<br />

Mar-10 Jul-10 Nov-10 Mar-11 Jul-11 Nov-11 Mar-12<br />

Source: Bloomberg<br />

SAMPLE<br />

loonies for cheap greenbacks. The<br />

longer the time horizon, the more<br />

attractive the U.S. dollar becomes<br />

below parity and the more comfortable<br />

investors should be holding it.<br />

To summarize, a Canadian currency<br />

above parity is priced for perfection<br />

and vulnerable to downward revisions<br />

in global growth. The most important<br />

short-term support comes from the<br />

Bank of Canada’s hawkish stance visà-vis<br />

the Fed. However, the long-term<br />

positives are mostly known, and with<br />

the Canadian dollar 20% higher than<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

its PPP valuation, they are already<br />

reflected in the price.<br />

The British pound<br />

The Eurozone crisis means that the<br />

pound’s limitations are being largely<br />

overlooked, and sterling now walks<br />

as a one-eyed man in the land of<br />

the blind. Looked at in isolation, the<br />

positives for the currency are not that<br />

positive, but given valuations and the<br />

mess across the Channel, the pound<br />

stands up to closer scrutiny. For one<br />

thing, Britain’s current-account deficit<br />

48 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012