Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

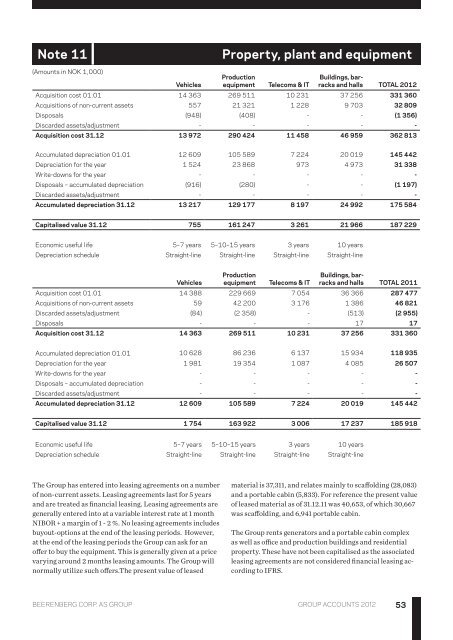

<strong>Note</strong> 11<br />

Property, plant and equipment<br />

(Amounts in NOK 1,000)<br />

Vehicles<br />

Production<br />

equipment<br />

Telecoms & IT<br />

Buildings, barracks<br />

and halls TOTAL 2012<br />

Acquisition cost 01.01 14 363 269 511 10 231 37 256 331 360<br />

Acquisitions of non-current assets 557 21 321 1 228 9 703 32 809<br />

Disposals (948) (408) - - (1 356)<br />

Discarded assets/adjustment - - - - -<br />

Acquisition cost 31.12 13 972 290 424 11 458 46 959 362 813<br />

Accumulated depreciation 01.01 12 609 105 589 7 224 20 019 145 442<br />

Depreciation for the year 1 524 23 868 973 4 973 31 338<br />

Write-downs for the year - - - - -<br />

Disposals – accumulated depreciation (916) (280) - - (1 197)<br />

Discarded assets/adjustment - - - - -<br />

Accumulated depreciation 31.12 13 217 129 177 8 197 24 992 175 584<br />

Capitalised value 31.12 755 161 247 3 261 21 966 187 229<br />

Economic useful life 5–7 years 5–10–15 years 3 years 10 years<br />

Depreciation schedule Straight-line Straight-line Straight-line Straight-line<br />

Vehicles<br />

Production<br />

equipment<br />

Telecoms & IT<br />

Buildings, barracks<br />

and halls TOTAL 2011<br />

Acquisition cost 01.01 14 388 229 669 7 054 36 366 287 477<br />

Acquisitions of non-current assets 59 42 200 3 176 1 386 46 821<br />

Discarded assets/adjustment (84) (2 358) - (513) (2 955)<br />

Disposals - - - 17 17<br />

Acquisition cost 31.12 14 363 269 511 10 231 37 256 331 360<br />

Accumulated depreciation 01.01 10 628 86 236 6 137 15 934 118 935<br />

Depreciation for the year 1 981 19 354 1 087 4 085 26 507<br />

Write-downs for the year - - - - -<br />

Disposals – accumulated depreciation - - - - -<br />

Discarded assets/adjustment - - - - -<br />

Accumulated depreciation 31.12 12 609 105 589 7 224 20 019 145 442<br />

Capitalised value 31.12 1 754 163 922 3 006 17 237 185 918<br />

Economic useful life 5–7 years 5–10–15 years 3 years 10 years<br />

Depreciation schedule Straight-line Straight-line Straight-line Straight-line<br />

The Group has entered into leasing agreements on a number<br />

of non-current assets. Leasing agreements last for 5 years<br />

and are treated as financial leasing. Leasing agreements are<br />

generally entered into at a variable interest rate at 1 month<br />

NIBOR + a margin of 1 - 2 %. No leasing agreements includes<br />

buyout-options at the end of the leasing periods. However,<br />

at the end of the leasing periods the Group can ask for an<br />

offer to buy the equipment. This is generally given at a price<br />

varying around 2 months leasing amounts. The Group will<br />

normally utilize such offers.The present value of leased<br />

material is 37,311, and relates mainly to scaffolding (28,083)<br />

and a portable cabin (5,833). For reference the present value<br />

of leased material as of 31.12.11 was 40,653, of which 30,667<br />

was scaffolding, and 6,941 portable cabin.<br />

The Group rents generators and a portable cabin complex<br />

as well as office and production buildings and residential<br />

property. These have not been capitalised as the associated<br />

leasing agreements are not considered financial leasing according<br />

to IFRS.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

53