Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

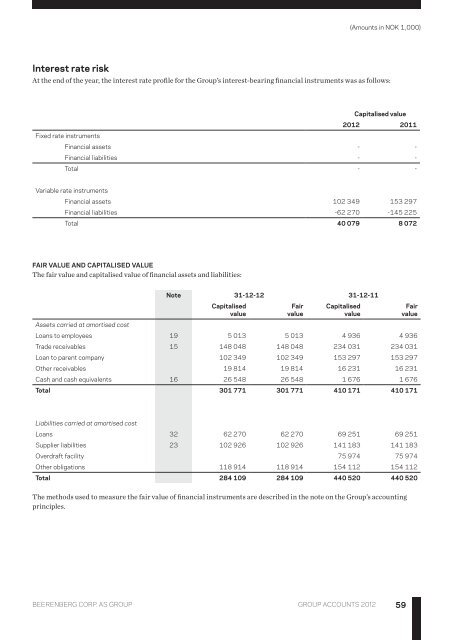

(Amounts in NOK 1,000)<br />

Interest rate risk<br />

At the end of the year, the interest rate profile for the Group’s interest-bearing financial instruments was as follows:<br />

Capitalised value<br />

2012 2011<br />

Fixed rate instruments<br />

Financial assets - -<br />

Financial liabilities - -<br />

Total - -<br />

Variable rate instruments<br />

Financial assets 102 349 153 297<br />

Financial liabilities -62 270 -145 225<br />

Total 40 079 8 072<br />

Fair value and capitalised value<br />

The fair value and capitalised value of financial assets and liabilities:<br />

<strong>Note</strong> 31-12-12 31-12-11<br />

Capitalised<br />

value<br />

Fair<br />

value<br />

Capitalised<br />

value<br />

Assets carried at amortised cost<br />

Loans to employees 19 5 013 5 013 4 936 4 936<br />

Trade receivables 15 148 048 148 048 234 031 234 031<br />

Loan to parent company 102 349 102 349 153 297 153 297<br />

Other receivables 19 814 19 814 16 231 16 231<br />

Cash and cash equivalents 16 26 548 26 548 1 676 1 676<br />

Total 301 771 301 771 410 171 410 171<br />

Fair<br />

value<br />

Liabilities carried at amortised cost<br />

Loans 32 62 270 62 270 69 251 69 251<br />

Supplier liabilities 23 102 926 102 926 141 183 141 183<br />

Overdraft facility 75 974 75 974<br />

Other obligations 118 914 118 914 154 112 154 112<br />

Total 284 109 284 109 440 520 440 520<br />

The methods used to measure the fair value of financial instruments are described in the note on the Group’s accounting<br />

principles.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

59