Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

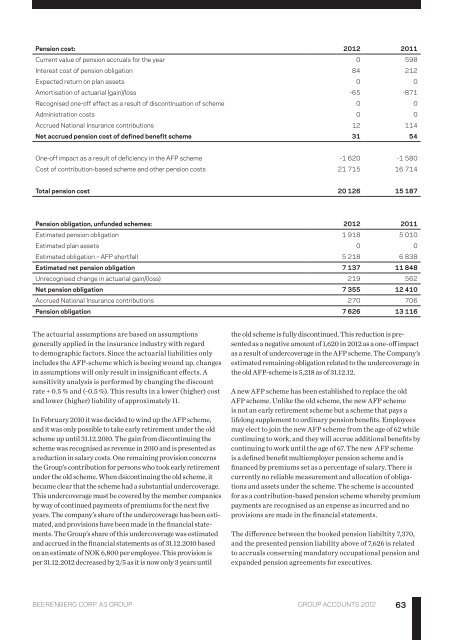

Pension cost: 2012 2011<br />

Current value of pension accruals for the year 0 598<br />

Interest cost of pension obligation 84 212<br />

Expected return on plan assets 0 0<br />

Amortisation of actuarial (gain)/loss -65 -871<br />

Recognised one-off effect as a result of discontinuation of scheme 0 0<br />

Administration costs 0 0<br />

Accrued National Insurance contributions 12 114<br />

Net accrued pension cost of defined benefit scheme 31 54<br />

One-off impact as a result of deficiency in the AFP scheme -1 620 -1 580<br />

Cost of contribution-based scheme and other pension costs 21 715 16 714<br />

Total pension cost 20 126 15 187<br />

Pension obligation, unfunded schemes: 2012 2011<br />

Estimated pension obligation 1 918 5 010<br />

Estimated plan assets 0 0<br />

Estimated obligation – AFP shortfall 5 218 6 838<br />

Estimated net pension obligation 7 137 11 848<br />

Unrecognised change in actuarial gain/(loss) 219 562<br />

Net pension obligation 7 355 12 410<br />

Accrued National Insurance contributions 270 706<br />

Pension obligation 7 626 13 116<br />

The actuarial assumptions are based on assumptions<br />

generally applied in the insurance industry with regard<br />

to demographic factors. Since the actuarial liabilities only<br />

includes the AFP-scheme which is beeing wound up, changes<br />

in assumptions will only result in insignificant effects. A<br />

sensitivity analysis is performed by changing the discount<br />

rate + 0.5 % and (-0.5 %). This results in a lower (higher) cost<br />

and lower (higher) liability of approximately 11.<br />

In February 2010 it was decided to wind up the AFP scheme,<br />

and it was only possible to take early retirement under the old<br />

scheme up until 31.12.2010. The gain from discontinuing the<br />

scheme was recognised as revenue in 2010 and is presented as<br />

a reduction in salary costs. One remaining provision concerns<br />

the Group’s contribution for persons who took early retirement<br />

under the old scheme. When dsicontinuing the old scheme, it<br />

became clear that the scheme had a substantial undercoverage.<br />

This undercoverage must be covered by the member companies<br />

by way of continued payments of premiums for the next five<br />

years. The company’s share of the undercoverage has been estimated,<br />

and provisions have been made in the financial statements.<br />

The Group’s share of this undercoverage was estimated<br />

and accrued in the financial statements as of 31.12.2010 based<br />

on an estimate of NOK 6,800 per employee. This provision is<br />

per 31.12.2012 decreased by 2/5 as it is now only 3 years until<br />

the old scheme is fully discontinued. This reduction is presented<br />

as a negative amount of 1,620 in 2012 as a one-off impact<br />

as a result of undercoverage in the AFP scheme. The Company’s<br />

estimated remaining obligation related to the undercoverage in<br />

the old AFP-scheme is 5,218 as of 31.12.12.<br />

A new AFP scheme has been established to replace the old<br />

AFP scheme. Unlike the old scheme, the new AFP scheme<br />

is not an early retirement scheme but a scheme that pays a<br />

lifelong supplement to ordinary pension benefits. Employees<br />

may elect to join the new AFP scheme from the age of 62 while<br />

continuing to work, and they will accrue additional benefits by<br />

continuing to work until the age of 67. The new AFP scheme<br />

is a defined benefit multiemployer pension scheme and is<br />

financed by premiums set as a percentage of salary. There is<br />

currently no reliable measurement and allocation of obligations<br />

and assets under the scheme. The scheme is accounted<br />

for as a contribution-based pension scheme whereby premium<br />

payments are recognised as an expense as incurred and no<br />

provisions are made in the financial statements.<br />

The difference between the booked pension liabiltity 7,370,<br />

and the presented pension liability above of 7,626 is related<br />

to accruals conserning mandatory occupational pension and<br />

expanded pension agreements for executives.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

63