Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Note</strong> 27<br />

Related parties<br />

(Amounts in NOK 1,000)<br />

In 2012 the Group conducted transactions with related parties<br />

as follows:<br />

<strong>Beerenberg</strong> Corp. AS has given a loan to its parent<br />

company <strong>Beerenberg</strong> Holding AS of 102,349. This has<br />

given <strong>Beerenberg</strong> Corp. AS interest income of 6,072 and<br />

<strong>Beerenberg</strong> Holding AS a corresponding expense. The loans<br />

are granted on terms according to arm’s length principle.<br />

Current interest rates are 12 months NIBOR + 2%<br />

<strong>Beerenberg</strong> Corp. AS and <strong>Beerenberg</strong> Holding AS have given<br />

loans to employees, cf. <strong>Note</strong> 19.<br />

Please see <strong>Note</strong>s 19 and 21 for details of loans, severance pay<br />

and other related matters.<br />

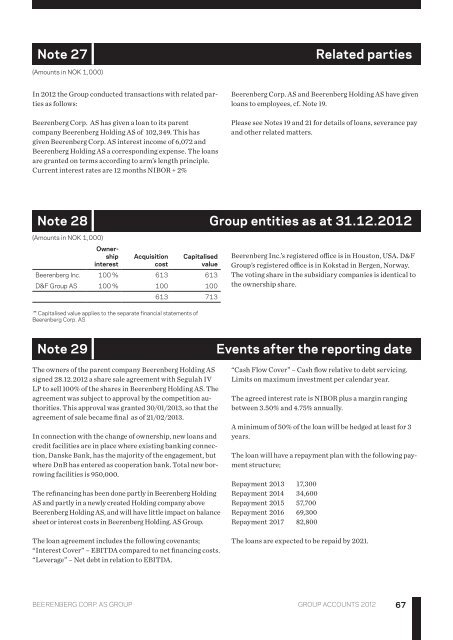

<strong>Note</strong> 28 Group entities as at 31.12.2012<br />

(Amounts in NOK 1,000)<br />

Ownership<br />

interest<br />

Acquisition<br />

cost<br />

Capitalised<br />

value<br />

<strong>Beerenberg</strong> Inc. 100 % 613 613<br />

D&F Group AS 100 % 100 100<br />

613 713<br />

<strong>Beerenberg</strong> Inc.’s registered office is in Houston, USA. D&F<br />

Group’s registered office is in Kokstad in Bergen, Norway.<br />

The voting share in the subsidiary companies is identical to<br />

the ownership share.<br />

** Capitalised value applies to the separate financial statements of<br />

<strong>Beerenberg</strong> Corp. AS<br />

<strong>Note</strong> 29<br />

Events after the reporting date<br />

The owners of the parent company <strong>Beerenberg</strong> Holding AS<br />

signed 28.12.2012 a share sale agreement with Segulah IV<br />

LP to sell 100% of the shares in <strong>Beerenberg</strong> Holding AS. The<br />

agreement was subject to approval by the competition authorities.<br />

This approval was granted 30/01/2013, so that the<br />

agreement of sale became final as of 21/02/2013.<br />

In connection with the change of ownership, new loans and<br />

credit facilities are in place where existing banking connection,<br />

Danske Bank, has the majority of the engagement, but<br />

where DnB has entered as cooperation bank. Total new borrowing<br />

facilities is 950,000.<br />

The refinancing has been done partly in <strong>Beerenberg</strong> Holding<br />

AS and partly in a newly created Holding company above<br />

<strong>Beerenberg</strong> Holding AS, and will have little impact on balance<br />

sheet or interest costs in <strong>Beerenberg</strong> Holding. AS Group.<br />

The loan agreement includes the following covenants;<br />

“Interest Cover” – EBITDA compared to net financing costs.<br />

“Leverage” – Net debt in relation to EBITDA.<br />

“Cash Flow Cover” – Cash flow relative to debt servicing.<br />

Limits on maximum investment per calendar year.<br />

The agreed interest rate is NIBOR plus a margin ranging<br />

between 3.50% and 4.75% annually.<br />

A minimum of 50% of the loan will be hedged at least for 3<br />

years.<br />

The loan will have a repayment plan with the following payment<br />

structure;<br />

Repayment 2013 17,300<br />

Repayment 2014 34,600<br />

Repayment 2015 57,700<br />

Repayment 2016 69,300<br />

Repayment 2017 82,800<br />

The loans are expected to be repaid by 2021.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

67