Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

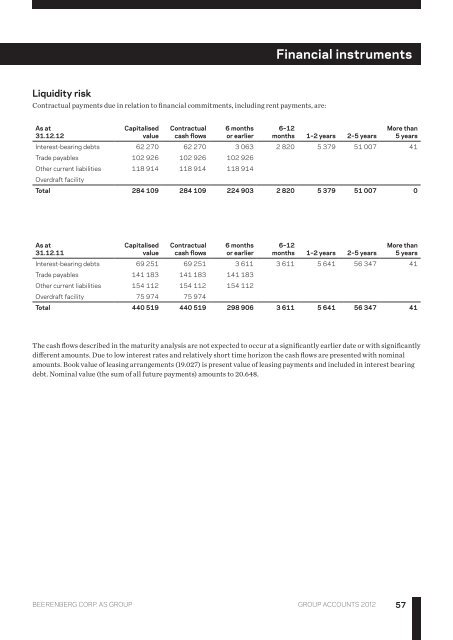

Financial instruments<br />

Liquidity risk<br />

Contractual payments due in relation to financial commitments, including rent payments, are:<br />

As at<br />

31.12.12<br />

Capitalised<br />

value<br />

Contractual<br />

cash flows<br />

6 months<br />

or earlier<br />

6–12<br />

months 1–2 years 2–5 years<br />

More than<br />

5 years<br />

Interest-bearing debts 62 270 62 270 3 063 2 820 5 379 51 007 41<br />

Trade payables 102 926 102 926 102 926<br />

Other current liabilities 118 914 118 914 118 914<br />

Overdraft facility<br />

Total 284 109 284 109 224 903 2 820 5 379 51 007 0<br />

As at<br />

31.12.11<br />

Capitalised<br />

value<br />

Contractual<br />

cash flows<br />

6 months<br />

or earlier<br />

6–12<br />

months 1–2 years 2–5 years<br />

More than<br />

5 years<br />

Interest-bearing debts 69 251 69 251 3 611 3 611 5 641 56 347 41<br />

Trade payables 141 183 141 183 141 183<br />

Other current liabilities 154 112 154 112 154 112<br />

Overdraft facility 75 974 75 974<br />

Total 440 519 440 519 298 906 3 611 5 641 56 347 41<br />

The cash flows described in the maturity analysis are not expected to occur at a significantly earlier date or with significantly<br />

different amounts. Due to low interest rates and relatively short time horizon the cash flows are presented with nominal<br />

amounts. Book value of leasing arrangements (19.027) is present value of leasing payments and included in interest bearing<br />

debt. Nominal value (the sum of all future payments) amounts to 20.648.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

57