Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

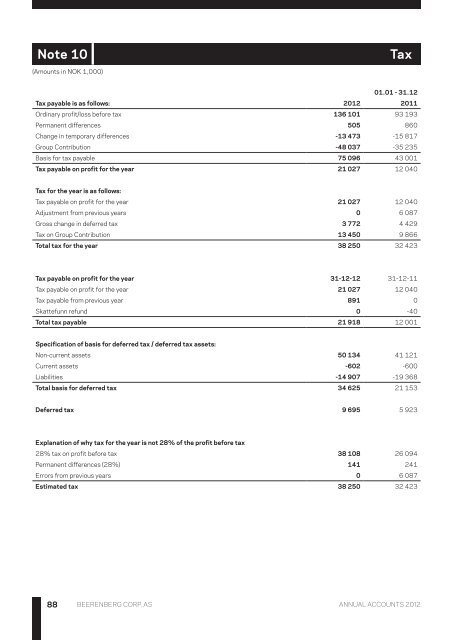

<strong>Note</strong> 10<br />

Tax<br />

(Amounts in NOK 1,000)<br />

01.01 - 31.12<br />

Tax payable is as follows: 2012 2011<br />

Ordinary profit/loss before tax 136 101 93 193<br />

Permanent differences 505 860<br />

Change in temporary differences -13 473 -15 817<br />

Group Contribution -48 037 -35 235<br />

Basis for tax payable 75 096 43 001<br />

Tax payable on profit for the year 21 027 12 040<br />

Tax for the year is as follows:<br />

Tax payable on profit for the year 21 027 12 040<br />

Adjustment from previous years 0 6 087<br />

Gross change in deferred tax 3 772 4 429<br />

Tax on Group Contribution 13 450 9 866<br />

Total tax for the year 38 250 32 423<br />

Tax payable on profit for the year 31-12-12 31-12-11<br />

Tax payable on profit for the year 21 027 12 040<br />

Tax payable from previous year 891 0<br />

Skattefunn refund 0 -40<br />

Total tax payable 21 918 12 001<br />

Specification of basis for deferred tax / deferred tax assets:<br />

Non-current assets 50 134 41 121<br />

Current assets -602 -600<br />

Liabilities -14 907 -19 368<br />

Total basis for deferred tax 34 625 21 153<br />

Deferred tax 9 695 5 923<br />

Explanation of why tax for the year is not 28% of the profit before tax<br />

28% tax on profit before tax 38 108 26 094<br />

Permanent differences (28%) 141 241<br />

Errors from previous years 0 6 087<br />

Estimated tax 38 250 32 423<br />

88<br />

<strong>Beerenberg</strong> CORP. AS Annual accounts 2012