Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

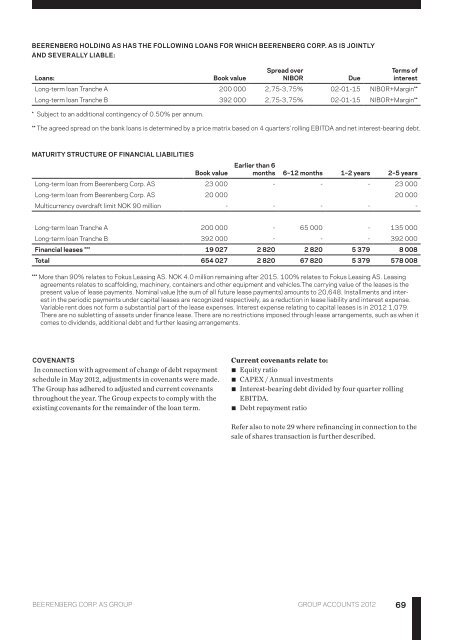

<strong>Beerenberg</strong> Holding AS has the following loans for which <strong>Beerenberg</strong> Corp. AS is jointly<br />

and severally liable:<br />

Loans:<br />

Book value<br />

Spread over<br />

NIBOR<br />

Due<br />

Terms of<br />

interest<br />

Long-term loan Tranche A 200 000 2,75-3,75% 02-01-15 NIBOR+Margin**<br />

Long-term loan Tranche B 392 000 2,75-3,75% 02-01-15 NIBOR+Margin**<br />

* Subject to an additional contingency of 0.50% per annum.<br />

** The agreed spread on the bank loans is determined by a price matrix based on 4 quarters’ rolling EBITDA and net interest-bearing debt.<br />

Maturity structure of financial liabilities<br />

Book value<br />

Earlier than 6<br />

months 6–12 months 1–2 years 2–5 years<br />

Long-term loan from <strong>Beerenberg</strong> Corp. AS 23 000 - - - 23 000<br />

Long-term loan from <strong>Beerenberg</strong> Corp. AS 20 000 20 000<br />

Multicurrency overdraft limit NOK 90 million - - - - -<br />

Long-term loan Tranche A 200 000 - 65 000 - 135 000<br />

Long-term loan Tranche B 392 000 - - - 392 000<br />

Financial leases *** 19 027 2 820 2 820 5 379 8 008<br />

Total 654 027 2 820 67 820 5 379 578 008<br />

*** More than 90% relates to Fokus Leasing AS. NOK 4.0 million remaining after 2015. 100% relates to Fokus Leasing AS. Leasing<br />

agreements relates to scaffolding, machinery, containers and other equipment and vehicles.The carrying value of the leases is the<br />

present value of lease payments. Nominal value (the sum of all future lease payments) amounts to 20,648. Installments and interest<br />

in the periodic payments under capital leases are recognized respectively, as a reduction in lease liability and interest expense.<br />

Variable rent does not form a substantial part of the lease expenses. Interest expense relating to capital leases is in 2012 1,079.<br />

There are no subletting of assets under finance lease. There are no restrictions imposed through lease arrangements, such as when it<br />

comes to dividends, additional debt and further leasing arrangements.<br />

Covenants<br />

In connection with agreement of change of debt repayment<br />

schedule in May 2012, adjustments in covenants were made.<br />

The Group has adhered to adjusted and current covenants<br />

throughout the year. The Group expects to comply with the<br />

existing covenants for the remainder of the loan term.<br />

Current covenants relate to:<br />

▪▪<br />

Equity ratio<br />

▪▪<br />

CAPEX / Annual investments<br />

▪▪<br />

Interest-bearing debt divided by four quarter rolling<br />

EBITDA.<br />

▪▪<br />

Debt repayment ratio<br />

Refer also to note 29 where refinancing in connection to the<br />

sale of shares transaction is further described.<br />

<strong>Beerenberg</strong> CORP. AS Group group accounts 2012<br />

69