Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

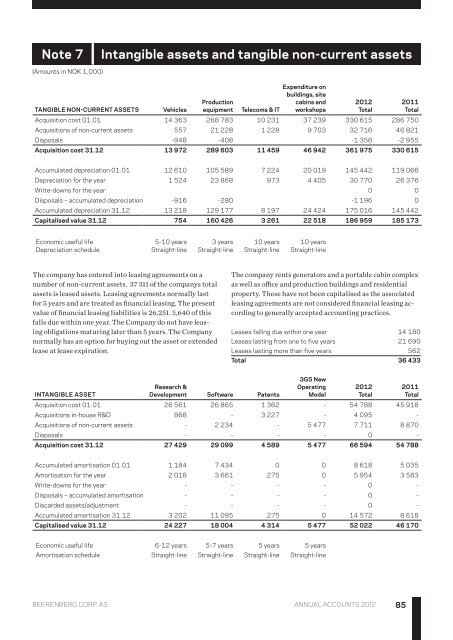

<strong>Note</strong> 7<br />

Intangible assets and tangible non-current assets<br />

(Amounts in NOK 1,000)<br />

Tangible non-current assets<br />

Vehicles<br />

Production<br />

equipment<br />

Telecoms & IT<br />

Expenditure on<br />

buildings, site<br />

cabins and<br />

workshops<br />

Acquisition cost 01.01 14 363 268 783 10 231 37 239 330 615 286 750<br />

Acquisitions of non-current assets 557 21 228 1 228 9 703 32 716 46 821<br />

Disposals -948 -408 -1 356 -2 955<br />

Acquisition cost 31.12 13 972 289 603 11 459 46 942 361 975 330 615<br />

2012<br />

Total<br />

2011<br />

Total<br />

Accumulated depreciation 01.01 12 610 105 589 7 224 20 019 145 442 119 066<br />

Depreciation for the year 1 524 23 868 973 4 405 30 770 26 376<br />

Write-downs for the year 0 0<br />

Disposals – accumulated depreciation -916 -280 -1 196 0<br />

Accumulated depreciation 31.12 13 218 129 177 8 197 24 424 175 016 145 442<br />

Capitalised value 31.12 754 160 426 3 261 22 518 186 959 185 173<br />

Economic useful life 5-10 years 3 years 10 years 10 years<br />

Depreciation schedule Straight-line Straight-line Straight-line Straight-line<br />

The company has entered into leasing agreements on a<br />

number of non-current assets. 37 311 of the companys total<br />

assets is leased assets. Leasing agreements normally last<br />

for 5 years and are treated as financial leasing. The present<br />

value of financial leasing liabilities is 26,251. 5,640 of this<br />

falls due within one year. The Company do not have leasing<br />

obligations maturing later than 5 years. The Company<br />

normally has an option for buying out the asset or extended<br />

lease at lease expiration.<br />

The company rents generators and a portable cabin complex<br />

as well as office and production buildings and residential<br />

property. These have not been capitalised as the associated<br />

leasing agreements are not considered financial leasing according<br />

to generally accepted accounting practices.<br />

Leases falling due within one year 14 180<br />

Leases lasting from one to five years 21 690<br />

Leases lasting more than five years 562<br />

Total 36 433<br />

Intangible asset<br />

Research &<br />

Development Software Patents<br />

3GS New<br />

Operating<br />

Model<br />

2012<br />

Total<br />

2011<br />

Total<br />

Acquisition cost 01.01 26 561 26 865 1 362 - 54 788 45 918<br />

Acquisitions in-house R&D 868 - 3 227 - 4 095 -<br />

Acquisitions of non-current assets - 2 234 - 5 477 7 711 8 870<br />

Disposals - - - - 0 -<br />

Acquisition cost 31.12 27 429 29 099 4 589 5 477 66 594 54 788<br />

Accumulated amortisation 01.01 1 184 7 434 0 0 8 618 5 035<br />

Amortisation for the year 2 018 3 661 275 0 5 954 3 583<br />

Write-downs for the year - - - - 0 -<br />

Disposals – accumulated amortisation - - - - 0 -<br />

Discarded assets/adjustment - - - - 0 -<br />

Accumulated amortisation 31.12 3 202 11 095 275 0 14 572 8 618<br />

Capitalised value 31.12 24 227 18 004 4 314 5 477 52 022 46 170<br />

Economic useful life 6-12 years 5-7 years 5 years 5 years<br />

Amortisation schedule Straight-line Straight-line Straight-line Straight-line<br />

<strong>Beerenberg</strong> CORP. AS Annual accounts 2012<br />

85