Note 1 - Beerenberg

Note 1 - Beerenberg

Note 1 - Beerenberg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report<br />

Message from the CEO<br />

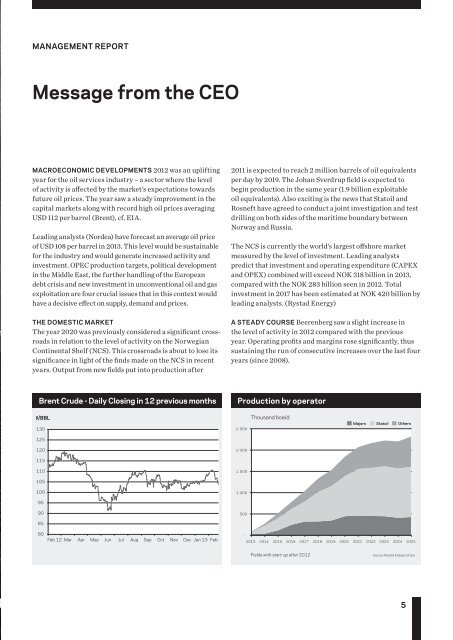

Macroeconomic developments 2012 was an uplifting<br />

year for the oil services industry – a sector where the level<br />

of activity is affected by the market’s expectations towards<br />

future oil prices. The year saw a steady improvement in the<br />

capital markets along with record high oil prices averaging<br />

USD 112 per barrel (Brent), cf. EIA.<br />

Leading analysts (Nordea) have forecast an average oil price<br />

of USD 108 per barrel in 2013. This level would be sustainable<br />

for the industry and would generate increased activity and<br />

investment. OPEC production targets, political development<br />

in the Middle East, the further handling of the European<br />

debt crisis and new investment in unconventional oil and gas<br />

exploitation are four crucial issues that in this context would<br />

have a decisive effect on supply, demand and prices.<br />

The domestic market<br />

The year 2020 was previously considered a significant crossroads<br />

in relation to the level of activity on the Norwegian<br />

Continental Shelf (NCS). This crossroads is about to lose its<br />

significance in light of the finds made on the NCS in recent<br />

years. Output from new fields put into production after<br />

2011 is expected to reach 2 million barrels of oil equivalents<br />

per day by 2019. The Johan Sverdrup field is expected to<br />

begin production in the same year (1.9 billion exploitable<br />

oil equivalents). Also exciting is the news that Statoil and<br />

Rosneft have agreed to conduct a joint investigation and test<br />

drilling on both sides of the maritime boundary between<br />

Norway and Russia.<br />

The NCS is currently the world’s largest offshore market<br />

measured by the level of investment. Leading analysts<br />

predict that investment and operating expenditure (CAPEX<br />

and OPEX) combined will exceed NOK 318 billion in 2013,<br />

compared with the NOK 283 billion seen in 2012. Total<br />

investment in 2017 has been estimated at NOK 420 billion by<br />

leading analysts. (Rystad Energy)<br />

A steady course <strong>Beerenberg</strong> saw a slight increase in<br />

the level of activity in 2012 compared with the previous<br />

year. Operating profits and margins rose significantly, thus<br />

sustaining the run of consecutive increases over the last four<br />

years (since 2008).<br />

Brent Crude - Daily Closing in 12 previous months<br />

Production by by operator<br />

$/BBL<br />

130<br />

2 500<br />

Thousand boe/d<br />

Majors Statoil Others<br />

125<br />

120<br />

2 000<br />

115<br />

110<br />

1 500<br />

105<br />

100<br />

1 000<br />

95<br />

90<br />

500<br />

85<br />

80<br />

Feb 12 Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan 13 Feb<br />

-<br />

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025<br />

Fields with start-up after 2012<br />

Source: Rystad Energy UCube<br />

5