WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARCH 31, 2015 (UNAUDITED)<br />

12. LINE OF CREDIT<br />

Effective May 23, 2014, the Funds in the Trust renewed and amended agreements for two open lines of credit totaling<br />

$300,000,000, one of which is $100,000,000 uncommitted, and the other of which is $200,000,000 committed, with State Street<br />

Bank and Trust Company (together, the “Line”). The agreements, as amended, increased the amounts available on the Line from<br />

the prior total of $75,000,000, with $25,000,000 uncommitted and $50,000,000 committed. The Funds incur commitment fees on<br />

the undrawn portion of the committed part of the Line, and interest expense to the extent of amounts drawn (borrowed) under<br />

the entire Line. Interest is based on the higher of (a) the Federal Funds rate as in effect on the date of borrowing, plus a margin, or<br />

(b) the overnight London Interbank Offered Rate (LIBOR) as in effect on the date of borrowing, plus a margin. Commitment fees<br />

are pro-rated among the Funds based upon relative average net assets. Interest expense is charged directly to a Fund based upon<br />

actual amounts borrowed by that Fund.<br />

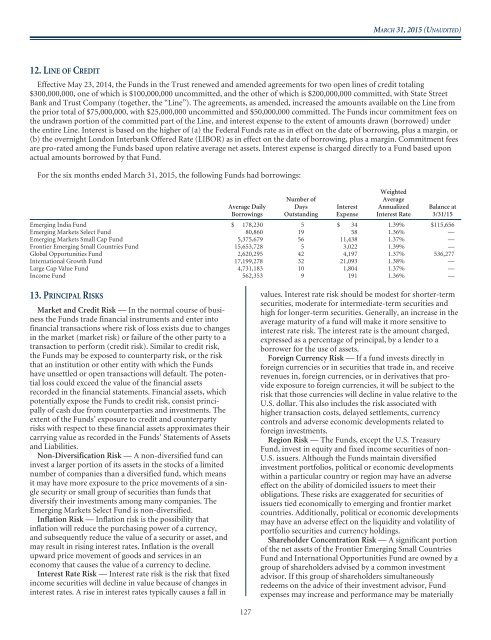

For the six months ended March 31, 2015, the following Funds had borrowings:<br />

Average Daily<br />

Borrowings<br />

Number of<br />

Days<br />

Outstanding<br />

Interest<br />

Expense<br />

Weighted<br />

Average<br />

Annualized<br />

Interest Rate<br />

Balance at<br />

3/31/15<br />

Emerging India Fund $ 178,230 5 $ 34 1.39% $115,656<br />

Emerging Markets Select Fund 80,860 19 58 1.36% —<br />

Emerging Markets Small Cap Fund 5,375,679 56 11,438 1.37% —<br />

Frontier Emerging Small Countries Fund 15,653,728 5 3,022 1.39% —<br />

Global Opportunities Fund 2,620,295 42 4,197 1.37% 536,277<br />

International Growth Fund 17,199,278 32 21,093 1.38% —<br />

Large Cap Value Fund 4,731,183 10 1,804 1.37% —<br />

Income Fund 562,353 9 191 1.36% —<br />

13. PRINCIPAL RISKS<br />

Market and Credit Risk — In the normal course of business<br />

the Funds trade financial instruments and enter into<br />

financial transactions where risk of loss exists due to changes<br />

in the market (market risk) or failure of the other party to a<br />

transaction to perform (credit risk). Similar to credit risk,<br />

the Funds may be exposed to counterparty risk, or the risk<br />

that an institution or other entity with which the Funds<br />

have unsettled or open transactions will default. The potential<br />

loss could exceed the value of the financial assets<br />

recorded in the financial statements. Financial assets, which<br />

potentially expose the Funds to credit risk, consist principally<br />

of cash due from counterparties and investments. The<br />

extent of the Funds’ exposure to credit and counterparty<br />

risks with respect to these financial assets approximates their<br />

carrying value as recorded in the Funds’ Statements of Assets<br />

and Liabilities.<br />

Non-Diversification Risk — A non-diversified fund can<br />

invest a larger portion of its assets in the stocks of a limited<br />

number of companies than a diversified fund, which means<br />

it may have more exposure to the price movements of a single<br />

security or small group of securities than funds that<br />

diversify their investments among many companies. The<br />

Emerging Markets Select Fund is non-diversified.<br />

Inflation Risk — Inflation risk is the possibility that<br />

inflation will reduce the purchasing power of a currency,<br />

and subsequently reduce the value of a security or asset, and<br />

may result in rising interest rates. Inflation is the overall<br />

upward price movement of goods and services in an<br />

economy that causes the value of a currency to decline.<br />

Interest Rate Risk — Interest rate risk is the risk that fixed<br />

income securities will decline in value because of changes in<br />

interest rates. A rise in interest rates typically causes a fall in<br />

values. Interest rate risk should be modest for shorter-term<br />

securities, moderate for intermediate-term securities and<br />

high for longer-term securities. Generally, an increase in the<br />

average maturity of a fund will make it more sensitive to<br />

interest rate risk. The interest rate is the amount charged,<br />

expressed as a percentage of principal, by a lender to a<br />

borrower for the use of assets.<br />

Foreign Currency Risk — If a fund invests directly in<br />

foreign currencies or in securities that trade in, and receive<br />

revenues in, foreign currencies, or in derivatives that provide<br />

exposure to foreign currencies, it will be subject to the<br />

risk that those currencies will decline in value relative to the<br />

U.S. dollar. This also includes the risk associated with<br />

higher transaction costs, delayed settlements, currency<br />

controls and adverse economic developments related to<br />

foreign investments.<br />

Region Risk — The Funds, except the U.S. Treasury<br />

Fund, invest in equity and fixed income securities of non-<br />

U.S. issuers. Although the Funds maintain diversified<br />

investment portfolios, political or economic developments<br />

within a particular country or region may have an adverse<br />

effect on the ability of domiciled issuers to meet their<br />

obligations. These risks are exaggerated for securities of<br />

issuers tied economically to emerging and frontier market<br />

countries. Additionally, political or economic developments<br />

may have an adverse effect on the liquidity and volatility of<br />

portfolio securities and currency holdings.<br />

Shareholder Concentration Risk — A significant portion<br />

of the net assets of the Frontier Emerging Small Countries<br />

Fund and International Opportunities Fund are owned by a<br />

group of shareholders advised by a common investment<br />

advisor. If this group of shareholders simultaneously<br />

redeems on the advice of their investment advisor, Fund<br />

expenses may increase and performance may be materially<br />

127