WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

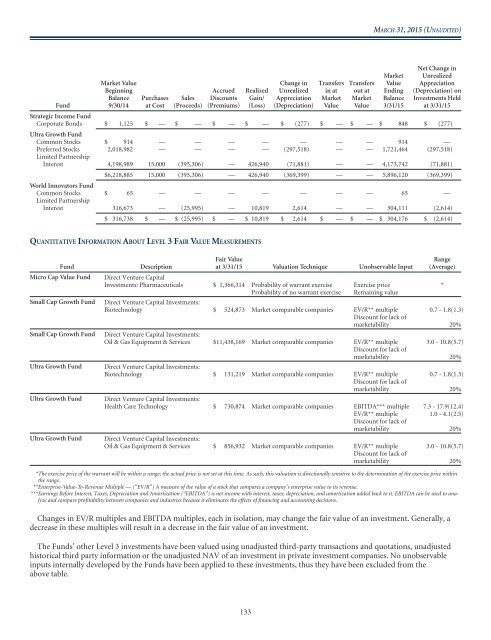

MARCH 31, 2015 (UNAUDITED)<br />

Fund<br />

Market Value<br />

Beginning<br />

Balance<br />

9/30/14<br />

Purchases<br />

at Cost<br />

Sales<br />

(Proceeds)<br />

Accrued<br />

Discounts<br />

(Premiums)<br />

Realized<br />

Gain/<br />

(Loss)<br />

Change in<br />

Unrealized<br />

Appreciation<br />

(Depreciation)<br />

Transfers<br />

in at<br />

Market<br />

Value<br />

Transfers<br />

out at<br />

Market<br />

Value<br />

Market<br />

Value<br />

Ending<br />

Balance<br />

3/31/15<br />

Net Change in<br />

Unrealized<br />

Appreciation<br />

(Depreciation) on<br />

Investments Held<br />

at 3/31/15<br />

Strategic Income Fund<br />

Corporate Bonds $ 1,125 $ — $ — $ — $ — $ (277) $ — $ — $ 848 $ (277)<br />

Ultra Growth Fund<br />

Common Stocks $ 914 — — — — — — — 914 —<br />

Preferred Stocks 2,018,982 — — — — (297,518) — — 1,721,464 (297,518)<br />

Limited Partnership<br />

Interest 4,198,989 15,000 (395,306) — 426,940 (71,881) — — 4,173,742 (71,881)<br />

$6,218,885 15,000 (395,306) — 426,940 (369,399) — — 5,896,120 (369,399)<br />

World Innovators Fund<br />

Common Stocks $ 65 — — — — — — — 65 —<br />

Limited Partnership<br />

Interest 316,673 — (25,995) — 10,819 2,614 — — 304,111 (2,614)<br />

$ 316,738 $ — $ (25,995) $ — $ 10,819 $ 2,614 $ — $ — $ 304,176 $ (2,614)<br />

QUANTITATIVE INFORMATION ABOUT LEVEL 3FAIR VALUE MEASUREMENTS<br />

Fund<br />

Micro Cap Value Fund<br />

Small Cap Growth Fund<br />

Small Cap Growth Fund<br />

Ultra Growth Fund<br />

Ultra Growth Fund<br />

Ultra Growth Fund<br />

Description<br />

Fair Value<br />

at 3/31/15 Valuation Technique Unobservable Input<br />

Range<br />

(Average)<br />

Direct Venture Capital<br />

Investments: Pharmaceuticals $ 1,366,314 Probability of warrant exercise Exercise price *<br />

Probability of no warrant exercise Remaining value<br />

Direct Venture Capital Investments:<br />

Biotechnology $ 524,873 Market comparable companies EV/R** multiple 0.7 - 1.8(1.3)<br />

Discount for lack of<br />

marketability 20%<br />

Direct Venture Capital Investments:<br />

Oil & Gas Equipment & Services $11,438,169 Market comparable companies EV/R** multiple 3.0 - 10.8(5.7)<br />

Discount for lack of<br />

marketability 20%<br />

Direct Venture Capital Investments:<br />

Biotechnology $ 131,219 Market comparable companies EV/R** multiple 0.7 - 1.8(1.3)<br />

Discount for lack of<br />

marketability 20%<br />

Direct Venture Capital Investments:<br />

Health Care Technology $ 730,874 Market comparable companies EBITDA*** multiple 7.3 - 17.9(12.4)<br />

EV/R** multiple 1.0 - 4.1(2.5)<br />

Discount for lack of<br />

marketability 20%<br />

Direct Venture Capital Investments:<br />

Oil & Gas Equipment & Services $ 856,932 Market comparable companies EV/R** multiple 3.0 - 10.8(5.7)<br />

Discount for lack of<br />

marketability 20%<br />

*The exercise price of the warrant will be within a range; the actual price is not set at this time. As such, this valuation is directionally sensitive to the determination of the exercise price within<br />

the range.<br />

**Enterprise-Value-To-Revenue Multiple — (“EV/R”) A measure of the value of a stock that compares a company’s enterprise value to its revenue.<br />

***Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) is net income with interest, taxes, depreciation, and amortization added back to it. EBITDA can be used to analyze<br />

and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.<br />

Changes in EV/R multiples and EBITDA multiples, each in isolation, may change the fair value of an investment. Generally, a<br />

decrease in these multiples will result in a decrease in the fair value of an investment.<br />

The Funds’ other Level 3 investments have been valued using unadjusted third-party transactions and quotations, unadjusted<br />

historical third party information or the unadjusted NAV of an investment in private investment companies. No unobservable<br />

inputs internally developed by the Funds have been applied to these investments, thus they have been excluded from the<br />

above table.<br />

133