WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

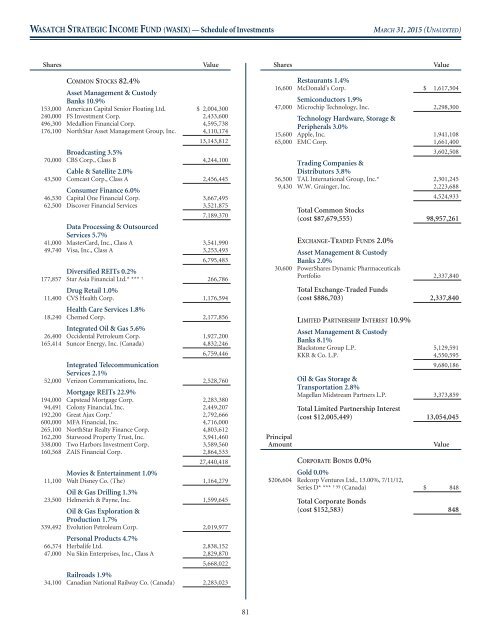

<strong>WASATCH</strong> STRATEGIC INCOME FUND (WASIX) — Schedule of Investments<br />

MARCH 31, 2015 (UNAUDITED)<br />

Shares<br />

Value<br />

Shares<br />

Value<br />

COMMON STOCKS 82.4%<br />

Asset Management & Custody<br />

Banks 10.9%<br />

153,000 American Capital Senior Floating Ltd. $ 2,004,300<br />

240,000 FS Investment Corp. 2,433,600<br />

496,300 Medallion Financial Corp. 4,595,738<br />

176,100 NorthStar Asset Management Group, Inc. 4,110,174<br />

13,143,812<br />

Broadcasting 3.5%<br />

70,000 CBS Corp., Class B 4,244,100<br />

Cable & Satellite 2.0%<br />

43,500 Comcast Corp., Class A 2,456,445<br />

Consumer Finance 6.0%<br />

46,530 Capital One Financial Corp. 3,667,495<br />

62,500 Discover Financial Services 3,521,875<br />

7,189,370<br />

Data Processing & Outsourced<br />

Services 5.7%<br />

41,000 MasterCard, Inc., Class A 3,541,990<br />

49,740 Visa, Inc., Class A 3,253,493<br />

6,795,483<br />

Diversified REITs 0.2%<br />

177,857 Star Asia Financial Ltd.* *** † 266,786<br />

Drug Retail 1.0%<br />

11,400 CVS Health Corp. 1,176,594<br />

Health Care Services 1.8%<br />

18,240 Chemed Corp. 2,177,856<br />

Integrated Oil & Gas 5.6%<br />

26,400 Occidental Petroleum Corp. 1,927,200<br />

165,414 Suncor Energy, Inc. (Canada) 4,832,246<br />

6,759,446<br />

Integrated Telecommunication<br />

Services 2.1%<br />

52,000 Verizon Communications, Inc. 2,528,760<br />

Mortgage REITs 22.9%<br />

194,000 Capstead Mortgage Corp. 2,283,380<br />

94,491 Colony Financial, Inc. 2,449,207<br />

192,200 Great Ajax Corp. * 2,792,666<br />

600,000 MFA Financial, Inc. 4,716,000<br />

265,100 NorthStar Realty Finance Corp. 4,803,612<br />

162,200 Starwood Property Trust, Inc. 3,941,460<br />

338,000 Two Harbors Investment Corp. 3,589,560<br />

160,568 ZAIS Financial Corp. 2,864,533<br />

27,440,418<br />

Movies & Entertainment 1.0%<br />

11,100 Walt Disney Co. (The) 1,164,279<br />

Oil & Gas Drilling 1.3%<br />

23,500 Helmerich & Payne, Inc. 1,599,645<br />

Oil & Gas Exploration &<br />

Production 1.7%<br />

339,492 Evolution Petroleum Corp. 2,019,977<br />

Personal Products 4.7%<br />

66,374 Herbalife Ltd. 2,838,152<br />

47,000 Nu Skin Enterprises, Inc., Class A 2,829,870<br />

5,668,022<br />

Railroads 1.9%<br />

34,100 Canadian National Railway Co. (Canada) 2,283,023<br />

Restaurants 1.4%<br />

16,600 McDonald’s Corp. $ 1,617,504<br />

Semiconductors 1.9%<br />

47,000 Microchip Technology, Inc. 2,298,300<br />

Technology Hardware, Storage &<br />

Peripherals 3.0%<br />

15,600 Apple, Inc. 1,941,108<br />

65,000 EMC Corp. 1,661,400<br />

3,602,508<br />

Trading Companies &<br />

Distributors 3.8%<br />

56,500 TAL International Group, Inc.* 2,301,245<br />

9,430 W.W. Grainger, Inc. 2,223,688<br />

4,524,933<br />

Total Common Stocks<br />

(cost $87,679,555) 98,957,261<br />

EXCHANGE-TRADED <strong>FUNDS</strong> 2.0%<br />

Asset Management & Custody<br />

Banks 2.0%<br />

30,600 PowerShares Dynamic Pharmaceuticals<br />

Portfolio 2,337,840<br />

Principal<br />

Amount<br />

Total Exchange-Traded Funds<br />

(cost $886,703) 2,337,840<br />

LIMITED PARTNERSHIP INTEREST 10.9%<br />

Asset Management & Custody<br />

Banks 8.1%<br />

Blackstone Group L.P. 5,129,591<br />

KKR & Co. L.P. 4,550,595<br />

9,680,186<br />

Oil & Gas Storage &<br />

Transportation 2.8%<br />

Magellan Midstream Partners L.P. 3,373,859<br />

Total Limited Partnership Interest<br />

(cost $12,005,449) 13,054,045<br />

Value<br />

CORPORATE BONDS 0.0%<br />

Gold 0.0%<br />

$206,604 Redcorp Ventures Ltd., 13.00%, 7/11/12,<br />

Series D* *** †§§ (Canada) $ 848<br />

Total Corporate Bonds<br />

(cost $152,583) 848<br />

81