WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>WASATCH</strong> GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary<br />

MARCH 31, 2015 (UNAUDITED)<br />

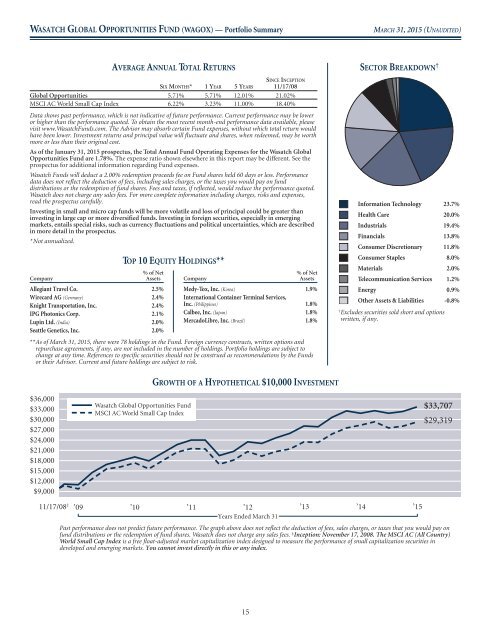

AVERAGE ANNUAL TOTAL RETURNS<br />

SINCE INCEPTION<br />

SIX MONTHS* 1YEAR 5YEARS 11/17/08<br />

Global Opportunities 5.71% 5.71% 12.01% 21.02%<br />

MSCI AC World Small Cap Index 6.22% 3.23% 11.00% 18.40%<br />

Data shows past performance, which is not indicative of future performance. Current performance may be lower<br />

or higher than the performance quoted. To obtain the most recent month-end performance data available, please<br />

visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would<br />

have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth<br />

more or less than their original cost.<br />

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global<br />

Opportunities Fund are 1.78%. The expense ratio shown elsewhere in this report may be different. See the<br />

prospectus for additional information regarding Fund expenses.<br />

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance<br />

data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund<br />

distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted.<br />

Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses,<br />

read the prospectus carefully.<br />

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than<br />

investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging<br />

markets, entails special risks, such as currency fluctuations and political uncertainties, which are described<br />

in more detail in the prospectus.<br />

*Not annualized.<br />

% of Net<br />

Company<br />

Assets<br />

Allegiant Travel Co. 2.5%<br />

Wirecard AG (Germany) 2.4%<br />

Knight Transportation, Inc. 2.4%<br />

IPG Photonics Corp. 2.1%<br />

Lupin Ltd. (India) 2.0%<br />

Seattle Genetics, Inc. 2.0%<br />

TOP 10 EQUITY HOLDINGS**<br />

% of Net<br />

Company<br />

Assets<br />

Medy-Tox, Inc. (Korea) 1.9%<br />

International Container Terminal Services,<br />

Inc. (Philippines) 1.8%<br />

Calbee, Inc. (Japan) 1.8%<br />

MercadoLibre, Inc. (Brazil) 1.8%<br />

**As of March 31, 2015, there were 78 holdings in the Fund. Foreign currency contracts, written options and<br />

repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to<br />

change at any time. References to specific securities should not be construed as recommendations by the Funds<br />

or their Advisor. Current and future holdings are subject to risk.<br />

SECTOR BREAKDOWN †<br />

Information Technology 23.7%<br />

Health Care 20.0%<br />

Industrials 19.4%<br />

Financials 13.8%<br />

Consumer Discretionary 11.8%<br />

Consumer Staples 8.0%<br />

Materials 2.0%<br />

Telecommunication Services 1.2%<br />

Energy 0.9%<br />

Other Assets & Liabilities -0.8%<br />

† Excludes securities sold short and options<br />

written, if any.<br />

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT<br />

$36,000<br />

Wasatch Global Opportunities Fund<br />

$33,000 $33,707<br />

MSCI AC World Small Cap Index<br />

$30,000<br />

$29,319<br />

$27,000<br />

$24,000<br />

$21,000<br />

$18,000<br />

$15,000<br />

$12,000<br />

$9,000<br />

11/17/08 ‡ ’09 ’10 ’11 ’12<br />

’13<br />

’14<br />

’15<br />

Years Ended March 31<br />

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would payon<br />

fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡ Inception: November 17, 2008. The MSCI AC (All Country)<br />

World Small Cap Index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities in<br />

developed and emerging markets. You cannot invest directly in this or any index.<br />

15