WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>WASATCH</strong> <strong>FUNDS</strong> — Notes to Financial Statements (continued)<br />

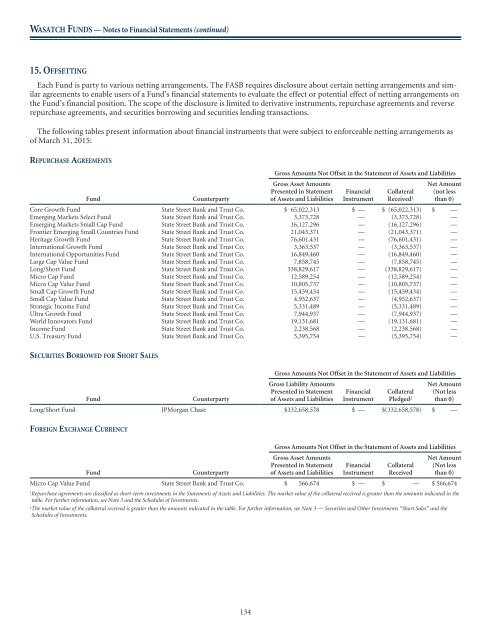

15. OFFSETTING<br />

Each Fund is party to various netting arrangements. The FASB requires disclosure about certain netting arrangements and similar<br />

agreements to enable users of a Fund’s financial statements to evaluate the effect or potential effect of netting arrangements on<br />

the Fund’s financial position. The scope of the disclosure is limited to derivative instruments, repurchase agreements and reverse<br />

repurchase agreements, and securities borrowing and securities lending transactions.<br />

The following tables present information about financial instruments that were subject to enforceable netting arrangements as<br />

of March 31, 2015:<br />

REPURCHASE AGREEMENTS<br />

Fund<br />

Counterparty<br />

Gross Amounts Not Offset in the Statement of Assets and Liabilities<br />

Gross Asset Amounts<br />

Presented in Statement<br />

of Assets and Liabilities<br />

Financial<br />

Instrument<br />

Collateral<br />

Received 1<br />

Net Amount<br />

(not less<br />

than 0)<br />

Core Growth Fund State Street Bank and Trust Co. $ 65,022,313 $ — $ (65,022,313) $ —<br />

Emerging Markets Select Fund State Street Bank and Trust Co. 3,373,728 — (3,373,728) —<br />

Emerging Markets Small Cap Fund State Street Bank and Trust Co. 16,127,296 — (16,127,296) —<br />

Frontier Emerging Small Countries Fund State Street Bank and Trust Co. 21,043,371 — (21,043,371) —<br />

Heritage Growth Fund State Street Bank and Trust Co. 76,601,431 — (76,601,431) —<br />

International Growth Fund State Street Bank and Trust Co. 3,363,537 — (3,363,537) —<br />

International Opportunities Fund State Street Bank and Trust Co. 16,849,460 — (16,849,460) —<br />

Large Cap Value Fund State Street Bank and Trust Co. 7,858,745 — (7,858,745) —<br />

Long/Short Fund State Street Bank and Trust Co. 338,829,617 — (338,829,617) —<br />

Micro Cap Fund State Street Bank and Trust Co. 12,589,254 — (12,589,254) —<br />

Micro Cap Value Fund State Street Bank and Trust Co. 10,805,737 — (10,805,737) —<br />

Small Cap Growth Fund State Street Bank and Trust Co. 15,459,434 — (15,459,434) —<br />

Small Cap Value Fund State Street Bank and Trust Co. 4,952,637 — (4,952,637) —<br />

Strategic Income Fund State Street Bank and Trust Co. 5,331,489 — (5,331,489) —<br />

Ultra Growth Fund State Street Bank and Trust Co. 7,944,937 — (7,944,937) —<br />

World Innovators Fund State Street Bank and Trust Co. 19,131,681 — (19,131,681) —<br />

Income Fund State Street Bank and Trust Co. 2,238,568 — (2,238,568) —<br />

U.S. Treasury Fund State Street Bank and Trust Co. 5,395,754 — (5,395,754) —<br />

SECURITIES BORROWED FOR SHORT SALES<br />

Gross Amounts Not Offset in the Statement of Assets and Liabilities<br />

Fund<br />

Counterparty<br />

Gross Liability Amounts<br />

Presented in Statement<br />

of Assets and Liabilities<br />

Financial<br />

Instrument<br />

Collateral<br />

Pledged 2<br />

Net Amount<br />

(Not less<br />

than 0)<br />

Long/Short Fund JPMorgan Chase $332,658,578 $ — $(332,658,578) $ —<br />

FOREIGN EXCHANGE CURRENCY<br />

Gross Amounts Not Offset in the Statement of Assets and Liabilities<br />

Fund<br />

Counterparty<br />

Gross Asset Amounts<br />

Presented in Statement<br />

of Assets and Liabilities<br />

Financial<br />

Instrument<br />

Collateral<br />

Received<br />

Net Amount<br />

(Not less<br />

than 0)<br />

Micro Cap Value Fund State Street Bank and Trust Co. $ 566,674 $ — $ — $ 566,674<br />

1 Repurchase agreements are classified as short-term investments in the Statements of Assets and Liabilities. The market value of the collateral received is greater than the amounts indicated in the<br />

table. For further information, see Note 3 and the Schedules of Investments.<br />

2 The market value of the collateral received is greater than the amounts indicated in the table. For further information, see Note 3 — Securities and Other Investments “Short Sales” and the<br />

Schedules of Investments.<br />

134