WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

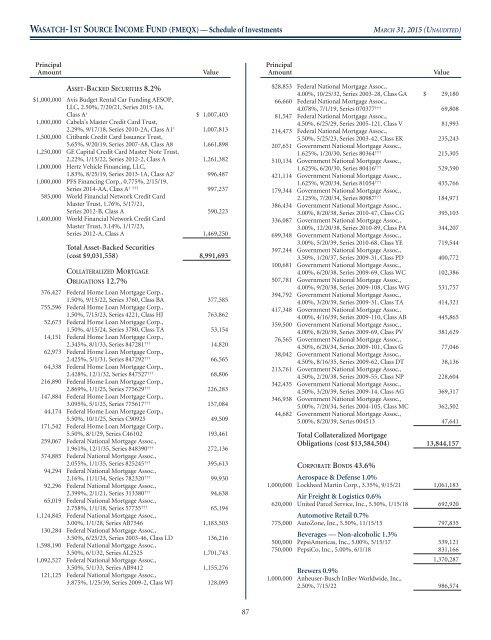

<strong>WASATCH</strong>-1ST SOURCE INCOME FUND (FMEQX) — Schedule of Investments<br />

MARCH 31, 2015 (UNAUDITED)<br />

Principal<br />

Amount<br />

Value<br />

Principal<br />

Amount<br />

Value<br />

ASSET-BACKED SECURITIES 8.2%<br />

$1,000,000 Avis Budget Rental Car Funding AESOP,<br />

LLC, 2.50%, 7/20/21, Series 2015-1A,<br />

Class A † $ 1,007,403<br />

1,000,000 Cabela’s Master Credit Card Trust,<br />

2.29%, 9/17/18, Series 2010-2A, Class A1 † 1,007,813<br />

1,500,000 Citibank Credit Card Issuance Trust,<br />

5.65%, 9/20/19, Series 2007-A8, Class A8 1,661,898<br />

1,250,000 GE Capital Credit Card Master Note Trust,<br />

2.22%, 1/15/22, Series 2012-2, Class A 1,261,382<br />

1,000,000 Hertz Vehicle Financing, LLC,<br />

1.83%, 8/25/19, Series 2013-1A, Class A2 † 996,487<br />

1,000,000 PFS Financing Corp., 0.775%, 2/15/19,<br />

Series 2014-AA, Class A † ††† 997,237<br />

585,000 World Financial Network Credit Card<br />

Master Trust, 1.76%, 5/17/21,<br />

Series 2012-B, Class A 590,223<br />

1,400,000 World Financial Network Credit Card<br />

Master Trust, 3.14%, 1/17/23,<br />

Series 2012-A, Class A 1,469,250<br />

Total Asset-Backed Securities<br />

(cost $9,031,558) 8,991,693<br />

COLLATERALIZED MORTGAGE<br />

OBLIGATIONS 12.7%<br />

376,427 Federal Home Loan Mortgage Corp.,<br />

1.50%, 9/15/22, Series 3760, Class BA 377,585<br />

755,596 Federal Home Loan Mortgage Corp.,<br />

1.50%, 7/15/23, Series 4221, Class HJ 763,862<br />

52,673 Federal Home Loan Mortgage Corp.,<br />

1.50%, 4/15/24, Series 3780, Class TA 53,154<br />

14,151 Federal Home Loan Mortgage Corp.,<br />

2.345%, 8/1/33, Series 847281 ††† 14,820<br />

62,973 Federal Home Loan Mortgage Corp.,<br />

2.425%, 5/1/31, Series 847292 ††† 66,565<br />

64,338 Federal Home Loan Mortgage Corp.,<br />

2.428%, 12/1/32, Series 847527 ††† 68,806<br />

216,890 Federal Home Loan Mortgage Corp.,<br />

2.869%, 1/1/25, Series 775629 ††† 226,283<br />

147,884 Federal Home Loan Mortgage Corp.,<br />

3.095%, 5/1/25, Series 775617 ††† 157,084<br />

44,174 Federal Home Loan Mortgage Corp.,<br />

5.50%, 10/1/25, Series C90925 49,509<br />

171,542 Federal Home Loan Mortgage Corp.,<br />

5.50%, 8/1/29, Series C46102 193,461<br />

259,067 Federal National Mortgage Assoc.,<br />

1.961%, 12/1/35, Series 848390 ††† 272,136<br />

374,885 Federal National Mortgage Assoc.,<br />

2.055%, 1/1/35, Series 825245 ††† 395,613<br />

94,294 Federal National Mortgage Assoc.,<br />

2.16%, 11/1/34, Series 782320 ††† 99,930<br />

92,296 Federal National Mortgage Assoc.,<br />

2.399%, 2/1/21, Series 313380 ††† 94,638<br />

65,019 Federal National Mortgage Assoc.,<br />

2.758%, 1/1/18, Series 57735 ††† 65,194<br />

1,124,845 Federal National Mortgage Assoc.,<br />

3.00%, 1/1/28, Series AB7546 1,183,503<br />

130,284 Federal National Mortgage Assoc.,<br />

3.50%, 6/25/23, Series 2003-46, Class LD 136,216<br />

1,598,190 Federal National Mortgage Assoc.,<br />

3.50%, 6/1/32, Series AL2525 1,701,743<br />

1,092,527 Federal National Mortgage Assoc.,<br />

3.50%, 5/1/33, Series AB9412 1,155,276<br />

121,125 Federal National Mortgage Assoc.,<br />

3.875%, 1/25/39, Series 2009-2, Class WJ 128,093<br />

$28,853 Federal National Mortgage Assoc.,<br />

4.00%, 10/25/32, Series 2003-28, Class GA $ 29,180<br />

66,660 Federal National Mortgage Assoc.,<br />

4.078%, 7/1/19, Series 070377 ††† 69,808<br />

81,547 Federal National Mortgage Assoc.,<br />

4.50%, 6/25/29, Series 2005-121, Class V 81,993<br />

214,473 Federal National Mortgage Assoc.,<br />

5.50%, 5/25/23, Series 2003-42, Class EK 235,243<br />

207,651 Government National Mortgage Assoc.,<br />

1.625%, 1/20/30, Series 80364 ††† 215,305<br />

510,134 Government National Mortgage Assoc.,<br />

1.625%, 6/20/30, Series 80416 ††† 529,590<br />

421,114 Government National Mortgage Assoc.,<br />

1.625%, 9/20/34, Series 81054 ††† 435,766<br />

179,344 Government National Mortgage Assoc.,<br />

2.125%, 7/20/34, Series 80987 ††† 184,971<br />

386,434 Government National Mortgage Assoc.,<br />

3.00%, 8/20/38, Series 2010-47, Class CG 395,103<br />

336,087 Government National Mortgage Assoc.,<br />

3.00%, 12/20/38, Series 2010-89, Class PA 344,207<br />

699,348 Government National Mortgage Assoc.,<br />

3.00%, 5/20/39, Series 2010-68, Class YE 719,544<br />

397,244 Government National Mortgage Assoc.,<br />

3.50%, 1/20/37, Series 2009-31, Class PD 400,772<br />

100,681 Government National Mortgage Assoc.,<br />

4.00%, 6/20/38, Series 2009-69, Class WC 102,386<br />

507,781 Government National Mortgage Assoc.,<br />

4.00%, 9/20/38, Series 2009-108, Class WG 531,757<br />

394,792 Government National Mortgage Assoc.,<br />

4.00%, 3/20/39, Series 2009-31, Class TA 414,321<br />

417,348 Government National Mortgage Assoc.,<br />

4.00%, 4/16/39, Series 2009-110, Class AB 445,865<br />

359,500 Government National Mortgage Assoc.,<br />

4.00%, 8/20/39, Series 2009-69, Class PV 381,629<br />

76,565 Government National Mortgage Assoc.,<br />

4.50%, 6/20/34, Series 2009-101, Class G 77,046<br />

38,042 Government National Mortgage Assoc.,<br />

4.50%, 8/16/35, Series 2009-62, Class DT 38,136<br />

213,761 Government National Mortgage Assoc.,<br />

4.50%, 2/20/38, Series 2009-55, Class NP 228,604<br />

342,435 Government National Mortgage Assoc.,<br />

4.50%, 3/20/39, Series 2009-14, Class AG 369,317<br />

346,938 Government National Mortgage Assoc.,<br />

5.00%, 7/20/34, Series 2004-105, Class MC 362,502<br />

44,682 Government National Mortgage Assoc.,<br />

5.00%, 8/20/39, Series 004513 47,641<br />

Total Collateralized Mortgage<br />

Obligations (cost $13,584,504) 13,844,157<br />

CORPORATE BONDS 43.6%<br />

Aerospace & Defense 1.0%<br />

1,000,000 Lockheed Martin Corp., 3.35%, 9/15/21 1,061,183<br />

Air Freight & Logistics 0.6%<br />

620,000 United Parcel Service, Inc., 5.50%, 1/15/18 692,920<br />

Automotive Retail 0.7%<br />

775,000 AutoZone, Inc., 5.50%, 11/15/15 797,835<br />

Beverages — Non-alcoholic 1.3%<br />

500,000 PepsiAmericas, Inc., 5.00%, 5/15/17 539,121<br />

750,000 PepsiCo, Inc., 5.00%, 6/1/18 831,166<br />

1,370,287<br />

Brewers 0.9%<br />

1,000,000 Anheuser-Busch InBev Worldwide, Inc.,<br />

2.50%, 7/15/22 986,574<br />

87