WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

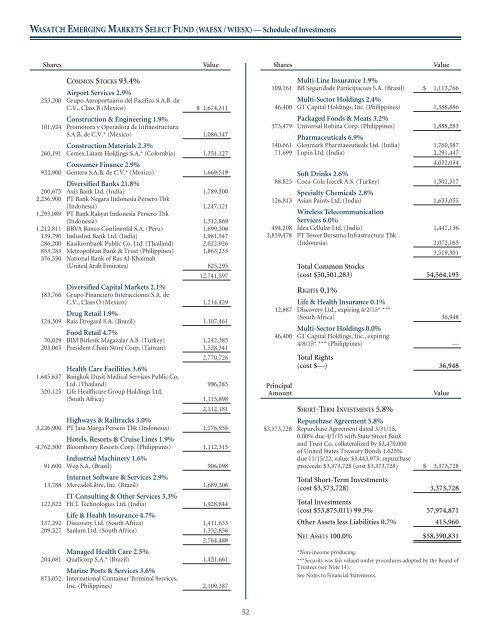

<strong>WASATCH</strong> EMERGING MARKETS SELECT FUND (WAESX / WIESX) — Schedule of Investments<br />

Shares<br />

Value<br />

Shares<br />

Value<br />

COMMON STOCKS 93.4%<br />

AirportServices2.9%<br />

255,200 Grupo Aeroportuario del Pacifico S.A.B. de<br />

C.V., Class B (Mexico) $ 1,674,311<br />

Construction & Engineering 1.9%<br />

101,924 Promotora y Operadora de Infraestructura<br />

S.A.B. de C.V.* (Mexico) 1,086,147<br />

Construction Materials 2.3%<br />

260,191 Cemex Latam Holdings S.A.* (Colombia) 1,351,127<br />

Consumer Finance 2.9%<br />

932,900 Gentera S.A.B. de C.V.* (Mexico) 1,669,519<br />

Diversified Banks 21.8%<br />

200,675 Axis Bank Ltd. (India) 1,789,300<br />

2,256,900 PT Bank Negara Indonesia Persero Tbk<br />

(Indonesia) 1,247,121<br />

1,293,089 PT Bank Rakyat Indonesia Persero Tbk<br />

(Indonesia) 1,312,869<br />

1,212,811 BBVA Banco Continental S.A. (Peru) 1,699,306<br />

139,790 IndusInd Bank Ltd. (India) 1,981,547<br />

286,200 Kasikornbank Public Co. Ltd. (Thailand) 2,022,926<br />

853,783 Metropolitan Bank & Trust (Philippines) 1,863,233<br />

376,550 National Bank of Ras Al-Khaimah<br />

(United Arab Emirates) 825,295<br />

12,741,597<br />

Diversified Capital Markets 2.1%<br />

183,766 Grupo Financiero Interacciones S.A. de<br />

C.V., Class O (Mexico) 1,214,429<br />

Drug Retail 1.9%<br />

124,309 Raia Drogasil S.A. (Brazil) 1,107,461<br />

Food Retail 4.7%<br />

70,029 BIM Birlesik Magazalar A.S. (Turkey) 1,242,385<br />

203,065 President Chain Store Corp. (Taiwan) 1,528,341<br />

2,770,726<br />

Health Care Facilities 3.6%<br />

1,645,637 Bangkok Dusit Medical Services Public Co.<br />

Ltd. (Thailand) 996,283<br />

320,125 Life Healthcare Group Holdings Ltd.<br />

(South Africa) 1,115,898<br />

2,112,181<br />

Highways & Railtracks 3.0%<br />

3,226,900 PT Jasa Marga Persero Tbk (Indonesia) 1,776,955<br />

Hotels, Resorts & Cruise Lines 1.9%<br />

4,762,500 Bloomberry Resorts Corp. (Philippines) 1,112,315<br />

Industrial Machinery 1.6%<br />

91,600 Weg S.A. (Brazil) 906,098<br />

Internet Software & Services 2.9%<br />

13,788 MercadoLibre, Inc. (Brazil) 1,689,306<br />

IT Consulting & Other Services 3.3%<br />

122,822 HCL Technologies Ltd. (India) 1,928,844<br />

Life & Health Insurance 4.7%<br />

137,292 Discovery Ltd. (South Africa) 1,411,633<br />

209,527 Sanlam Ltd. (South Africa) 1,352,856<br />

2,764,489<br />

Managed Health Care 2.5%<br />

204,681 Qualicorp S.A.* (Brazil) 1,451,661<br />

Marine Ports & Services 3.6%<br />

873,052 International Container Terminal Services,<br />

Inc. (Philippines) 2,109,387<br />

Multi-Line Insurance 1.9%<br />

109,161 BB Seguridade Participacoes S.A. (Brazil) $ 1,113,766<br />

Multi-Sector Holdings 2.4%<br />

46,400 GT Capital Holdings, Inc. (Philippines) 1,388,886<br />

Packaged Foods & Meats 3.2%<br />

373,479 Universal Robina Corp. (Philippines) 1,888,283<br />

Pharmaceuticals 6.9%<br />

140,661 Glenmark Pharmaceuticals Ltd. (India) 1,760,587<br />

71,699 Lupin Ltd. (India) 2,291,447<br />

4,052,034<br />

Soft Drinks 2.6%<br />

88,823 Coca-Cola Icecek A.S. (Turkey) 1,502,317<br />

Specialty Chemicals 2.8%<br />

126,813 Asian Paints Ltd. (India) 1,633,055<br />

Wireless Telecommunication<br />

Services 6.0%<br />

494,208 Idea Cellular Ltd. (India) 1,447,136<br />

2,859,478 PT Tower Bersama Infrastructure Tbk<br />

(Indonesia) 2,072,165<br />

3,519,301<br />

Total Common Stocks<br />

(cost $50,501,283) 54,564,195<br />

RIGHTS 0.1%<br />

Life & Health Insurance 0.1%<br />

12,887 Discovery Ltd., expiring 4/2/15* ***<br />

(South Africa) 36,948<br />

Multi-Sector Holdings 0.0%<br />

46,400 GT Capital Holdings, Inc., expiring<br />

4/8/15* *** (Philippines) —<br />

Principal<br />

Amount<br />

Total Rights<br />

(cost $—) 36,948<br />

Value<br />

SHORT-TERM INVESTMENTS 5.8%<br />

Repurchase Agreement 5.8%<br />

$3,373,728 Repurchase Agreement dated 3/31/15,<br />

0.00% due 4/1/15 with State Street Bank<br />

and Trust Co. collateralized by $3,470,000<br />

of United States Treasury Bonds 1.625%<br />

due 11/15/22; value: $3,443,975; repurchase<br />

proceeds: $3,373,728 (cost $3,373,728) $ 3,373,728<br />

Total Short-Term Investments<br />

(cost $3,373,728) 3,373,728<br />

Total Investments<br />

(cost $53,875,011) 99.3% 57,974,871<br />

Other Assets less Liabilities 0.7% 415,960<br />

NET ASSETS 100.0% $58,390,831<br />

*Non-income producing.<br />

***Security was fair valued under procedures adopted by the Board of<br />

Trustees (see Note 14).<br />

See Notes to Financial Statements.<br />

52