WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

WASATCH FUNDS - Curian Clearing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

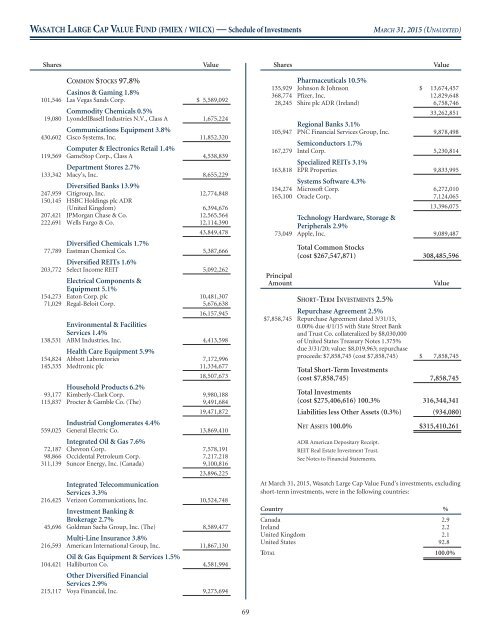

<strong>WASATCH</strong> LARGE CAP VALUE FUND (FMIEX / WILCX) — Schedule of Investments<br />

MARCH 31, 2015 (UNAUDITED)<br />

Shares<br />

Value<br />

Shares<br />

Value<br />

COMMON STOCKS 97.8%<br />

Casinos & Gaming 1.8%<br />

101,546 Las Vegas Sands Corp. $ 5,589,092<br />

Commodity Chemicals 0.5%<br />

19,080 LyondellBasell Industries N.V., Class A 1,675,224<br />

Communications Equipment 3.8%<br />

430,602 Cisco Systems, Inc. 11,852,320<br />

Computer & Electronics Retail 1.4%<br />

119,569 GameStop Corp., Class A 4,538,839<br />

Department Stores 2.7%<br />

133,342 Macy’s, Inc. 8,655,229<br />

Diversified Banks 13.9%<br />

247,959 Citigroup, Inc. 12,774,848<br />

150,145 HSBC Holdings plc ADR<br />

(United Kingdom) 6,394,676<br />

207,421 JPMorgan Chase & Co. 12,565,564<br />

222,691 Wells Fargo & Co. 12,114,390<br />

43,849,478<br />

Diversified Chemicals 1.7%<br />

77,789 Eastman Chemical Co. 5,387,666<br />

Diversified REITs 1.6%<br />

203,772 Select Income REIT 5,092,262<br />

Electrical Components &<br />

Equipment 5.1%<br />

154,273 Eaton Corp. plc 10,481,307<br />

71,029 Regal-Beloit Corp. 5,676,638<br />

16,157,945<br />

Environmental & Facilities<br />

Services 1.4%<br />

138,531 ABM Industries, Inc. 4,413,598<br />

Health Care Equipment 5.9%<br />

154,824 Abbott Laboratories 7,172,996<br />

145,335 Medtronic plc 11,334,677<br />

18,507,673<br />

Household Products 6.2%<br />

93,177 Kimberly-Clark Corp. 9,980,188<br />

115,837 Procter & Gamble Co. (The) 9,491,684<br />

19,471,872<br />

Industrial Conglomerates 4.4%<br />

559,025 General Electric Co. 13,869,410<br />

Integrated Oil & Gas 7.6%<br />

72,187 Chevron Corp. 7,578,191<br />

98,866 Occidental Petroleum Corp. 7,217,218<br />

311,139 Suncor Energy, Inc. (Canada) 9,100,816<br />

23,896,225<br />

Integrated Telecommunication<br />

Services 3.3%<br />

216,425 Verizon Communications, Inc. 10,524,748<br />

Investment Banking &<br />

Brokerage 2.7%<br />

45,696 Goldman Sachs Group, Inc. (The) 8,589,477<br />

Multi-Line Insurance 3.8%<br />

216,593 American International Group, Inc. 11,867,130<br />

Oil & Gas Equipment & Services 1.5%<br />

104,421 Halliburton Co. 4,581,994<br />

Other Diversified Financial<br />

Services 2.9%<br />

215,117 Voya Financial, Inc. 9,273,694<br />

Pharmaceuticals 10.5%<br />

135,929 Johnson & Johnson $ 13,674,457<br />

368,774 Pfizer, Inc. 12,829,648<br />

28,245 Shire plc ADR (Ireland) 6,758,746<br />

33,262,851<br />

Regional Banks 3.1%<br />

105,947 PNC Financial Services Group, Inc. 9,878,498<br />

Semiconductors 1.7%<br />

167,279 Intel Corp. 5,230,814<br />

Specialized REITs 3.1%<br />

163,818 EPR Properties 9,833,995<br />

Systems Software 4.3%<br />

154,274 Microsoft Corp. 6,272,010<br />

165,100 Oracle Corp. 7,124,065<br />

13,396,075<br />

Technology Hardware, Storage &<br />

Peripherals 2.9%<br />

73,049 Apple, Inc. 9,089,487<br />

Principal<br />

Amount<br />

Total Common Stocks<br />

(cost $267,547,871) 308,485,596<br />

Value<br />

SHORT-TERM INVESTMENTS 2.5%<br />

Repurchase Agreement 2.5%<br />

$7,858,745 Repurchase Agreement dated 3/31/15,<br />

0.00% due 4/1/15 with State Street Bank<br />

and Trust Co. collateralized by $8,030,000<br />

of United States Treasury Notes 1.375%<br />

due 3/31/20; value: $8,019,963; repurchase<br />

proceeds: $7,858,745 (cost $7,858,745) $ 7,858,745<br />

Total Short-Term Investments<br />

(cost $7,858,745) 7,858,745<br />

Total Investments<br />

(cost $275,406,616) 100.3% 316,344,341<br />

Liabilities less Other Assets (0.3%) (934,080)<br />

NET ASSETS 100.0% $315,410,261<br />

ADR American Depositary Receipt.<br />

REIT Real Estate Investment Trust.<br />

See Notes to Financial Statements.<br />

At March 31, 2015, Wasatch Large Cap Value Fund’s investments, excluding<br />

short-term investments, were in the following countries:<br />

Country %<br />

Canada 2.9<br />

Ireland 2.2<br />

United Kingdom 2.1<br />

United States 92.8<br />

TOTAL 100.0%<br />

69