measure and monitor the processes and report results ... - Refresco.de

measure and monitor the processes and report results ... - Refresco.de

measure and monitor the processes and report results ... - Refresco.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

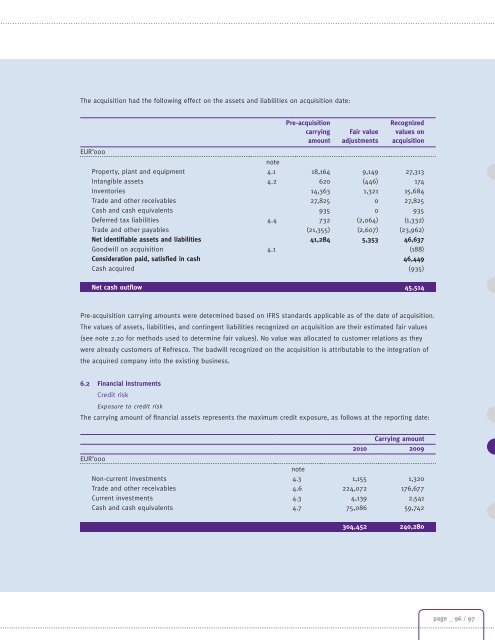

The acquisition had <strong>the</strong> following effect on <strong>the</strong> assets <strong>and</strong> liabilities on acquisition date:<br />

Pre-acquisition<br />

carrying<br />

amount<br />

Fair value<br />

adjustments<br />

Recognized<br />

values on<br />

acquisition<br />

EUR’000<br />

Property, plant <strong>and</strong> equipment<br />

note<br />

4.1 18,164 9,149 27,313<br />

Intangible assets 4.2 620 (446) 174<br />

Inventories 14,363 1,321 15,684<br />

Tra<strong>de</strong> <strong>and</strong> o<strong>the</strong>r receivables 27,825 0 27,825<br />

Cash <strong>and</strong> cash equivalents 935 0 935<br />

Deferred tax liabilities 4.4 732 (2,064) (1,332)<br />

Tra<strong>de</strong> <strong>and</strong> o<strong>the</strong>r payables (21,355) (2,607) (23,962)<br />

Net i<strong>de</strong>ntifiable assets <strong>and</strong> liabilities 41,284 5,353 46,637<br />

Goodwill on acquisition 4.1 (188)<br />

Consi<strong>de</strong>ration paid, satisfied in cash 46,449<br />

Cash acquired (935)<br />

Net cash outflow 45,514<br />

Preacquisition carrying amounts were <strong>de</strong>termined based on IFRS st<strong>and</strong>ards applicable as of <strong>the</strong> date of acquisition.<br />

The values of assets, liabilities, <strong>and</strong> contingent liabilities recognized on acquisition are <strong>the</strong>ir estimated fair values<br />

(see note 2.20 for methods used to <strong>de</strong>termine fair values). No value was allocated to customer relations as <strong>the</strong>y<br />

were already customers of <strong>Refresco</strong>. The badwill recognized on <strong>the</strong> acquisition is attributable to <strong>the</strong> integration of<br />

<strong>the</strong> acquired company into <strong>the</strong> existing business.<br />

6.2 Financial instruments<br />

Credit risk<br />

Exposure to credit risk<br />

The carrying amount of financial assets represents <strong>the</strong> maximum credit exposure, as follows at <strong>the</strong> <strong>report</strong>ing date:<br />

EUR’000<br />

Carrying amount<br />

2010 2009<br />

note<br />

Noncurrent investments 4.3 1,155 1,320<br />

Tra<strong>de</strong> <strong>and</strong> o<strong>the</strong>r receivables 4.6 224,072 176,677<br />

Current investments 4.3 4,139 2,541<br />

Cash <strong>and</strong> cash equivalents 4.7 75,086 59,742<br />

304,452 240,280<br />

page _ 96 / 97