Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

Exchange differences arising on translation of equity are offset against the other reserves. Exchange differences resulting<br />

from the application of differing exchange rates in the income statement are likewise reported under the “Other reserves<br />

and currency translation balancing item”, and are not recognised in profit or loss.<br />

In the separate financial statements of <strong>Frauenthal</strong> <strong>Holding</strong> <strong>AG</strong> and its subsidiaries, foreign currency receivables and payables<br />

are measured at the exchange rate prevailing at the date of the transaction. Exchange gains and losses arising at the end of<br />

the reporting period are recognised in profit or loss.<br />

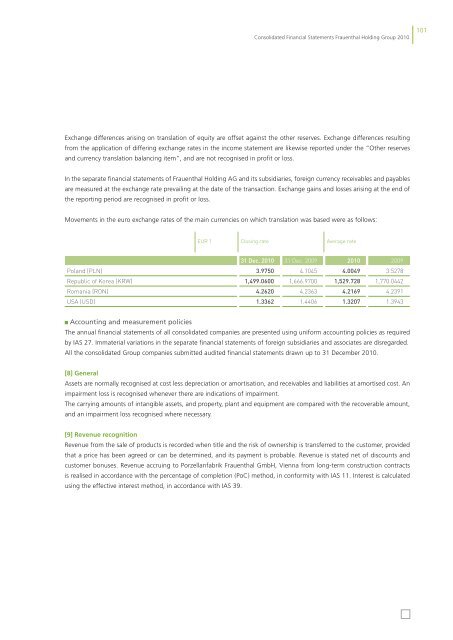

Movements in the euro exchange rates of the main currencies on which translation was based were as follows:<br />

31 dec. <strong>2010</strong> 31 Dec. 2009 <strong>2010</strong> 2009<br />

Poland (PLN) 3.9750 4.1045 4.0049 3.5278<br />

Republic of Korea (KRW) 1,499.0600 1,666.9700 1,529.728 1,770.0442<br />

Romania (RON) 4.2620 4.2363 4.2169 4.2391<br />

USA (USD) 1.3362 1.4406 1.3207 1.3943<br />

Accounting and measurement policies<br />

EUR 1 Closing rate Average rate<br />

The annual financial statements of all consolidated companies are presented using uniform accounting policies as required<br />

by IAS 27. Immaterial variations in the separate financial statements of foreign subsidiaries and associates are disregarded.<br />

All the consolidated Group companies submitted audited financial statements drawn up to 31 December <strong>2010</strong>.<br />

[8] General<br />

Assets are normally recognised at cost less depreciation or amortisation, and receivables and liabilities at amortised cost. An<br />

impairment loss is recognised whenever there are indications of impairment.<br />

The carrying amounts of intangible assets, and property, plant and equipment are compared with the recoverable amount,<br />

and an impairment loss recognised where necessary.<br />

[9] Revenue recognition<br />

Revenue from the sale of products is recorded when title and the risk of ownership is transferred to the customer, provided<br />

that a price has been agreed or can be determined, and its payment is probable. Revenue is stated net of discounts and<br />

customer bonuses. Revenue accruing to Porzellanfabrik <strong>Frauenthal</strong> GmbH, Vienna from long-term construction contracts<br />

is realised in accordance with the percentage of completion (PoC) method, in conformity with IAS 11. Interest is calculated<br />

using the effective interest method, in accordance with IAS 39.<br />

101