Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

[10] Non-current assets<br />

Acquired and internally generated intangible assets are recognised in accordance with IAS 38 if it is probable that use of<br />

the assets will be associated with future economic benefits and their cost can be reliably determined.<br />

They are recognised at cost, and are amortised over between three and ten years if their useful lives are determinable.<br />

Intangible assets with indefinite useful lives and goodwill recognised on consolidation are not amortised. Pursuant to paragraph<br />

108 of IAS 38, the carrying values are tested for impairment at least annually, and impairment is recognised wherever<br />

there is an indication that the economic benefits expected to arise from the assets have declined. Most of the non-amortised<br />

intangible assets are goodwill and acquired trademarks whose useful lives cannot be determined at present.<br />

Development costs incurred by Porzellanfabrik <strong>Frauenthal</strong> GmbH (diesel catalysts for trucks) are recognised as internally<br />

generated intangible assets in accordance with IAS 38. Recognition is at production cost provided that there are clearly<br />

allocatable costs, that completion of the assets is technically feasible and that there is a market for them. There must also<br />

be a sufficient probability that the development activities will generate future cash inflows. All the development projects in<br />

progress are being carried out with the intention of completing them. The capitalised production costs comprise the costs<br />

directly and indirectly attributable to the development process. Capitalised development costs are amortised over the anticipated<br />

product life cycle from the commencement of production. Sufficient technical and financial resources are available<br />

to complete the development projects.<br />

All property, plant and equipment is used for operational purposes, and is measured at cost less depreciation over the<br />

useful lives of the assets. Depreciation is according to the straight-line method. Low value non-current assets with costs per<br />

item of up to EUR 400 that are immediately written off in the local accounts for tax reasons are likewise written off in the<br />

consolidated accounts in the year of addition and reported as disposals on grounds of immateriality.<br />

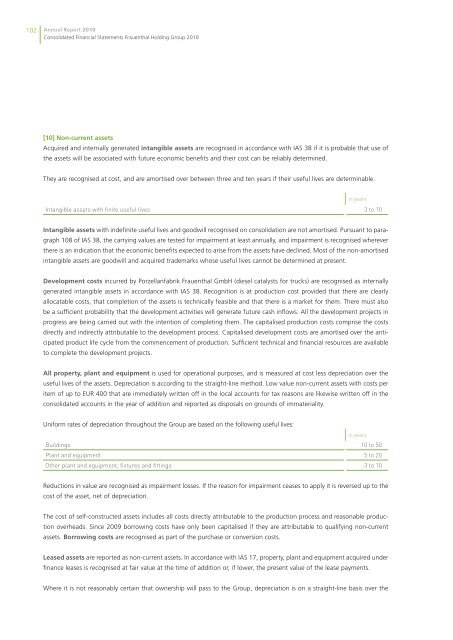

Uniform rates of depreciation throughout the Group are based on the following useful lives:<br />

in years<br />

Intangible assets with finite useful lives 3 to 10<br />

in years<br />

Buildings 10 to 50<br />

Plant and equipment 5 to 20<br />

Other plant and equipment, fixtures and fittings 3 to 10<br />

Reductions in value are recognised as impairment losses. If the reason for impairment ceases to apply it is reversed up to the<br />

cost of the asset, net of depreciation.<br />

The cost of self-constructed assets includes all costs directly attributable to the production process and reasonable production<br />

overheads. Since 2009 borrowing costs have only been capitalised if they are attributable to qualifying non-current<br />

assets. Borrowing costs are recognised as part of the purchase or conversion costs.<br />

Leased assets are reported as non-current assets. In accordance with IAS 17, property, plant and equipment acquired under<br />

finance leases is recognised at fair value at the time of addition or, if lower, the present value of the lease payments.<br />

Where it is not reasonably certain that ownership will pass to the Group, depreciation is on a straight-line basis over the