Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

Operating Review<br />

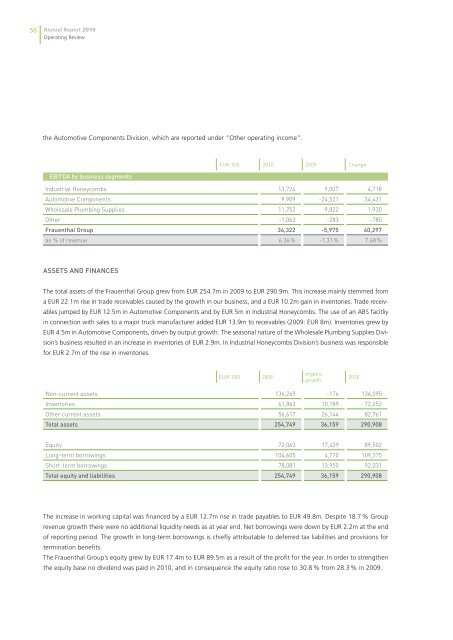

the Automotive Components Division, which are reported under “Other operating income”.<br />

eBitda by business segments<br />

Industrial Honeycombs 13,724 9,007 4,718<br />

Automotive Components 9,909 -24,521 34,431<br />

Wholesale Plumbing Supplies 11,752 9,822 1,930<br />

Other -1,063 -283 -780<br />

<strong>Frauenthal</strong> group 34,322 -5,975 40,297<br />

as % of revenue 6.36 % -1.31 % 7.68 %<br />

aSSetS and FinanCeS<br />

The total assets of the <strong>Frauenthal</strong> Group grew from EUR 254.7m in 2009 to EUR 290.9m. This increase mainly stemmed from<br />

a EUR 22.1m rise in trade receivables caused by the growth in our business, and a EUR 10.2m gain in inventories. Trade receivables<br />

jumped by EUR 12.5m in Automotive Components and by EUR 5m in Industrial Honeycombs. The use of an ABS facitliy<br />

in connection with sales to a major truck manufacturer added EUR 13.9m to receivables (2009: EUR 8m). Inventories grew by<br />

EUR 4.5m in Automotive Components, driven by output growth. The seasonal nature of the Wholesale Plumbing Supplies Division’s<br />

business resulted in an increase in inventories of EUR 2.9m. In Industrial Honeycombs Division’s business was responsible<br />

for EUR 2.7m of the rise in inventories.<br />

BILANZENTWICKLUNG<br />

EUR ’000 <strong>2010</strong> 2009 Change<br />

EUR ’000<br />

organic<br />

growth<br />

Non-current assets 136,269 -174 136,095<br />

Inventories 61,863 10,189 72,052<br />

Other current assets 56,617 26,144 82,761<br />

total assets 254,749 36,159 290,908<br />

Equity 72,063 17,439 89,502<br />

Long-term borrowings 104,605 4,770 109,375<br />

Short-term borrowings 78,081 13,950 92,031<br />

total equity and liabilities 254,749 36,159 290,908<br />

The increase in working capital was financed by a EUR 12.7m rise in trade payables to EUR 49.8m. Despite 18.7 % Group<br />

revenue growth there were no additional liquidity needs as at year end. Net borrowings were down by EUR 2.2m at the end<br />

of reporting period. The growth in long-term borrowings is chiefly attributable to deferred tax liabilities and provisions for<br />

termination benefits.<br />

The <strong>Frauenthal</strong> Group’s equity grew by EUR 17.4m to EUR 89.5m as a result of the profit for the year. In order to strengthen<br />

the equity base no dividend was paid in <strong>2010</strong>, and in consequence the equity ratio rose to 30.8 % from 28.3 % in 2009.<br />

2009<br />

<strong>2010</strong>