Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

122 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

long-term borrowings include EUR 612,000 secured by collateral (31 Dec. 2009: EUR 5,457,000). The collateral pledged for<br />

liabilities includes EUR 379,000 (2009: EUR 379,000) in bank balances pledged by Porzellanfabrik <strong>Frauenthal</strong> as security for<br />

liabilities. This relates to a passbook which was pledged to Ceram Liegenschaftsverwaltungs GmbH under the shareholder<br />

agreement concluded in connection with the demerger and disposal of the insulator business in 2001. It is highly unlikely<br />

that recourse will be made to the collateral. As at the end of the reporting period the Pol-Necks subsidiary in Poland had<br />

EUR 233,000 (2009: EUR 500,000) in outstanding borrowings which were secured by collateral. There is collateral to a total<br />

value of EUR 2,924,000 (2009: EUR 5,078,000), which consists of inventories, land, and other assets pledged by this company.<br />

Of this, EUR 122,000 (2009: EUR 500,000) relates to inventories, EUR 416,000 (2009: EUR 1,100,000) to land, EUR<br />

294,000 (2009: EUR 1,000,000) to investment loads and EUR 2,092,000 (2009: EUR 2,500,000) to the production plant,<br />

which has insurance cover.<br />

The bank borrowings include EUR 570,000 (2009: EUR 611,000) in finance lease liabilities, of which EUR 277,000 (2009:<br />

EUR 269,000) have maturities of over five years, and EUR 212,000 (2009: EUR 263,000) maturities of between one and five<br />

years, while EUR 81,000 (2009: EUR 79,000) are current.<br />

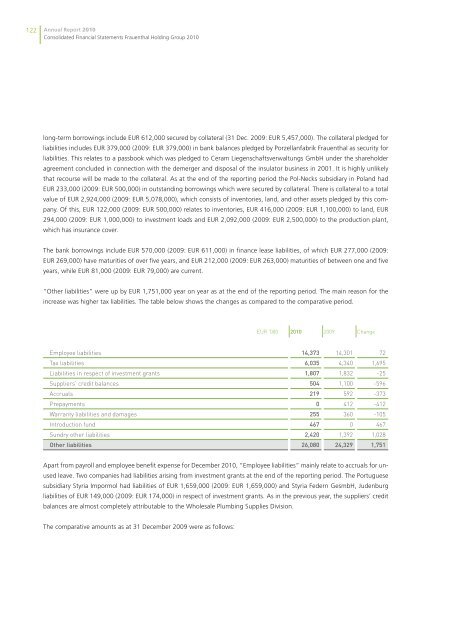

“Other liabilities” were up by EUR 1,751,000 year on year as at the end of the reporting period. The main reason for the<br />

increase was higher tax liabilities. The table below shows the changes as compared to the comparative period.<br />

Employee liabilities 14,373 14,301 72<br />

Tax liabilities 6,035 4,340 1,695<br />

Liabilities in respect of investment grants 1,807 1,832 -25<br />

Suppliers‘ credit balances 504 1,100 -596<br />

Accruals 219 592 -373<br />

Prepayments 0 412 -412<br />

Warranty liabilities and damages 255 360 -105<br />

Introduction fund 467 0 467<br />

Sundry other liabilities 2,420 1,392 1,028<br />

other liabilities 26,080 24,329 1,751<br />

Apart from payroll and employee benefit expense for December <strong>2010</strong>, “Employee liabilities” mainly relate to accruals for unused<br />

leave. Two companies had liabilities arising from investment grants at the end of the reporting period. The Portuguese<br />

subsidiary Styria Impormol had liabilities of EUR 1,659,000 (2009: EUR 1,659,000) and Styria Federn GesmbH, Judenburg<br />

liabilities of EUR 149,000 (2009: EUR 174,000) in respect of investment grants. As in the previous year, the suppliers’ credit<br />

balances are almost completely attributable to the Wholesale Plumbing Supplies Division.<br />

The comparative amounts as at 31 December 2009 were as follows:<br />

EUR ’000 <strong>2010</strong><br />

2009 Change