Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

128 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

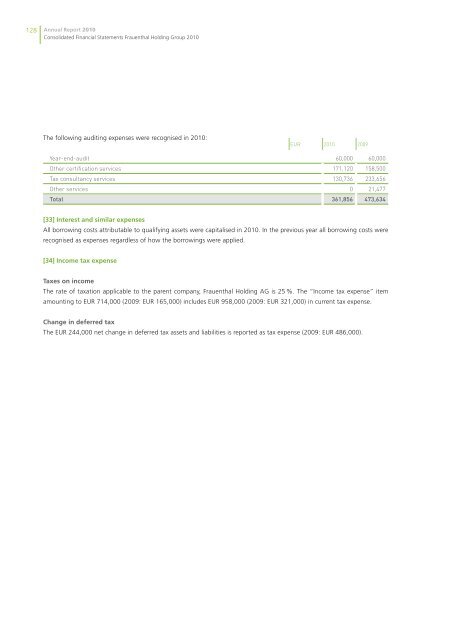

The following auditing expenses were recognised in <strong>2010</strong>:<br />

Year-end-audit 60,000 60,000<br />

Other certification services 171,120 158,500<br />

Tax consultancy services 130,736 233,656<br />

Other services 0 21,477<br />

Total 361,856 473,634<br />

[33] Interest and similar expenses<br />

All borrowing costs attributable to qualifying assets were capitalised in <strong>2010</strong>. In the previous year all borrowing costs were<br />

recognised as expenses regardless of how the borrowings were applied.<br />

[34] Income tax expense<br />

EUR <strong>2010</strong> 2009<br />

Taxes on income<br />

The rate of taxation applicable to the parent company, <strong>Frauenthal</strong> <strong>Holding</strong> <strong>AG</strong> is 25 %. The “Income tax expense” item<br />

amounting to EUR 714,000 (2009: EUR 165,000) includes EUR 958,000 (2009: EUR 321,000) in current tax expense.<br />

Change in deferred tax<br />

The EUR 244,000 net change in deferred tax assets and liabilities is reported as tax expense (2009: EUR 486,000).