Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

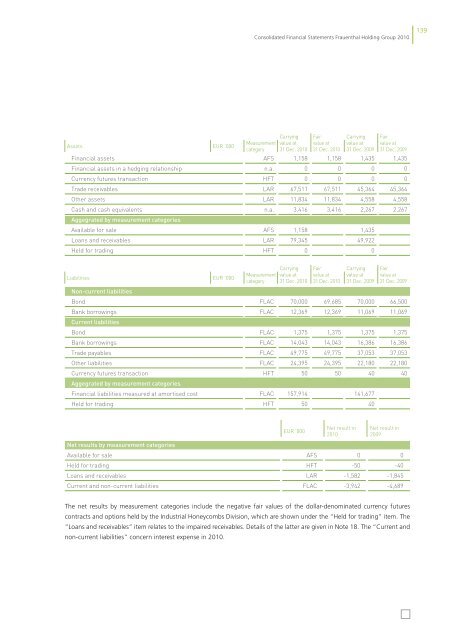

Liabilities EUR ’000<br />

non-current liabilities<br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

Carrying Fair Carrying Fair<br />

Assets<br />

EUR ’000<br />

Measurement<br />

category<br />

value at<br />

31 Dec. <strong>2010</strong><br />

value at<br />

31 Dec. <strong>2010</strong><br />

value at<br />

31 Dec. 2009<br />

value at<br />

31 Dec. 2009<br />

Financial assets AFS 1,158 1,158 1,435 1,435<br />

Financial assets in a hedging relationship n.a. 0 0 0 0<br />

Currency futures transaction HFT 0 0 0 0<br />

Trade receivables LAR 67,511 67,511 45,364 45,364<br />

Other assets LAR 11,834 11,834 4,558 4,558<br />

Cash and cash equivalents<br />

aggegrated by measurement categories<br />

n.a. 3,416 3,416 2,267 2,267<br />

Available for sale AFS 1,158 1,435<br />

Loans and receivables LAR 79,345 49,922<br />

Held for trading HFT 0 0<br />

Bond FLAC 70,000 69,685 70,000 66,500<br />

Bank borrowings FLAC 12,369 12,369 11,069 11,069<br />

Current liabilities<br />

Bond FLAC 1,375 1,375 1,375 1,375<br />

Bank borrowings FLAC 14,043 14,043 16,386 16,386<br />

Trade payables FLAC 49,775 49,775 37,053 37,053<br />

Other liabilities FLAC 24,395 24,395 22,180 22,180<br />

Currency futures transaction HFT 50 50 40 40<br />

aggegrated by measurement categories<br />

Measurement<br />

category<br />

Carrying<br />

value at<br />

31 Dec. <strong>2010</strong><br />

Fair<br />

value at<br />

31 Dec. <strong>2010</strong><br />

Carrying<br />

value at<br />

31 Dec. 2009<br />

Financial liabilities measured at amortised cost FLAC 157,914 141,677<br />

Held for trading HFT 50 40<br />

EUR ’000<br />

Net result in<br />

<strong>2010</strong><br />

Fair<br />

value at<br />

31 Dec. 2009<br />

Net result in<br />

2009<br />

net results by measurement categories<br />

Available for sale AFS 0 0<br />

Held for trading HFT -50 -40<br />

Loans and receivables LAR -1,582 -1,845<br />

Current and non-current liabilities FLAC -3,942 -4,689<br />

The net results by measurement categories include the negative fair values of the dollar-denominated currency futures<br />

contracts and options held by the Industrial Honeycombs Division, which are shown under the “Held for trading” item. The<br />

“Loans and receivables” item relates to the impaired receivables. Details of the latter are given in Note 18. The “Current and<br />

non-current liabilities” concern interest expense in <strong>2010</strong>.<br />

139