Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

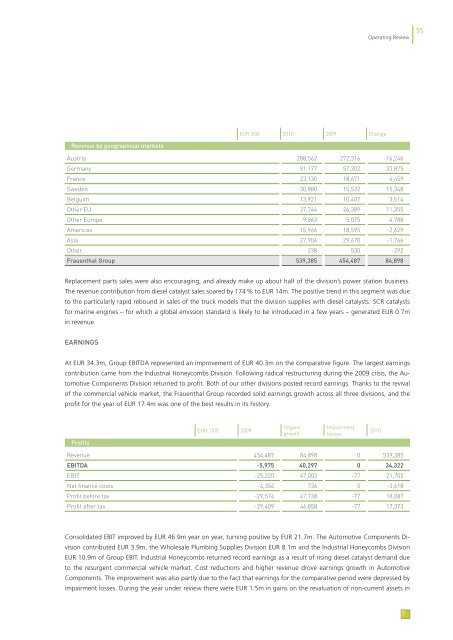

evenue by geographical markets<br />

Profits<br />

Organic Impairment<br />

EUR ’000 2009<br />

<strong>2010</strong><br />

growth<br />

losses<br />

Operating Review<br />

Austria 288,562 272,316 16,246<br />

Germany 91,177 57,302 33,875<br />

France 23,130 18,671 4,459<br />

Sweden 30,880 15,532 15,348<br />

Belguim 13,921 10,407 3,514<br />

Other EU 37,744 26,389 11,355<br />

Other Europe 9,863 5,075 4,788<br />

Americas 15,966 18,595 -2,629<br />

Asia 27,904 29,670 -1,766<br />

Other 238 530 -292<br />

<strong>Frauenthal</strong> group 539,385 454,487 84,898<br />

Replacement parts sales were also encouraging, and already make up about half of the division’s power station business.<br />

The revenue contribution from diesel catalyst sales soared by 174 % to EUR 14m. The positive trend in this segment was due<br />

to the particularly rapid rebound in sales of the truck models that the division supplies with diesel catalysts. SCR catalysts<br />

for marine engines – for which a global emission standard is likely to be introduced in a few years – generated EUR 0.7m<br />

in revenue.<br />

earningS<br />

EUR ’000 <strong>2010</strong> 2009 Change<br />

At EUR 34.3m, Group EBITDA represented an improvement of EUR 40.3m on the comparative fi gure. The largest earnings<br />

contribution came from the Industrial Honeycombs Division. Following radical restructuring during the 2009 crisis, the Automotive<br />

Components Division returned to profi t. Both of our other divisions posted record earnings. Thanks to the revival<br />

of the commercial vehicle market, the <strong>Frauenthal</strong> Group recorded solid earnings growth across all three divisions, and the<br />

profi t for the year of EUR 17.4m was one of the best results in its history.<br />

Revenue 454,487 84,898 0 539,385<br />

eBitda -5,975 40,297 0 34,322<br />

EBIT -25,220 47,002 -77 21,705<br />

Net fi nance costs -4,354 736 0 -3,618<br />

Profi t before tax -29,574 47,738 -77 18,087<br />

Profi t after tax -29,409 46,858 -77 17,373<br />

Consolidated EBIT improved by EUR 46.9m year on year, turning positive by EUR 21.7m. The Automotive Components Division<br />

contributed EUR 3.9m, the Wholesale Plumbing Supplies Division EUR 8.1m and the Industrial Honeycombs Division<br />

EUR 10.9m of Group EBIT. Industrial Honeycombs returned record earnings as a result of rising diesel catalyst demand due<br />

to the resurgent commercial vehicle market. Cost reductions and higher revenue drove earnings growth in Automotive<br />

Components. The improvement was also partly due to the fact that earnings for the comparative period were depressed by<br />

impairment losses. During the year under review there were EUR 1.5m in gains on the revaluation of non-current assets in<br />

55