Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

112 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

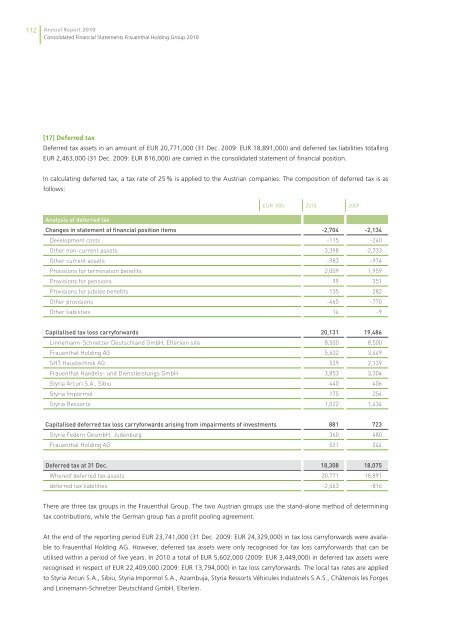

[17] Deferred tax<br />

Deferred tax assets in an amount of EUR 20,771,000 (31 Dec. 2009: EUR 18,891,000) and deferred tax liabilities totalling<br />

EUR 2,463,000 (31 Dec. 2009: EUR 816,000) are carried in the consolidated statement of financial position.<br />

In calculating deferred tax, a tax rate of 25 % is applied to the Austrian companies. The composition of deferred tax is as<br />

follows:<br />

EUR ’000<br />

analysis of deferred tax<br />

Changes in statement of financial position items -2,704 -2,134<br />

Development costs -115 -240<br />

Other non-current assets -3,398 -2,733<br />

Other current assets -983 -974<br />

Provisions for termination benefits 2,009 1,959<br />

Provisions for pensions 99 351<br />

Provisions for jubilee benefits 135 282<br />

Other provisions -465 -770<br />

Other liabilities<br />

ufgliederung latente Steuern<br />

14 -9<br />

Capitalised tax loss carryforwards 20,131 19,486<br />

Linnemann-Schnetzer Deutschland GmbH, Elterlein site 8,500 8,500<br />

<strong>Frauenthal</strong> <strong>Holding</strong> <strong>AG</strong> 5,602 3,449<br />

SHT Haustechnik <strong>AG</strong> 539 2,139<br />

<strong>Frauenthal</strong> Handels- und Dienstleistungs GmbH 3,853 3,304<br />

Styria Arcuri S.A., Sibiu 440 406<br />

Styria Impormol 175 254<br />

Styria Ressorts 1,022 1,434<br />

Capitalised deferred tax loss carryforwards arising from impairments of investments 881 723<br />

Styria Federn GesmbH, Judenburg 360 480<br />

<strong>Frauenthal</strong> <strong>Holding</strong> <strong>AG</strong> 521 244<br />

deferred tax at 31 dec. 18,308 18,075<br />

Whereof deferred tax assets 20,771 18,891<br />

deferred tax liabilities -2,463 -816<br />

There are three tax groups in the <strong>Frauenthal</strong> Group. The two Austrian groups use the stand-alone method of determining<br />

tax contributions, while the German group has a profit pooling agreement.<br />

At the end of the reporting period EUR 23,741,000 (31 Dec. 2009: EUR 24,329,000) in tax loss carryforwards were available<br />

to <strong>Frauenthal</strong> <strong>Holding</strong> <strong>AG</strong>. However, deferred tax assets were only recognised for tax loss carryforwards that can be<br />

utilised within a period of five years. In <strong>2010</strong> a total of EUR 5,602,000 (2009: EUR 3,449,000) in deferred tax assets were<br />

recognised in respect of EUR 22,409,000 (2009: EUR 13,794,000) in tax loss carryforwards. The local tax rates are applied<br />

to Styria Arcuri S.A., Sibiu, Styria Impormol S.A., Azambuja, Styria Ressorts Véhicules Industriels S.A.S., Châtenois les Forges<br />

and Linnemann-Schnetzer Deutschland GmbH, Elterlein.<br />

<strong>2010</strong><br />

2009