Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

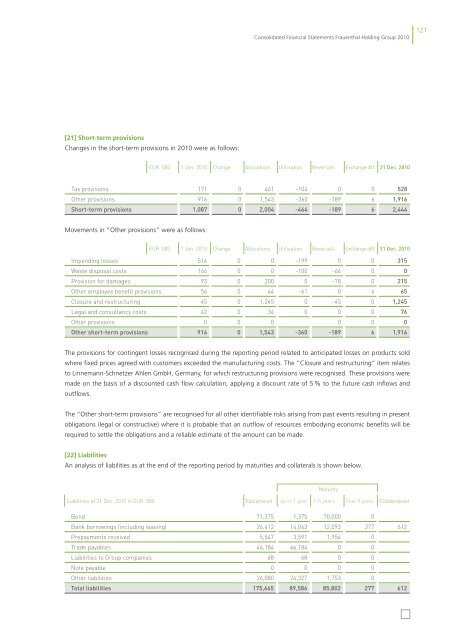

[21] Short-term provisions<br />

Changes in the short-term provisions in <strong>2010</strong> were as follows:<br />

EUR ’000<br />

1 Jan. <strong>2010</strong> Change<br />

Movements in “Other provisions” were as follows:<br />

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

Allocations Utilisation Reversals Exchange diff. 31 dec. <strong>2010</strong><br />

Tax provisions 171 0 461 -104 0 0 528<br />

Other provisions 916 0 1,543 -360 -189 6 1,916<br />

Short-term provisions 1,087 0 2,004 -464 -189 6 2,444<br />

Impending losses 514 0 0 -199 0 0 315<br />

Waste disposal costs 166 0 0 -100 -66 0 0<br />

Provision for damages 93 0 200 0 -78 0 215<br />

Other employee benefi t provisions 56 0 64 -61 0 6 65<br />

Closure and restructuring 45 0 1,245 0 -45 0 1,245<br />

Legal and consultancy costs 42 0 34 0 0 0 76<br />

Other provisions 0 0 0 0 0 0<br />

Other short-term provisions 916 0 1,543 -360 -189 6 1,916<br />

The provisions for contingent losses recognised during the reporting period related to anticipated losses on products sold<br />

where fixed prices agreed with customers exceeded the manufacturing costs. The “Closure and restructuring” item relates<br />

to Linnemann-Schnetzer Ahlen GmbH, Germany, for which restructuring provisions were recognised. These provisions were<br />

made on the basis of a discounted cash flow calculation, applying a discount rate of 5 % to the future cash inflows and<br />

outflows.<br />

The “Other short-term provisions” are recognised for all other identifiable risks arising from past events resulting in present<br />

obligations (legal or constructive) where it is probable that an outflow of resources embodying economic benefits will be<br />

required to settle the obligations and a reliable estimate of the amount can be made.<br />

[22] Liabilities<br />

An analysis of liabilities as at the end of the reporting period by maturities and collaterals is shown below.<br />

Liabilities at 31 Dec. <strong>2010</strong> in EUR ’000<br />

EUR ’000<br />

1 Jan. <strong>2010</strong> Change<br />

Allocations Utilisation Reversals Exchange diff. 31 dec. <strong>2010</strong><br />

Maturity<br />

Total amount Up to 1 year 1–5 years Over 5 years Collateralised<br />

Bond 71,375 1,375 70,000 0<br />

Bank borrowings (including leasing) 26,412 14,043 12,093 277 612<br />

Prepayments received 5,547 3,591 1,956 0<br />

Trade payables 46,184 46,184 0 0<br />

Liabilities to Group companies 68 68 0 0<br />

Note payable 0 0 0 0<br />

Other liabilities 26,080 24,327 1,753 0<br />

Von total den liabilities langfristigen Krediten waren zum Bilanzstichtag TEUR 3.303 175,665 (31.Dezember2009: 89,586 TEUR 85,802 5.457) durch 277 Vermögen 612 The<br />

121