Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Annual Report 2010 - Frauenthal Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated Financial Statements <strong>Frauenthal</strong> <strong>Holding</strong> Group <strong>2010</strong><br />

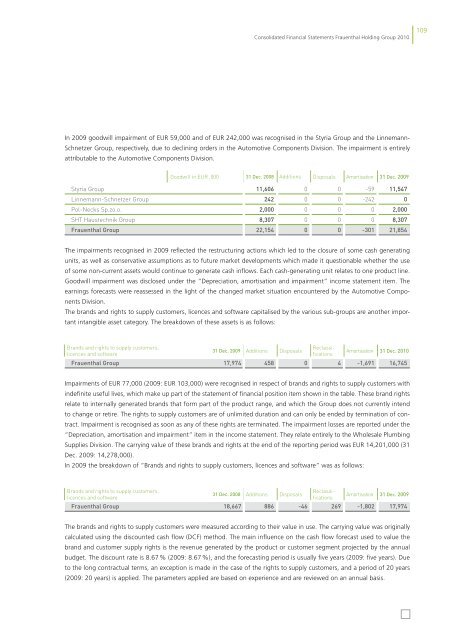

In 2009 goodwill impairment of EUR 59,000 and of EUR 242,000 was recognised in the Styria Group and the Linnemann-<br />

Schnetzer Group, respectively, due to declining orders in the Automotive Components Division. The impairment is entirely<br />

attributable to the Automotive Components Division.<br />

Goodwill in EUR ‚000 31 dec. 2008 Additions Disposals Amortisation 31 dec. 2009<br />

Styria Group 11,606 0 0 -59 11,547<br />

Linnemann-Schnetzer Group 242 0 0 -242 0<br />

Pol-Necks Sp.zo.o. 2,000 0 0 0 2,000<br />

SHT Haustechnik Group 8,307 0 0 0 8,307<br />

<strong>Frauenthal</strong> group 22,154 0 0 -301 21,854<br />

The impairments recognised in 2009 refl ected the restructuring actions which led to the closure of some cash generating<br />

units, as well as conservative assumptions as to future market developments which made it questionable whether the use<br />

of some non-current assets would continue to generate cash infl ows. Each cash-generating unit relates to one product line.<br />

Goodwill impairment was disclosed under the “Depreciation, amortisation and impairment” income statement item. The<br />

earnings forecasts were reassessed in the light of the changed market situation encountered by the Automotive Components<br />

Division.<br />

The brands and rights to supply customers, licences and software capitalised by the various sub-groups are another important<br />

intangible asset category. The breakdown of these assets is as follows:<br />

Brands and rights to supply customers,<br />

licences and software<br />

31 dec. 2009 Additions Disposals<br />

Reclas sifi<br />

cations<br />

Amortisation 31 dec. <strong>2010</strong><br />

<strong>Frauenthal</strong> group 17,974 458 0 4 -1,691 16,745<br />

Impairments of EUR 77,000 (2009: EUR 103,000) were recognised in respect of brands and rights to supply customers with<br />

indefi nite useful lives, which make up part of the statement of fi nancial position item shown in the table. These brand rights<br />

relate to internally generated brands that form part of the product range, and which the Group does not currently intend<br />

to change or retire. The rights to supply customers are of unlimited duration and can only be ended by termination of contract.<br />

Impairment is recognised as soon as any of these rights are terminated. The impairment losses are reported under the<br />

“Depreciation, amortisation and impairment” item in the income statement. They relate entirely to the Wholesale Plumbing<br />

Supplies Division. The carrying value of these brands and rights at the end of the reporting period was EUR 14,201,000 (31<br />

Dec. 2009: 14,278,000).<br />

In 2009 the breakdown of “Brands and rights to supply customers, licences and software” was as follows:<br />

Brands and rights to supply customers,<br />

licences and software<br />

31 dec. 2008<br />

Additions Disposals<br />

Reclas sifi<br />

cations<br />

Amortisation 31 dec. 2009<br />

<strong>Frauenthal</strong> group 18,667 886 -46 269 -1,802 17,974<br />

The brands and rights to supply customers were measured according to their value in use. The carrying value was originally<br />

calculated using the discounted cash fl ow (DCF) method. The main infl uence on the cash fl ow forecast used to value the<br />

brand and customer supply rights is the revenue generated by the product or customer segment projected by the annual<br />

budget. The discount rate is 8.67 % (2009: 8.67 %), and the forecasting period is usually fi ve years (2009: fi ve years). Due<br />

to the long contractual terms, an exception is made in the case of the rights to supply customers, and a period of 20 years<br />

(2009: 20 years) is applied. The parameters applied are based on experience and are reviewed on an annual basis.<br />

109