International Energy Outlook 2011 - EIA

International Energy Outlook 2011 - EIA

International Energy Outlook 2011 - EIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

U.S. <strong>Energy</strong> Information Administration | <strong>International</strong> <strong>Energy</strong> <strong>Outlook</strong> <strong>2011</strong><br />

Liquid fuels<br />

In contrast, the Low Oil Price and High Oil Price cases in IEO<strong>2011</strong> assume that changes in demand growth, resulting in different levels<br />

of demand, also affect prices. Thus, the Low Oil Price and High Oil Price cases incorporate alternative assumptions about economic<br />

growth and other structural factors in non-OECD countries that shift the “demand schedule” for liquids fuels while also continuing to<br />

maintain a portion of the change in “supply schedules” that drive the Traditional High Oil Price and Traditional Low Oil Price cases. The<br />

IEO<strong>2011</strong> Low Oil Price case assumes that liquids demand in the non-OECD countries (where most of the world’s demand uncertainty<br />

lies) at any given price level is lower than in the Reference case, and that total liquids supply available at any price point is higher than in<br />

the Reference case. It also assumes that the shifts in demand and supply schedules lead to changes in the liquids quantities, resulting in<br />

price levels that are the same as those in the Traditional Low Oil Price case. That is, the only change is in the amount of oil consumed in<br />

the world market. Similarly, the IEO<strong>2011</strong> High Oil Price case assumes that liquids demand in the non-OECD countries at any given price<br />

level is higher than in the Reference case, and that the total liquids supply available at any price point is lower than in the Reference case,<br />

with the shifts in demand and supply schedules leading to changes in the quantities of liquids available, so that price levels that are the<br />

same as those in the Traditional High Oil Price case. Again, the only change is in the amount of oil consumed in the market.<br />

In the Reference case, world oil prices are $95 per barrel in 2015 (real 2009 dollars), increasing slowly to $125 per barrel in<br />

2035 ($200 per day in nominal terms). The Reference case represents <strong>EIA</strong>’s current best judgment regarding exploration and<br />

development costs and accessibility of oil resources outside the United States. It also assumes that OPEC producers will choose to<br />

maintain their share of the market and will schedule investments in incremental production capacity so that OPEC’s conventional<br />

oil production represents about 42 percent of the world’s total liquids production. To retain that share, OPEC would have to increase<br />

production by 11.3 million barrels per day from 2008 to 2035, or 43 percent of the projected total increase in world liquids supply<br />

(Figure 32). Non-OPEC conventional supplies—including production from high-cost projects and from countries with unattractive<br />

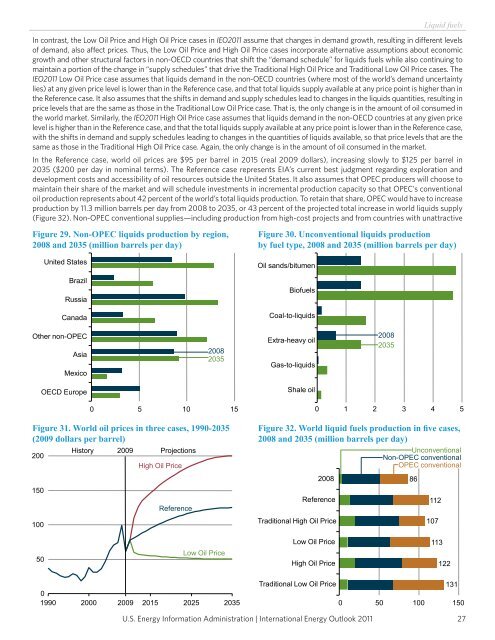

Figure 29. Non-OPEC liquids production by region,<br />

2008 and 2035 (million barrels per day)<br />

200<br />

150<br />

100<br />

50<br />

United States<br />

Brazil<br />

Russia<br />

Canada<br />

Other non-OPEC<br />

Asia<br />

Mexico<br />

OECD Europe<br />

0 5 10 15<br />

Figure 31. World oil prices in three cases, 1990-2035<br />

(2009 dollars per barrel)<br />

History 2009 Projections<br />

High Oil Price<br />

Reference<br />

2008<br />

2035<br />

Low Oil Price<br />

0<br />

1990 2000 2009 2015 2025 2035<br />

Figure 30. Unconventional liquids production<br />

by fuel type, 2008 and 2035 (million barrels per day)<br />

Oil sands/bitumen<br />

Biofuels<br />

Coal-to-liquids<br />

Extra-heavy oil<br />

Gas-to-liquids<br />

Shale oil<br />

2008<br />

Reference<br />

Traditional High Oil Price<br />

Low Oil Price<br />

High Oil Price<br />

Traditional Low Oil Price<br />

2008<br />

2035<br />

0 1 2 3 4 5<br />

Figure 32. World liquid fuels production in five cases,<br />

2008 and 2035 (million barrels per day)<br />

Unconventional<br />

Non-OPEC conventional<br />

OPEC conventional<br />

86<br />

112<br />

107<br />

113<br />

122<br />

131<br />

0 50 100 150<br />

27