International Energy Outlook 2011 - EIA

International Energy Outlook 2011 - EIA

International Energy Outlook 2011 - EIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

U.S. <strong>Energy</strong> Information Administration | <strong>International</strong> <strong>Energy</strong> <strong>Outlook</strong> <strong>2011</strong><br />

Liquid fuels<br />

automobile efficiency standards and government incentives introduced in many nations during the recession, such as the U.S.<br />

“cash for clunkers” program, designed to encourage consumers to trade in older, less efficient cars for newer ones that are more<br />

fuel-efficient. In Japan and OECD Europe, liquids consumption declines by average annual rates of 0.4 percent (0.5 million barrels<br />

per day) and 0.2 percent (0.7 million barrels per day), respectively, from 2008 to 2035.<br />

As a result of the different growth trends for the non-OECD and OECD regions, non-OECD liquids consumption in 2020 exceeds<br />

OECD consumption. The difference widens considerably over time, and in 2035 non-OECD consumption is 23 percent greater than<br />

OECD consumption. Although China’s demand for liquids increases by 3.5 percent per year over the projection, its consumption in<br />

2035 still is 5.0 million barrels per day less than U.S. liquids consumption.<br />

In the Low Oil Price case, non-OECD consumption and OECD consumption are nearly identical, at 57.0 and 56.3 million barrels per<br />

day in 2035, respectively. OECD consumption is higher than in the Reference case, because low prices discourage conservation<br />

and allow consumers to continue to use liquid fuels without economic impact. Most of the increase in OECD consumption in the<br />

Low Oil Price case occurs in the Americas and in Asia.<br />

In contrast to the OECD, non-OECD consumption is 4.8 million barrels per day lower in the Low Oil Price case than in the Reference<br />

Case. In this case, slower growth in demand for liquids among the developing nations keeps world oil prices low—in contrast<br />

to the Traditional Low Oil Price case, where low prices encourage increased consumption worldwide. Although OECD liquids<br />

consumption levels in 2035 are similar in the Low Oil Price and Traditional Low Oil Price cases, non-OECD consumption grows to<br />

a total of 74.4 million barrels per day in 2035 in the Traditional Low Oil Price case—17.4 million barrels per day higher than in the<br />

Low Oil Price case and 12.6 million barrels higher than in the Reference case.<br />

In the High Oil Price case, where high oil prices are a result of strong growth in non-OECD demand for liquids, non-OECD liquids<br />

consumption represents 61 percent of the world total in 2035. China’s consumption of liquids grows by an average of 3.8 percent<br />

per year (from 7.8 million barrels per day in 2008 to 21.2 million barrels per day in 2035), as compared with 3.5 percent per year<br />

in the Reference case. India and the Middle East also increase consumption by an average of more than 2.0 percent per year.<br />

OECD consumption declines slightly through the mid-term and increases only slightly in the longer term, with high world oil prices<br />

encouraging consumers to conserve fuel and turn to alternatives fuels whenever possible. OECD liquid fuel use in the High Oil Price<br />

case remains below the 2008 level of 48.0 million barrels per day through 2035.<br />

Non-OECD demand, which is higher in the High Oil Price case than in the Reference case, provides support for higher world oil<br />

prices. For example, in the High Oil Price case China’s liquids consumption in 2035 is equal to U.S. consumption. In contrast, in<br />

the Traditional High Oil Price case, demand for liquids in all regions is affected only by price, with high prices dampening liquids<br />

demand and encouraging conservation and fuel switching. As a result, liquids consumption in the Traditional High Oil Price case<br />

is lower than in the Reference case in every IEO<strong>2011</strong> region. In the Traditional High Oil Price case, non-OECD liquids consumption<br />

totals 59.4 million barrels per day in 2035, as compared with 74.2 million barrels per day in the High Oil Price case and 61.8 million<br />

barrels per day in the Reference case. OECD liquids consumption in 2035 in the Traditional High Oil Price case is almost the same<br />

as in the High Oil Price case.<br />

Recent market trends<br />

In 2010, world oil prices responded primarily to expectations about demand, with producers, consumers, and traders looking<br />

for some indication as to when the world’s economy would recover, what shape the recovery would take, and how strong the<br />

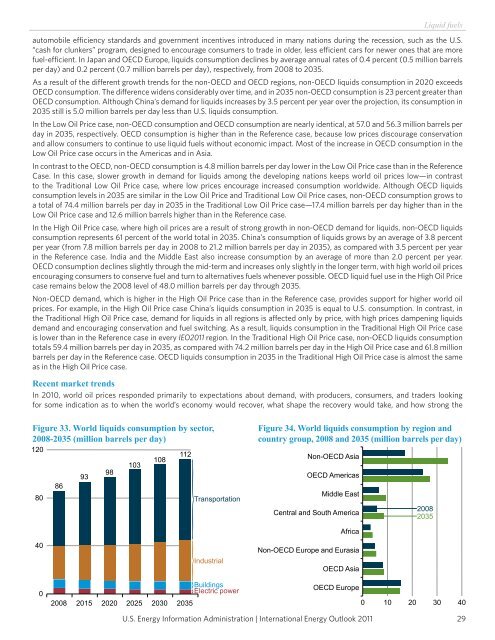

Figure 33. World liquids consumption by sector,<br />

2008-2035 (million barrels per day)<br />

120<br />

80<br />

40<br />

0<br />

86<br />

93<br />

98<br />

103<br />

108<br />

112<br />

2008 2015 2020 2025 2030 2035<br />

Transportation<br />

Industrial<br />

Buildings<br />

Electric power<br />

Figure 34. World liquids consumption by region and<br />

country group, 2008 and 2035 (million barrels per day)<br />

Non-OECD Asia<br />

OECD Americas<br />

Middle East<br />

Central and South America<br />

Africa<br />

Non-OECD Europe and Eurasia<br />

OECD Asia<br />

OECD Europe<br />

2008<br />

2035<br />

0 10 20 30 40<br />

29