The Case Study - Seylan Bank

The Case Study - Seylan Bank

The Case Study - Seylan Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

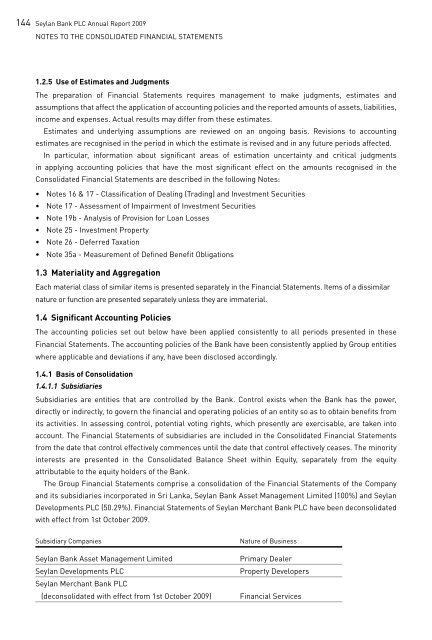

144<strong>Seylan</strong> <strong>Bank</strong> PLC Annual Report 2009Notes to the Consolidated Financial Statements1.2.5 Use of Estimates and Judgments<strong>The</strong> preparation of Financial Statements requires management to make judgments, estimates andassumptions that affect the application of accounting policies and the reported amounts of assets, liabilities,income and expenses. Actual results may differ from these estimates.Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accountingestimates are recognised in the period in which the estimate is revised and in any future periods affected.In particular, information about significant areas of estimation uncertainty and critical judgmentsin applying accounting policies that have the most significant effect on the amounts recognised in theConsolidated Financial Statements are described in the following Notes:• Notes 16 & 17 - Classification of Dealing (Trading) and Investment Securities• Note 17 - Assessment of Impairment of Investment Securities• Note 19b - Analysis of Provision for Loan Losses• Note 25 - Investment Property• Note 26 - Deferred Taxation• Note 35a - Measurement of Defined Benefit Obligations1.3 Materiality and AggregationEach material class of similar items is presented separately in the Financial Statements. Items of a dissimilarnature or function are presented separately unless they are immaterial.1.4 Significant Accounting Policies<strong>The</strong> accounting policies set out below have been applied consistently to all periods presented in theseFinancial Statements. <strong>The</strong> accounting policies of the <strong>Bank</strong> have been consistently applied by Group entitieswhere applicable and deviations if any, have been disclosed accordingly.1.4.1 Basis of Consolidation1.4.1.1 SubsidiariesSubsidiaries are entities that are controlled by the <strong>Bank</strong>. Control exists when the <strong>Bank</strong> has the power,directly or indirectly, to govern the financial and operating policies of an entity so as to obtain benefits fromits activities. In assessing control, potential voting rights, which presently are exercisable, are taken intoaccount. <strong>The</strong> Financial Statements of subsidiaries are included in the Consolidated Financial Statementsfrom the date that control effectively commences until the date that control effectively ceases. <strong>The</strong> minorityinterests are presented in the Consolidated Balance Sheet within Equity, separately from the equityattributable to the equity holders of the <strong>Bank</strong>.<strong>The</strong> Group Financial Statements comprise a consolidation of the Financial Statements of the Companyand its subsidiaries incorporated in Sri Lanka, <strong>Seylan</strong> <strong>Bank</strong> Asset Management Limited (100%) and <strong>Seylan</strong>Developments PLC (50.29%). Financial Statements of <strong>Seylan</strong> Merchant <strong>Bank</strong> PLC have been deconsolidatedwith effect from 1st October 2009.Subsidiary Companies<strong>Seylan</strong> <strong>Bank</strong> Asset Management Limited<strong>Seylan</strong> Developments PLC<strong>Seylan</strong> Merchant <strong>Bank</strong> PLC(deconsolidated with effect from 1st October 2009)Nature of BusinessPrimary DealerProperty DevelopersFinancial Services