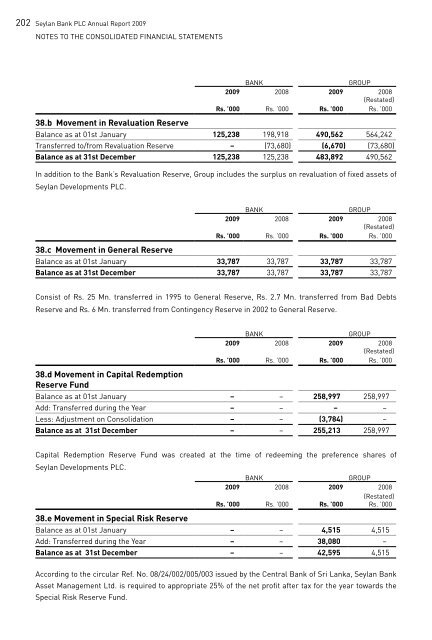

202<strong>Seylan</strong> <strong>Bank</strong> PLC Annual Report 2009Notes to the Consolidated Financial StatementsBANKGROUP2009 2008 2009 2008(Restated)Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’00038.b Movement in Revaluation ReserveBalance as at 01st January 125,238 198,918 490,562 564,242Transferred to/from Revaluation Reserve – (73,680) (6,670) (73,680)Balance as at 31st December 125,238 125,238 483,892 490,562In addition to the <strong>Bank</strong>’s Revaluation Reserve, Group includes the surplus on revaluation of fixed assets of<strong>Seylan</strong> Developments PLC.BANKGROUP2009 2008 2009 2008(Restated)Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’00038.c Movement in General ReserveBalance as at 01st January 33,787 33,787 33,787 33,787Balance as at 31st December 33,787 33,787 33,787 33,787Consist of Rs. 25 Mn. transferred in 1995 to General Reserve, Rs. 2.7 Mn. transferred from Bad DebtsReserve and Rs. 6 Mn. transferred from Contingency Reserve in 2002 to General Reserve.BANKGROUP2009 2008 2009 2008(Restated)Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’00038.d Movement in Capital RedemptionReserve FundBalance as at 01st January – – 258,997 258,997Add: Transferred during the Year – – – –Less: Adjustment on Consolidation – – (3,784) –Balance as at 31st December – – 255,213 258,997Capital Redemption Reserve Fund was created at the time of redeeming the preference shares of<strong>Seylan</strong> Developments PLC.BANKGROUP2009 2008 2009 2008(Restated)Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’00038.e Movement in Special Risk ReserveBalance as at 01st January – – 4,515 4,515Add: Transferred during the Year – – 38,080 –Balance as at 31st December – – 42,595 4,515According to the circular Ref. No. 08/24/002/005/003 issued by the Central <strong>Bank</strong> of Sri Lanka, <strong>Seylan</strong> <strong>Bank</strong>Asset Management Ltd. is required to appropriate 25% of the net profit after tax for the year towards theSpecial Risk Reserve Fund.

<strong>Seylan</strong> <strong>Bank</strong> PLC Annual Report 2009 203Notes to the Consolidated Financial Statements39. Commitments and ContingenciesIn the normal course of business, the <strong>Bank</strong> makes various commitments and incurs certain contingentliabilities with legal recourse to its customers. No material losses are anticipated as a result of thesetransactions.BANKGROUP2009 2008 2009 2008(Restated)Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’00039.a CommitmentsUndrawn Credit Lines 8,698,972 8,943,671 8,698,972 8,943,671Capital Commitments (Note 40.a) 2,684 143,252 2,684 143,2528,701,656 9,086,923 8,701,656 9,086,92339.b ContingenciesAcceptances 2,781,914 3,544,212 2,781,914 3,544,212Stand by Letters of Credit 283,255 559,581 283,255 559,581Guarantees 7,194,304 8,005,123 7,194,304 8,005,123Documentary Credit 2,007,403 1,983,522 2,007,403 1,983,522Bills for Collection 1,335,048 3,353,715 1,335,048 3,353,715Forward Exchange Contracts (Net) (41,018) 341,299 (41,018) 341,29913,560,906 17,787,452 13,560,906 17,787,452Total Commitments and Contingencies 22,262,562 26,874,375 22,262,562 26,874,37539.c <strong>Case</strong>s Against the <strong>Bank</strong>In the normal course of business, the <strong>Bank</strong> is involved in various types of litigation with borrowers or otherswho have asserted or threatened claims/counter claims against the <strong>Bank</strong>. Including the following:c. i. Civil <strong>Case</strong>s1. Some of the appeals relate to cases;• CHC 128/2001 (1) and CHC 14/98 both cases are in appeal. Both appeals not yet listed.• CA (Rev) 1788/04. Appeal pending. Fixed for argument on 12th March 2010.• CHC 157/2001 (1) <strong>Case</strong> pending in Supreme Court. <strong>Case</strong> is fixed for argument on 21st June 2010.• HC (Civil) 137/99(1). Judgment delivered in favour of the <strong>Bank</strong>. Plaintiff appealed against judgment.• DC Colombo 15958/M. Appeal pending.2. DC Mt. Lavinia 4246/03 <strong>Case</strong> is filed against the <strong>Bank</strong> claiming wrongful seizure. <strong>The</strong> case is coming upon 24th March 2010 for inquiry.3. DC Colombo 157/2007 claiming that, <strong>Bank</strong> had honoured 3rd party cheque which, allegedly forged by thecustomer of our Raddolumgama Branch (RDL) and credited to his account. Trial on 10th March 2010.4. DC Ratnapura 23391/M case filed by customer for wrongful take over of assets not mortgaged. <strong>Case</strong> isfixed for answer on 12th March 2010.5. CHC Colombo 403/09/MR. <strong>Case</strong> filed by plaintiff claiming that <strong>Bank</strong> has not permitted the customer toutilise the facilities and charging high rate of interest. <strong>Case</strong> is fixed for Answer.