Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

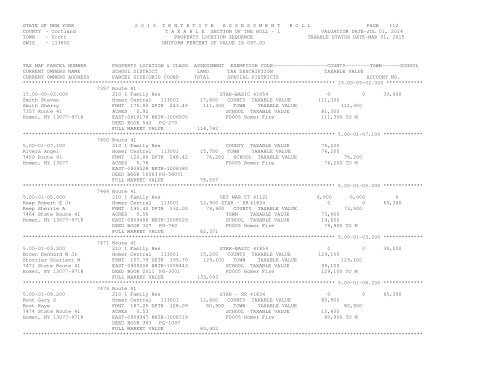

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 112COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 15.00-05-02.000 ************7357 Route 4115.00-05-02.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Smith Steven Homer Central 113001 17,800 COUNTY TAXABLE VALUE 111,300Smith Sherry FRNT 175.00 DPTH 243.49 111,300 TOWN TAXABLE VALUE 111,3007357 Route 41 ACRES 0.92 SCHOOL TAXABLE VALUE 81,300Homer, NY 13077-9718 EAST-0910179 NRTH-1006505 FD005 Homer Fire 111,300 TO MDEED BOOK 542 PG-270FULL MARKET VALUE 114,742******************************************************************************************************* 5.00-01-07.100 *************7450 Route 415.00-01-07.100 210 1 Family Res COUNTY TAXABLE VALUE 76,200Rivera Angel Homer Central 113001 15,700 TOWN TAXABLE VALUE 76,2007450 Route 41 FRNT 120.00 DPTH 248.42 76,200 SCHOOL TAXABLE VALUE 76,200Homer, NY 13077 ACRES 0.76 FD005 Homer Fire 76,200 TO MEAST-0909528 NRTH-1008380DEED BOOK 10363 PG-58001FULL MARKET VALUE 78,557******************************************************************************************************* 5.00-01-05.000 *************7464 Route 415.00-01-05.000 210 1 Family Res VET WAR CT 41121 6,000 6,000 0Keep Robert E Jr Homer Central 113001 12,900 STAR - SR 41834 0 0 65,300Keep Sherrie A FRNT 195.40 DPTH 132.00 79,900 COUNTY TAXABLE VALUE 73,9007464 State Route 41 ACRES 0.56 TOWN TAXABLE VALUE 73,900Homer, NY 13077-9718 EAST-0909408 NRTH-1008529 SCHOOL TAXABLE VALUE 14,600DEED BOOK 327 PG-760 FD005 Homer Fire 79,900 TO MFULL MARKET VALUE 82,371******************************************************************************************************* 5.00-01-03.200 *************7471 Route 415.00-01-03.200 210 1 Family Res STAR-BASIC 41854 0 0 30,000Brown Kennard W Jr Homer Central 113001 15,200 COUNTY TAXABLE VALUE 129,100Storrier Scarlett M FRNT 157.79 DPTH 195.70 129,100 TOWN TAXABLE VALUE 129,1007471 State Route 41 EAST-0909206 NRTH-1008443 SCHOOL TAXABLE VALUE 99,100Homer, NY 13077-9718 DEED BOOK 2011 PG-3001 FD005 Homer Fire 129,100 TO MFULL MARKET VALUE 133,093******************************************************************************************************* 5.00-01-08.200 *************7474 Route 415.00-01-08.200 210 1 Family Res STAR - SR 41834 0 0 65,300Root Gary S Homer Central 113001 12,600 COUNTY TAXABLE VALUE 80,900Root Kaye FRNT 187.25 DPTH 128.09 80,900 TOWN TAXABLE VALUE 80,9007474 State Route 41 ACRES 0.53 SCHOOL TAXABLE VALUE 15,600Homer, NY 13077-9718 EAST-0909347 NRTH-1008719 FD005 Homer Fire 80,900 TO MDEED BOOK 363 PG-1007FULL MARKET VALUE 83,402************************************************************************************************************************************