STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 119COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 36.00-03-04.200 ************6328 Stevens Rd36.00-03-04.200 210 1 Family Res COUNTY TAXABLE VALUE 144,600Lavere Michael A Homer Central 113001 21,100 TOWN TAXABLE VALUE 144,600Lavere Katherine S ACRES 2.33 BANKCORELOG 144,600 SCHOOL TAXABLE VALUE 144,6006328 Stevens Rd EAST-0927794 NRTH-0989237 FD005 Homer Fire 144,600 TO MHomer, NY 13077-9710 DEED BOOK 1998 PG-2807FULL MARKET VALUE 149,072******************************************************************************************************* 36.00-03-05.200 ************6399 Stevens Rd36.00-03-05.200 210 1 Family Res STAR-BASIC 41854 0 0 30,000Riley Patrick Homer Central 113001 25,000 COUNTY TAXABLE VALUE 191,000808 State Route 222 ACRES 3.23 BANKCORELOG 191,000 TOWN TAXABLE VALUE 191,000<strong>Cortland</strong>, NY 13045 EAST-0927049 NRTH-0989772 SCHOOL TAXABLE VALUE 161,000DEED BOOK 2011 PG-5701 FD005 Homer Fire 191,000 TO MFULL MARKET VALUE 196,907******************************************************************************************************* 26.00-02-02.110 ************6438 Stevens Rd26.00-02-02.110 210 1 Family Res STAR-BASIC 41854 0 0 30,000Schneider Peter G Homer Central 113001 23,800 COUNTY TAXABLE VALUE 222,800Schneider Kara L ACRES 4.00 222,800 TOWN TAXABLE VALUE 222,8006438 Stevens Rd EAST-0927399 NRTH-0991213 SCHOOL TAXABLE VALUE 192,800Homer, NY 13077-9710 DEED BOOK 2014 PG-5042 FD005 Homer Fire 222,800 TO MFULL MARKET VALUE 229,691******************************************************************************************************* 26.00-02-01.120 ************6454 Stevens Rd26.00-02-01.120 240 Rural res VET WAR CT 41121 6,000 6,000 0Matthews Bradley K Homer Central 113001 33,900 STAR-BASIC 41854 0 0 30,000Matthews Laurie J ACRES 10.24 BANKCORELOG 165,000 COUNTY TAXABLE VALUE 159,0006454 Stevens Rd EAST-0927823 NRTH-0991552 TOWN TAXABLE VALUE 159,000Homer, NY 13077-9710 DEED BOOK 1997 PG-4086 SCHOOL TAXABLE VALUE 135,000FULL MARKET VALUE 170,103 FD005 Homer Fire 165,000 TO M******************************************************************************************************* 26.00-02-01.200 ************6466 Stevens Rd26.00-02-01.200 240 Rural res VET WAR C 41122 6,000 0 0Brush Peter N Homer Central 113001 35,600 VET WAR T 41123 0 6,000 06466 Stevens Rd ACRES 11.47 142,600 STAR - SR 41834 0 0 65,300Homer, NY 13077-9710 EAST-0927882 NRTH-0991872 COUNTY TAXABLE VALUE 136,600DEED BOOK 2011 PG-3308 TOWN TAXABLE VALUE 136,600FULL MARKET VALUE 147,010 SCHOOL TAXABLE VALUE 77,300FD005 Homer Fire 142,600 TO M******************************************************************************************************* 26.00-02-01.110 ************6505 Stevens Rd26.00-02-01.110 260 Seasonal res COUNTY TAXABLE VALUE 35,700Bieber John S Homer Central 113001 15,700 TOWN TAXABLE VALUE 35,700PO Box 259 ACRES 27.91 35,700 SCHOOL TAXABLE VALUE 35,700Homer, NY 13077 EAST-0927840 NRTH-0992517 FD005 Homer Fire 35,700 TO MDEED BOOK 2000 PG-1284FULL MARKET VALUE 36,804

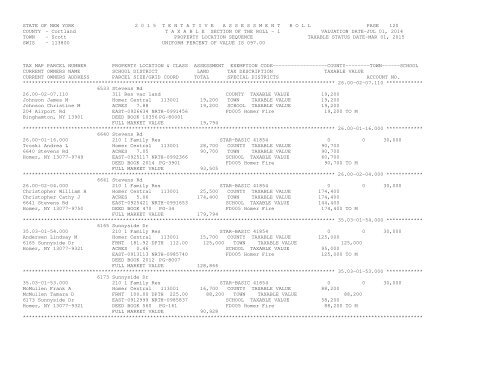

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 120COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 26.00-02-07.110 ************6533 Stevens Rd26.00-02-07.110 311 Res vac land COUNTY TAXABLE VALUE 19,200Johnson James M Homer Central 113001 19,200 TOWN TAXABLE VALUE 19,200Johnson Christine M ACRES 7.88 19,200 SCHOOL TAXABLE VALUE 19,200204 Airport Rd EAST-0926634 NRTH-0991456 FD005 Homer Fire 19,200 TO MBinghamton, NY 13901 DEED BOOK 10356 PG-80001FULL MARKET VALUE 19,794******************************************************************************************************* 26.00-01-16.000 ************6640 Stevens Rd26.00-01-16.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Troski Andrea L Homer Central 113001 28,700 COUNTY TAXABLE VALUE 90,7006640 Stevens Rd ACRES 7.05 90,700 TOWN TAXABLE VALUE 90,700Homer, NY 13077-9749 EAST-0925117 NRTH-0992366 SCHOOL TAXABLE VALUE 60,700DEED BOOK 2014 PG-3901 FD005 Homer Fire 90,700 TO MFULL MARKET VALUE 93,505******************************************************************************************************* 26.00-02-04.000 ************6641 Stevens Rd26.00-02-04.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Christopher William H Homer Central 113001 25,500 COUNTY TAXABLE VALUE 174,400Christopher Cathy J ACRES 5.06 174,400 TOWN TAXABLE VALUE 174,4006641 Stevens Rd EAST-0925421 NRTH-0991653 SCHOOL TAXABLE VALUE 144,400Homer, NY 13077-9750 DEED BOOK 470 PG-34 FD005 Homer Fire 174,400 TO MFULL MARKET VALUE 179,794******************************************************************************************************* 35.03-01-54.000 ************6165 Sunnyside Dr35.03-01-54.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Andersen Lindsay M Homer Central 113001 15,700 COUNTY TAXABLE VALUE 125,0006165 Sunnyside Dr FRNT 181.92 DPTH 112.00 125,000 TOWN TAXABLE VALUE 125,000Homer, NY 13077-9321 ACRES 0.46 SCHOOL TAXABLE VALUE 95,000EAST-0913113 NRTH-0985740 FD005 Homer Fire 125,000 TO MDEED BOOK 2012 PG-8007FULL MARKET VALUE 128,866******************************************************************************************************* 35.03-01-53.000 ************6173 Sunnyside Dr35.03-01-53.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000McMullen Frank A Homer Central 113001 16,700 COUNTY TAXABLE VALUE 88,200McMullen Tamara D FRNT 100.00 DPTH 225.00 88,200 TOWN TAXABLE VALUE 88,2006173 Sunnyside Dr EAST-0912999 NRTH-0985837 SCHOOL TAXABLE VALUE 58,200Homer, NY 13077-9321 DEED BOOK 560 PG-161 FD005 Homer Fire 88,200 TO MFULL MARKET VALUE 90,928************************************************************************************************************************************