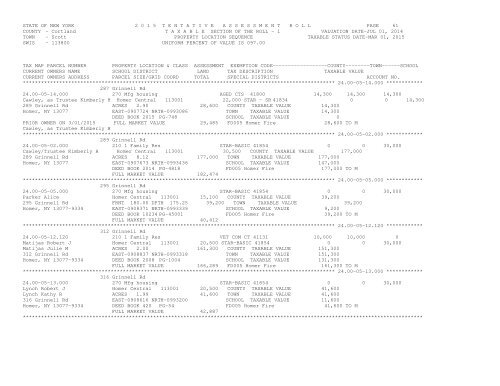

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 61COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-05-14.000 ************287 Grinnell Rd24.00-05-14.000 270 Mfg housing AGED CTS 41800 14,300 14,300 14,300Cawley, as Trustee Kimberly H Homer Central 113001 22,000 STAR - SR 41834 0 0 14,300289 Grinnell Rd ACRES 2.90 28,600 COUNTY TAXABLE VALUE 14,300Homer, NY 13077 EAST-0907724 NRTH-0993086 TOWN TAXABLE VALUE 14,300DEED BOOK 2015 PG-748 SCHOOL TAXABLE VALUE 0PRIOR OWNER ON 3/01/2015 FULL MARKET VALUE 29,485 FD005 Homer Fire 28,600 TO MCawley, as Trustee Kimberly H******************************************************************************************************* 24.00-05-02.000 ************289 Grinnell Rd24.00-05-02.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Cawley/Trustee Kimberly H Homer Central 113001 30,500 COUNTY TAXABLE VALUE 177,000289 Grinnell Rd ACRES 8.12 177,000 TOWN TAXABLE VALUE 177,000Homer, NY 13077 EAST-0907673 NRTH-0993436 SCHOOL TAXABLE VALUE 147,000DEED BOOK 2014 PG-4818 FD005 Homer Fire 177,000 TO MFULL MARKET VALUE 182,474******************************************************************************************************* 24.00-05-05.000 ************295 Grinnell Rd24.00-05-05.000 270 Mfg housing STAR-BASIC 41854 0 0 30,000Parker Alice Homer Central 113001 15,100 COUNTY TAXABLE VALUE 39,200295 Grinnell Rd FRNT 180.00 DPTH 175.25 39,200 TOWN TAXABLE VALUE 39,200Homer, NY 13077-9334 EAST-0908371 NRTH-0993339 SCHOOL TAXABLE VALUE 9,200DEED BOOK 10234 PG-45001 FD005 Homer Fire 39,200 TO MFULL MARKET VALUE 40,412******************************************************************************************************* 24.00-05-12.120 ************312 Grinnell Rd24.00-05-12.120 210 1 Family Res VET COM CT 41131 10,000 10,000 0Matijas Robert J Homer Central 113001 20,500 STAR-BASIC 41854 0 0 30,000Matijas Julie M ACRES 2.00 161,300 COUNTY TAXABLE VALUE 151,300312 Grinnell Rd EAST-0908837 NRTH-0993318 TOWN TAXABLE VALUE 151,300Homer, NY 13077-9334 DEED BOOK 2008 PG-1004 SCHOOL TAXABLE VALUE 131,300FULL MARKET VALUE 166,289 FD005 Homer Fire 161,300 TO M******************************************************************************************************* 24.00-05-13.000 ************316 Grinnell Rd24.00-05-13.000 270 Mfg housing STAR-BASIC 41854 0 0 30,000Lynch Robert J Homer Central 113001 20,500 COUNTY TAXABLE VALUE 41,600Lynch Kathy R ACRES 1.99 41,600 TOWN TAXABLE VALUE 41,600316 Grinnell Rd EAST-0908616 NRTH-0993200 SCHOOL TAXABLE VALUE 11,600Homer, NY 13077-9334 DEED BOOK 420 PG-54 FD005 Homer Fire 41,600 TO MFULL MARKET VALUE 42,887************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 62COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-05-06.000 ************327 Grinnell Rd24.00-05-06.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Meriwether Seth Homer Central 113001 27,900 COUNTY TAXABLE VALUE 147,100327 Grinnell Rd ACRES 6.52 147,100 TOWN TAXABLE VALUE 147,100Homer, NY 13077-9334 EAST-0908499 NRTH-0993715 SCHOOL TAXABLE VALUE 117,100DEED BOOK 2000, PG-1649, FD005 Homer Fire 147,100 TO MFULL MARKET VALUE 151,649******************************************************************************************************* 24.00-05-07.100 ************331 Grinnell Rd24.00-05-07.100 270 Mfg housing STAR-BASIC 41854 0 0 30,000Ferri Jeff E Homer Central 113001 24,100 COUNTY TAXABLE VALUE 66,900Ferri Louanne A ACRES 4.23 BANKCORELOG 66,900 TOWN TAXABLE VALUE 66,900331 Grinnell Rd EAST-0908842 NRTH-0993919 SCHOOL TAXABLE VALUE 36,900Homer, NY 13077-9334 DEED BOOK 1997 PG-862 FD005 Homer Fire 66,900 TO MFULL MARKET VALUE 68,969******************************************************************************************************* 24.00-05-10.000 ************334 Grinnell Rd24.00-05-10.000 270 Mfg housing STAR - SR 41834 0 0 54,300Brill Frances J Homer Central 113001 23,000 COUNTY TAXABLE VALUE 54,300Brill Wanda M ACRES 3.56 54,300 TOWN TAXABLE VALUE 54,300334 Grinnell Rd EAST-0909067 NRTH-0993435 SCHOOL TAXABLE VALUE 0Homer, NY 13077-9334 DEED BOOK 2013 PG-4280 FD005 Homer Fire 54,300 TO MFULL MARKET VALUE 55,979******************************************************************************************************* 24.00-05-04.000 ************291,293 Grinnell Rd24.00-05-04.000 270 Mfg housing VET WAR CT 41121 6,000 6,000 0Miles Richard & Charlotte Homer Central 113001 18,900 COUNTY TAXABLE VALUE 62,200French Donna C ACRES 1.00 68,200 TOWN TAXABLE VALUE 62,200291 Grinnell Rd EAST-0908215 NRTH-0993247 SCHOOL TAXABLE VALUE 68,200Homer, NY 13077-9334 DEED BOOK 2000 PG-4599 FD005 Homer Fire 68,200 TO MFULL MARKET VALUE 70,309******************************************************************************************************* 24.00-01-28.000 ************Grout Brook Rd24.00-01-28.000 311 Res vac land COUNTY TAXABLE VALUE 1,700Tinker Roger L Homer Central 113001 1,700 TOWN TAXABLE VALUE 1,700Tinker Laverna B ACRES 5.70 1,700 SCHOOL TAXABLE VALUE 1,7006828 Grout Brook Rd EAST-0906266 NRTH-0997154 FD005 Homer Fire 1,700 TO MHomer, NY 13077-8707 DEED BOOK 339 PG-951FULL MARKET VALUE 1,753******************************************************************************************************* 24.00-05-01.000 ************Grout Brook Rd24.00-05-01.000 311 Res vac land COUNTY TAXABLE VALUE 4,100Cawley/Trustee Kimberly H Homer Central 113001 4,100 TOWN TAXABLE VALUE 4,100289 Grinnell Rd ACRES 5.07 4,100 SCHOOL TAXABLE VALUE 4,100Homer, NY 13077 EAST-0907095 NRTH-0993675 FD005 Homer Fire 4,100 TO MDEED BOOK 2014 PG-4818FULL MARKET VALUE 4,227************************************************************************************************************************************