Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

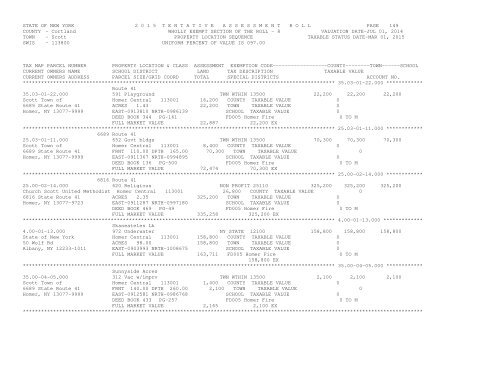

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 149COUNTY - <strong>Cortland</strong> WHOLLY EXEMPT SECTION OF THE ROLL - 8 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 35.03-01-22.000 ************Route 4135.03-01-22.000 591 Playground TWN WTHIN 13500 22,200 22,200 22,200<strong>Scott</strong> Town of Homer Central 113001 16,200 COUNTY TAXABLE VALUE 06689 State Route 41 ACRES 1.43 22,200 TOWN TAXABLE VALUE 0Homer, NY 13077-9999 EAST-0913810 NRTH-0986139 SCHOOL TAXABLE VALUE 0DEED BOOK 344 PG-161 FD005 Homer Fire 0 TO MFULL MARKET VALUE 22,887 22,200 EX******************************************************************************************************* 25.03-01-11.000 ************6689 Route 4125.03-01-11.000 652 Govt bldgs TWN WTHIN 13500 70,300 70,300 70,300<strong>Scott</strong> Town of Homer Central 113001 8,400 COUNTY TAXABLE VALUE 06689 State Route 41 FRNT 110.00 DPTH 165.00 70,300 TOWN TAXABLE VALUE 0Homer, NY 13077-9999 EAST-0911367 NRTH-0994895 SCHOOL TAXABLE VALUE 0DEED BOOK 136 PG-500 FD005 Homer Fire 0 TO MFULL MARKET VALUE 72,474 70,300 EX******************************************************************************************************* 25.00-02-14.000 ************6816 Route 4125.00-02-14.000 620 Religious NON PROFIT 25110 325,200 325,200 325,200Church <strong>Scott</strong> United Methodist Homer Central 113001 26,800 COUNTY TAXABLE VALUE 06816 State Route 41 ACRES 2.35 325,200 TOWN TAXABLE VALUE 0Homer, NY 13077-9723 EAST-0911287 NRTH-0997180 SCHOOL TAXABLE VALUE 0DEED BOOK 469 PG-49 FD005 Homer Fire 0 TO MFULL MARKET VALUE 335,258 325,200 EX******************************************************************************************************* 4.00-01-13.000 *************Skaneateles Lk4.00-01-13.000 972 Underwater NY STATE 12100 158,800 158,800 158,800State of New York Homer Central 113001 158,800 COUNTY TAXABLE VALUE 050 Wolf Rd ACRES 98.00 158,800 TOWN TAXABLE VALUE 0Albany, NY 12233-1011 EAST-0903993 NRTH-1008675 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 163,711 FD005 Homer Fire 0 TO M158,800 EX******************************************************************************************************* 35.00-04-05.000 ************Sunnyside Acres35.00-04-05.000 312 Vac w/imprv TWN WTHIN 13500 2,100 2,100 2,100<strong>Scott</strong> Town of Homer Central 113001 1,400 COUNTY TAXABLE VALUE 06689 State Route 41 FRNT 140.00 DPTH 260.00 2,100 TOWN TAXABLE VALUE 0Homer, NY 13077-9999 EAST-0912581 NRTH-0986768 SCHOOL TAXABLE VALUE 0DEED BOOK 433 PG-257 FD005 Homer Fire 0 TO MFULL MARKET VALUE 2,165 2,100 EX************************************************************************************************************************************