Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

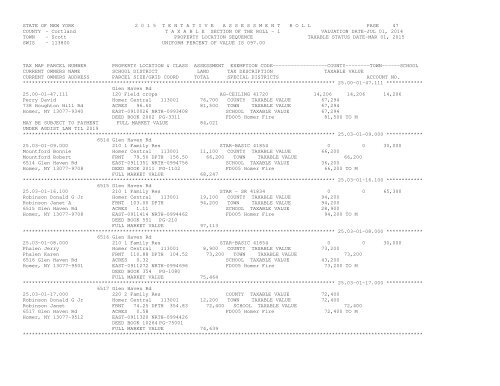

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 47COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 25.00-01-47.111 ************Glen Haven Rd25.00-01-47.111 120 Field crops AG-CEILING 41720 14,206 14,206 14,206Perry David Homer Central 113001 76,700 COUNTY TAXABLE VALUE 67,294738 Houghton Hill Rd ACRES 96.60 81,500 TOWN TAXABLE VALUE 67,294Homer, NY 13077-9340 EAST-0910026 NRTH-0993408 SCHOOL TAXABLE VALUE 67,294DEED BOOK 2002 PG-3311 FD005 Homer Fire 81,500 TO MMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 84,021UNDER AGDIST LAW TIL 2019******************************************************************************************************* 25.03-01-09.000 ************6514 Glen Haven Rd25.03-01-09.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Mountford Bonnie Homer Central 113001 11,100 COUNTY TAXABLE VALUE 66,200Mountford Robert FRNT 79.50 DPTH 156.50 66,200 TOWN TAXABLE VALUE 66,2006514 Glen Haven Rd EAST-0911351 NRTH-0994756 SCHOOL TAXABLE VALUE 36,200Homer, NY 13077-9708 DEED BOOK 2011 PG-1102 FD005 Homer Fire 66,200 TO MFULL MARKET VALUE 68,247******************************************************************************************************* 25.03-01-16.100 ************6515 Glen Haven Rd25.03-01-16.100 210 1 Family Res STAR - SR 41834 0 0 65,300Robinson Donald G Jr Homer Central 113001 19,100 COUNTY TAXABLE VALUE 94,200Robinson Janet A FRNT 103.00 DPTH 94,200 TOWN TAXABLE VALUE 94,2006515 Glen Haven Rd ACRES 1.11 SCHOOL TAXABLE VALUE 28,900Homer, NY 13077-9708 EAST-0911414 NRTH-0994462 FD005 Homer Fire 94,200 TO MDEED BOOK 551 PG-210FULL MARKET VALUE 97,113******************************************************************************************************* 25.03-01-08.000 ************6516 Glen Haven Rd25.03-01-08.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Phalen Jerry Homer Central 113001 8,900 COUNTY TAXABLE VALUE 73,200Phalen Karen FRNT 110.88 DPTH 104.52 73,200 TOWN TAXABLE VALUE 73,2006516 Glen Haven Rd ACRES 0.32 SCHOOL TAXABLE VALUE 43,200Homer, NY 13077-9501 EAST-0911272 NRTH-0994696 FD005 Homer Fire 73,200 TO MDEED BOOK 354 PG-1080FULL MARKET VALUE 75,464******************************************************************************************************* 25.03-01-17.000 ************6517 Glen Haven Rd25.03-01-17.000 220 2 Family Res COUNTY TAXABLE VALUE 72,400Robinson Donald G Jr Homer Central 113001 12,200 TOWN TAXABLE VALUE 72,400Robinson Janet FRNT 74.25 DPTH 354.83 72,400 SCHOOL TAXABLE VALUE 72,4006517 Glen Haven Rd ACRES 0.58 FD005 Homer Fire 72,400 TO MHomer, NY 13077-9512 EAST-0911320 NRTH-0994426DEED BOOK 10264 PG-75001FULL MARKET VALUE 74,639************************************************************************************************************************************