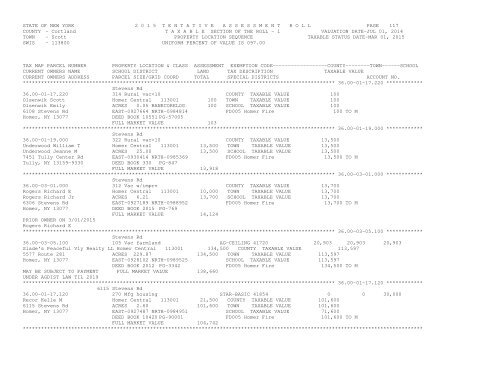

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 117COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 36.00-01-17.220 ************Stevens Rd36.00-01-17.220 314 Rural vac10 COUNTY TAXABLE VALUE 13,500Underwood William T Homer Central 113001 13,500 TOWN TAXABLE VALUE 13,500Underwood Jeanne M ACRES 25.00 13,500 SCHOOL TAXABLE VALUE 13,5007451 Tully Center Rd EAST-0930414 NRTH-0985369 FD005 Homer Fire 13,500 TO MTully, NY 13159-9330 DEED BOOK 330 PG-847FULL MARKET VALUE 13,918******************************************************************************************************* 36.00-03-01.000 ************Stevens Rd36.00-03-01.000 312 Vac w/imprv COUNTY TAXABLE VALUE 13,700Rogers Richard E Homer Central 113001 10,000 TOWN TAXABLE VALUE 13,700Rogers Richard Jr ACRES 6.21 13,700 SCHOOL TAXABLE VALUE 13,7006306 Stevens Rd EAST-0927189 NRTH-0988952 FD005 Homer Fire 13,700 TO MHomer, NY 13077 DEED BOOK 2015 PG-769FULL MARKET VALUE 14,124PRIOR OWNER ON 3/01/2015Rogers Richard E******************************************************************************************************* 36.00-03-05.100 ************Stevens Rd36.00-03-05.100 105 Vac farmland AG-CEILING 41720 20,903 20,903 20,903Slade's Peaceful Vly Realty LL Homer Central 113001 134,500 COUNTY TAXABLE VALUE 113,5975577 Route 281 ACRES 229.87 134,500 TOWN TAXABLE VALUE 113,597Homer, NY 13077 EAST-0928102 NRTH-0989525 SCHOOL TAXABLE VALUE 113,597DEED BOOK 2012 PG-3342 FD005 Homer Fire 134,500 TO MMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 138,660UNDER AGDIST LAW TIL 2019******************************************************************************************************* 36.00-01-17.120 ************6115 Stevens Rd36.00-01-17.120 270 Mfg housing STAR-BASIC 41854 0 0 30,000Recor Kelle M Homer Central 113001 21,500 COUNTY TAXABLE VALUE 101,6006115 Stevens Rd ACRES 2.60 101,600 TOWN TAXABLE VALUE 101,600Homer, NY 13077 EAST-0927487 NRTH-0984951 SCHOOL TAXABLE VALUE 71,600DEED BOOK 10420 PG-90001 FD005 Homer Fire 101,600 TO MFULL MARKET VALUE 104,742************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 118COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 36.00-01-17.210 ************6128 Stevens Rd36.00-01-17.210 210 1 Family Res STAR-BASIC 41854 0 0 30,000Dubois Kathleen A Homer Central 113001 27,700 COUNTY TAXABLE VALUE 144,3006128 Stevens Rd ACRES 7.82 144,300 TOWN TAXABLE VALUE 144,300Homer, NY 13077-9710 EAST-0928131 NRTH-0985034 SCHOOL TAXABLE VALUE 114,300DEED BOOK 422 PG-332 FD005 Homer Fire 144,300 TO MFULL MARKET VALUE 148,763******************************************************************************************************* 36.00-01-05.110 ************6192 Stevens Rd36.00-01-05.110 240 Rural res STAR-BASIC 41854 0 0 30,000Niederhofer Thomas R Homer Central 113001 54,300 COUNTY TAXABLE VALUE 178,600Niederhofer Sandy ACRES 47.00 178,600 TOWN TAXABLE VALUE 178,6006192 Stevens Rd EAST-0927401 NRTH-0986006 SCHOOL TAXABLE VALUE 148,600Homer, NY 13077-9767 DEED BOOK 2000 PG-4607 FD005 Homer Fire 178,600 TO MFULL MARKET VALUE 184,124******************************************************************************************************* 36.00-01-05.200 ************6252 Stevens Rd36.00-01-05.200 210 1 Family Res STAR-BASIC 41854 0 0 30,000Connery Philip M Homer Central 113001 29,200 COUNTY TAXABLE VALUE 177,200Connery Janie L ACRES 7.33 BANK BACTAX 177,200 TOWN TAXABLE VALUE 177,2006252 Stevens Rd EAST-0927867 NRTH-0988005 SCHOOL TAXABLE VALUE 147,200Homer, NY 13077-9710 DEED BOOK 1999 PG-161 FD005 Homer Fire 177,200 TO MFULL MARKET VALUE 182,680******************************************************************************************************* 36.00-03-02.000 ************6268 Stevens Rd36.00-03-02.000 270 Mfg housing STAR-BASIC 41854 0 0 30,000Rogers Richard E Jr Homer Central 113001 19,800 COUNTY TAXABLE VALUE 74,800Rogers Robyn S ACRES 1.50 BANKCFCUCOM 74,800 TOWN TAXABLE VALUE 74,8006268 Stevens Rd EAST-0927636 NRTH-0988529 SCHOOL TAXABLE VALUE 44,800Homer, NY 13077-9710 DEED BOOK 1999 PG-5282 FD005 Homer Fire 74,800 TO MFULL MARKET VALUE 77,113******************************************************************************************************* 36.00-03-03.000 ************6306 Stevens Rd36.00-03-03.000 215 1 Fam Res w/ STAR-BASIC 41854 0 0 30,000Rogers Richard Homer Central 113001 20,300 COUNTY TAXABLE VALUE 207,500Rogers Vickie Lynn ACRES 1.89 207,500 TOWN TAXABLE VALUE 207,5006306 Stevens Rd EAST-0927596 NRTH-0988816 SCHOOL TAXABLE VALUE 177,500Homer, NY 13077-9710 DEED BOOK 351 PG-834 FD005 Homer Fire 207,500 TO MFULL MARKET VALUE 213,918******************************************************************************************************* 36.00-03-04.100 ************6314 Stevens Rd36.00-03-04.100 312 Vac w/imprv COUNTY TAXABLE VALUE 11,400Rogers Richard E Homer Central 113001 5,400 TOWN TAXABLE VALUE 11,400Rogers Richard Jr ACRES 3.35 11,400 SCHOOL TAXABLE VALUE 11,4006306 Stevens Rd EAST-0927939 NRTH-0989152 FD005 Homer Fire 11,400 TO MHomer, NY 13077 DEED BOOK 2015 PG-769FULL MARKET VALUE 11,753PRIOR OWNER ON 3/01/2015Rogers Richard E