You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

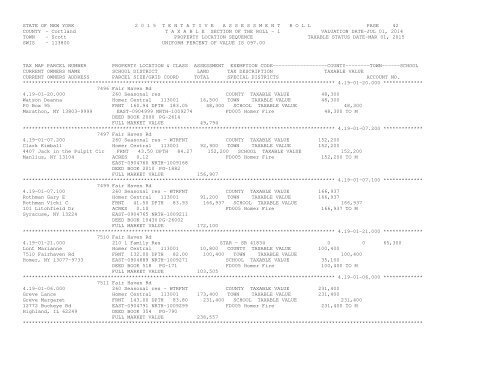

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 42COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 4.19-01-20.000 *************7496 Fair Haven Rd4.19-01-20.000 260 Seasonal res COUNTY TAXABLE VALUE 48,300Watson Deanna Homer Central 113001 16,500 TOWN TAXABLE VALUE 48,300PO Box 95 FRNT 160.94 DPTH 183.05 48,300 SCHOOL TAXABLE VALUE 48,300Marathon, NY 13803-9999 EAST-0904999 NRTH-1009274 FD005 Homer Fire 48,300 TO MDEED BOOK 2000 PG-2614FULL MARKET VALUE 49,794******************************************************************************************************* 4.19-01-07.200 *************7497 Fair Haven Rd4.19-01-07.200 260 Seasonal res - WTRFNT COUNTY TAXABLE VALUE 152,200Clark Kimball Homer Central 113001 92,900 TOWN TAXABLE VALUE 152,2004407 Jack in the Pulpit Cir FRNT 43.50 DPTH 84.27 152,200 SCHOOL TAXABLE VALUE 152,200Manlius, NY 13104 ACRES 0.12 FD005 Homer Fire 152,200 TO MEAST-0904760 NRTH-1009168DEED BOOK 2010 PG-1882FULL MARKET VALUE 156,907******************************************************************************************************* 4.19-01-07.100 *************7499 Fair Haven Rd4.19-01-07.100 260 Seasonal res - WTRFNT COUNTY TAXABLE VALUE 166,937Rothman Gary E Homer Central 113001 91,200 TOWN TAXABLE VALUE 166,937Rothman Vicki C FRNT 41.50 DPTH 83.93 166,937 SCHOOL TAXABLE VALUE 166,937101 Litchfield Dr ACRES 0.10 FD005 Homer Fire 166,937 TO MSyracuse, NY 13224 EAST-0904765 NRTH-1009211DEED BOOK 10430 PG-26002FULL MARKET VALUE 172,100******************************************************************************************************* 4.19-01-21.000 *************7510 Fair Haven Rd4.19-01-21.000 210 1 Family Res STAR - SR 41834 0 0 65,300Lont Marianne Homer Central 113001 10,800 COUNTY TAXABLE VALUE 100,4007510 Fairhaven Rd FRNT 132.00 DPTH 82.00 100,400 TOWN TAXABLE VALUE 100,400Homer, NY 13077-9733 EAST-0904889 NRTH-1009271 SCHOOL TAXABLE VALUE 35,100DEED BOOK 518 PG-171 FD005 Homer Fire 100,400 TO MFULL MARKET VALUE 103,505******************************************************************************************************* 4.19-01-06.000 *************7511 Fair Haven Rd4.19-01-06.000 260 Seasonal res - WTRFNT COUNTY TAXABLE VALUE 231,400Greve Lance Homer Central 113001 173,400 TOWN TAXABLE VALUE 231,400Greve Margaret FRNT 143.00 DPTH 83.80 231,400 SCHOOL TAXABLE VALUE 231,40012772 Buckeye Rd EAST-0904791 NRTH-1009299 FD005 Homer Fire 231,400 TO MHighland, IL 62249 DEED BOOK 354 PG-790FULL MARKET VALUE 238,557************************************************************************************************************************************