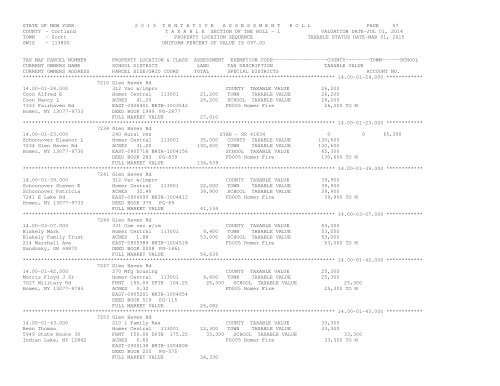

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 57COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 14.00-01-24.000 ************7210 Glen Haven Rd14.00-01-24.000 312 Vac w/imprv COUNTY TAXABLE VALUE 26,200Coon Alfred E Homer Central 113001 21,200 TOWN TAXABLE VALUE 26,200Coon Nancy L ACRES 41.20 26,200 SCHOOL TAXABLE VALUE 26,2007333 Fairhaven Rd EAST-0906401 NRTH-1003542 FD005 Homer Fire 26,200 TO MHomer, NY 13077-9733 DEED BOOK 1999 PG-2877FULL MARKET VALUE 27,010******************************************************************************************************* 14.00-01-23.000 ************7234 Glen Haven Rd14.00-01-23.000 240 Rural res STAR - SR 41834 0 0 65,300Schoonover Eleanor L Homer Central 113001 35,000 COUNTY TAXABLE VALUE 130,6007234 Glen Haven Rd ACRES 31.20 130,600 TOWN TAXABLE VALUE 130,600Homer, NY 13077-9730 EAST-0905718 NRTH-1004156 SCHOOL TAXABLE VALUE 65,300DEED BOOK 283 PG-839 FD005 Homer Fire 130,600 TO MFULL MARKET VALUE 134,639******************************************************************************************************* 14.00-01-39.000 ************7241 Glen Haven Rd14.00-01-39.000 312 Vac w/imprv COUNTY TAXABLE VALUE 39,900Schoonover Steven E Homer Central 113001 22,000 TOWN TAXABLE VALUE 39,900Schoonover Patricia ACRES 32.40 39,900 SCHOOL TAXABLE VALUE 39,9007241 E Lake Rd EAST-0904090 NRTH-1004412 FD005 Homer Fire 39,900 TO MHomer, NY 13077-9733 DEED BOOK 375 PG-89FULL MARKET VALUE 41,134******************************************************************************************************* 14.00-03-07.000 ************7244 Glen Haven Rd14.00-03-07.000 331 Com vac w/im COUNTY TAXABLE VALUE 53,000Blakely Mark Homer Central 113001 9,400 TOWN TAXABLE VALUE 53,000Blakely Family Trust ACRES 1.88 53,000 SCHOOL TAXABLE VALUE 53,000214 Marshall Ave EAST-0905389 NRTH-1004518 FD005 Homer Fire 53,000 TO MSandusky, OH 44870 DEED BOOK 2008 PG-1861FULL MARKET VALUE 54,639******************************************************************************************************* 14.00-01-42.000 ************7247 Glen Haven Rd14.00-01-42.000 270 Mfg housing COUNTY TAXABLE VALUE 25,300Morris Floyd J Sr Homer Central 113001 9,600 TOWN TAXABLE VALUE 25,3007027 Military Rd FRNT 165.00 DPTH 104.25 25,300 SCHOOL TAXABLE VALUE 25,300Homer, NY 13077-9743 ACRES 0.32 FD005 Homer Fire 25,300 TO MEAST-0905201 NRTH-1004654DEED BOOK 519 PG-115FULL MARKET VALUE 26,082******************************************************************************************************* 14.00-01-43.000 ************7253 Glen Haven Rd14.00-01-43.000 210 1 Family Res COUNTY TAXABLE VALUE 33,300Bean Thomas Homer Central 113001 12,300 TOWN TAXABLE VALUE 33,3005949 State Route 30 FRNT 150.00 DPTH 175.25 33,300 SCHOOL TAXABLE VALUE 33,300Indian Lake, NY 12842 ACRES 0.60 FD005 Homer Fire 33,300 TO MEAST-0905136 NRTH-1004808DEED BOOK 255 PG-575FULL MARKET VALUE 34,330

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 58COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 14.00-03-03.110 ************7270 Glen Haven Rd14.00-03-03.110 210 1 Family Res STAR - SR 41834 0 0 65,300Burch W James Homer Central 113001 21,700 COUNTY TAXABLE VALUE 72,400Burch Linda M ACRES 2.74 72,400 TOWN TAXABLE VALUE 72,4007270 Glen Haven Rd EAST-0905467 NRTH-1005090 SCHOOL TAXABLE VALUE 7,100Homer, NY 13077-9735 DEED BOOK 2000 PG-3891 FD005 Homer Fire 72,400 TO MFULL MARKET VALUE 74,639******************************************************************************************************* 14.00-01-44.000 ************7285 Glen Haven Rd14.00-01-44.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Dumond John E Homer Central 113001 33,900 COUNTY TAXABLE VALUE 81,500Dumond Cynthia A ACRES 10.29 BANKCORELOG 81,500 TOWN TAXABLE VALUE 81,5007285 Glen Haven Rd EAST-0904887 NRTH-1005094 SCHOOL TAXABLE VALUE 51,500Homer, NY 13077-9730 DEED BOOK 2002 PG-2691 FD005 Homer Fire 81,500 TO MFULL MARKET VALUE 84,021******************************************************************************************************* 14.00-03-01.000 ************7286 Glen Haven Rd14.00-03-01.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000McIntyre Cynthia A Homer Central 113001 21,100 COUNTY TAXABLE VALUE 116,9007286 Glen Haven Rd ACRES 2.32 116,900 TOWN TAXABLE VALUE 116,900Homer, NY 13077 EAST-0905449 NRTH-1005336 SCHOOL TAXABLE VALUE 86,900DEED BOOK 2010 PG-5636 FD005 Homer Fire 116,900 TO MFULL MARKET VALUE 120,515******************************************************************************************************* 14.00-01-48.110 ************7343 Glen Haven Rd14.00-01-48.110 210 1 Family Res STAR - SR 41834 0 0 65,300Lapp Hazel M Homer Central 113001 23,100 VET COM CT 41131 10,000 10,000 07343 Glen Haven Rd ACRES 2.70 122,400 COUNTY TAXABLE VALUE 112,400Homer, NY 13077-9790 EAST-0904937 NRTH-1005560 TOWN TAXABLE VALUE 112,400DEED BOOK 205 PG-374 SCHOOL TAXABLE VALUE 57,100FULL MARKET VALUE 126,186 FD005 Homer Fire 122,400 TO M******************************************************************************************************* 14.00-01-48.200 ************7349 Glen Haven Rd14.00-01-48.200 270 Mfg housing STAR - SR 41834 0 0 65,300Vanco David L Homer Central 113001 32,200 COUNTY TAXABLE VALUE 99,600Culp Marian L ACRES 7.75 99,600 TOWN TAXABLE VALUE 99,6007349 Glen Haven Rd EAST-0904447 NRTH-1005262 SCHOOL TAXABLE VALUE 34,300Homer, NY 13077 DEED BOOK 2000, PG-4320, FD005 Homer Fire 99,600 TO MFULL MARKET VALUE 102,680******************************************************************************************************* 14.00-01-49.000 ************7393 Glen Haven Rd14.00-01-49.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Sujkowski Marcin Homer Central 113001 24,000 COUNTY TAXABLE VALUE 138,500Sujkowski Sarah ACRES 4.10 138,500 TOWN TAXABLE VALUE 138,5007393 Glen Haven Rd EAST-0904167 NRTH-1005245 SCHOOL TAXABLE VALUE 108,500Homer, NY 13077 DEED BOOK 10353 PG-61002 FD005 Homer Fire 138,500 TO MFULL MARKET VALUE 142,784************************************************************************************************************************************