Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

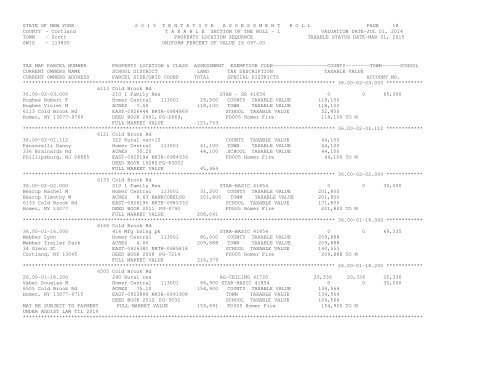

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 18COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 36.00-02-03.000 ************6113 Cold Brook Rd36.00-02-03.000 210 1 Family Res STAR - SR 41834 0 0 65,300Hughes Robert F Homer Central 113001 29,500 COUNTY TAXABLE VALUE 118,100Hughes Violet M ACRES 7.50 118,100 TOWN TAXABLE VALUE 118,1006113 Cold Brook Rd EAST-0926444 NRTH-0984869 SCHOOL TAXABLE VALUE 52,800Homer, NY 13077-9769 DEED BOOK 2001, PG-2669, FD005 Homer Fire 118,100 TO MFULL MARKET VALUE 121,753******************************************************************************************************* 36.00-02-01.112 ************6121 Cold Brook Rd36.00-02-01.112 322 Rural vac>10 COUNTY TAXABLE VALUE 44,100Panzarelli Danny Homer Central 113001 41,100 TOWN TAXABLE VALUE 44,100336 Brainards Rd ACRES 30.20 44,100 SCHOOL TAXABLE VALUE 44,100Phillipsburg, NJ 08865 EAST-0925194 NRTH-0984939 FD005 Homer Fire 44,100 TO MDEED BOOK 10282 PG-83002FULL MARKET VALUE 45,464******************************************************************************************************* 36.00-02-02.000 ************6133 Cold Brook Rd36.00-02-02.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Bearup Rachel M Homer Central 113001 31,200 COUNTY TAXABLE VALUE 201,800Bearup Timothy W ACRES 8.63 BANKCORELOG 201,800 TOWN TAXABLE VALUE 201,8006133 Cold Brook Rd EAST-0926190 NRTH-0985333 SCHOOL TAXABLE VALUE 171,800Homer, NY 13077 DEED BOOK 2011 PG-4790 FD005 Homer Fire 201,800 TO MFULL MARKET VALUE 208,041******************************************************************************************************* 36.00-01-16.000 ************6166 Cold Brook Rd36.00-01-16.000 416 Mfg hsing pk STAR-BASIC 41854 0 0 69,335Webber Lynn Homer Central 113001 80,000 COUNTY TAXABLE VALUE 209,888Webber Trailer Park ACRES 4.00 209,888 TOWN TAXABLE VALUE 209,88834 Glenn St EAST-0926381 NRTH-0985818 SCHOOL TAXABLE VALUE 140,553<strong>Cortland</strong>, NY 13045 DEED BOOK 2008 PG-7214 FD005 Homer Fire 209,888 TO MFULL MARKET VALUE 216,379******************************************************************************************************* 26.00-01-18.200 ************6505 Cold Brook Rd26.00-01-18.200 240 Rural res AG-CEILING 41720 20,336 20,336 20,336Vaber Douglas M Homer Central 113001 66,900 STAR-BASIC 41854 0 0 30,0006505 Cold Brook Rd ACRES 75.10 154,900 COUNTY TAXABLE VALUE 134,564Homer, NY 13077-9715 EAST-0923806 NRTH-0991908 TOWN TAXABLE VALUE 134,564DEED BOOK 2012 PG-5032 SCHOOL TAXABLE VALUE 104,564MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 159,691 FD005 Homer Fire 154,900 TO MUNDER AGDIST LAW TIL 2019************************************************************************************************************************************