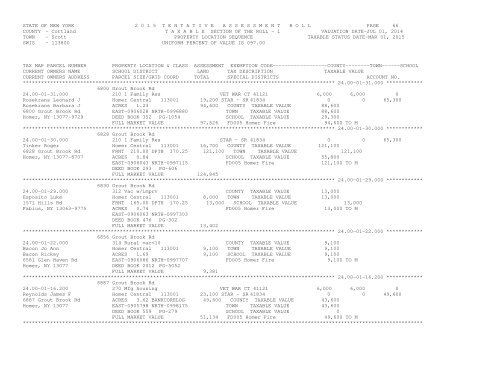

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 65COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-06-25.000 ************6740 Grout Brook Rd24.00-06-25.000 210 1 Family Res VET COM CT 41131 10,000 10,000 0Williams (LU) H Winston & Gera Homer Central 113001 22,600 STAR - SR 41834 0 0 65,300Williams Andrew W ACRES 3.29 124,100 VET DIS CT 41141 20,000 20,000 0Andrew Williams EAST-0906440 NRTH-0995565 COUNTY TAXABLE VALUE 94,1006740 Grout Brook Rd DEED BOOK 2012 PG-2762 TOWN TAXABLE VALUE 94,100Homer, NY 13077 FULL MARKET VALUE 127,938 SCHOOL TAXABLE VALUE 58,800FD005 Homer Fire 124,100 TO M******************************************************************************************************* 24.00-06-26.000 ************6754 Grout Brook Rd24.00-06-26.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Baldwin Bobby L Homer Central 113001 24,200 COUNTY TAXABLE VALUE 87,500Baldwin Betsy ACRES 4.24 BANKCORELOG 87,500 TOWN TAXABLE VALUE 87,5006754 Grout Brook Rd EAST-0906485 NRTH-0995945 SCHOOL TAXABLE VALUE 57,500Homer, NY 13077 DEED BOOK 10614 PG-49002 FD005 Homer Fire 87,500 TO MFULL MARKET VALUE 90,206******************************************************************************************************* 24.00-06-03.000 ************6770 Grout Brook Rd24.00-06-03.000 210 1 Family Res STAR - SR 41834 0 0 65,300Riter Kathleen M Homer Central 113001 16,800 COUNTY TAXABLE VALUE 80,100Riter Matthew S FRNT 100.00 DPTH 275.25 80,100 TOWN TAXABLE VALUE 80,1006770 Grout Brook Rd ACRES 0.85 SCHOOL TAXABLE VALUE 14,800Homer, NY 13077 EAST-0906336 NRTH-0996265 FD005 Homer Fire 80,100 TO MDEED BOOK 2009 PG-2766FULL MARKET VALUE 82,577******************************************************************************************************* 24.00-06-02.000 ************6772 Grout Brook Rd24.00-06-02.000 260 Seasonal res COUNTY TAXABLE VALUE 7,500Kabat Patricia A Homer Central 113001 6,200 TOWN TAXABLE VALUE 7,5006774 Grout Brook Rd FRNT 150.00 DPTH 260.52 7,500 SCHOOL TAXABLE VALUE 7,500Homer, NY 13077 EAST-0906255 NRTH-0996378 FD005 Homer Fire 7,500 TO MDEED BOOK 2008 PG-7149FULL MARKET VALUE 7,732******************************************************************************************************* 24.00-06-01.000 ************6774 Grout Brook Rd24.00-06-01.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Kabat Patricia Homer Central 113001 20,700 COUNTY TAXABLE VALUE 108,5006774 Grout Brook Rd FRNT 351.50 DPTH 260.52 108,500 TOWN TAXABLE VALUE 108,500Homer, NY 13077-8706 ACRES 2.15 SCHOOL TAXABLE VALUE 78,500EAST-0906134 NRTH-0996601 FD005 Homer Fire 108,500 TO MDEED BOOK 368 PG-796FULL MARKET VALUE 111,856************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 66COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-01-31.000 ************6800 Grout Brook Rd24.00-01-31.000 210 1 Family Res VET WAR CT 41121 6,000 6,000 0Rosekrans Leonard J Homer Central 113001 19,200 STAR - SR 41834 0 0 65,300Rosekrans Barbara J ACRES 1.23 94,600 COUNTY TAXABLE VALUE 88,6006800 Grout Brook Rd EAST-0906028 NRTH-0996880 TOWN TAXABLE VALUE 88,600Homer, NY 13077-9729 DEED BOOK 352 PG-1054 SCHOOL TAXABLE VALUE 29,300FULL MARKET VALUE 97,526 FD005 Homer Fire 94,600 TO M******************************************************************************************************* 24.00-01-30.000 ************6828 Grout Brook Rd24.00-01-30.000 210 1 Family Res STAR - SR 41834 0 0 65,300Tinker Roger Homer Central 113001 16,700 COUNTY TAXABLE VALUE 121,1006828 Grout Brook Rd FRNT 210.00 DPTH 170.25 121,100 TOWN TAXABLE VALUE 121,100Homer, NY 13077-8707 ACRES 0.84 SCHOOL TAXABLE VALUE 55,800EAST-0906043 NRTH-0997115 FD005 Homer Fire 121,100 TO MDEED BOOK 293 PG-606FULL MARKET VALUE 124,845******************************************************************************************************* 24.00-01-29.000 ************6830 Grout Brook Rd24.00-01-29.000 312 Vac w/imprv COUNTY TAXABLE VALUE 13,000Esposito Luke Homer Central 113001 8,000 TOWN TAXABLE VALUE 13,0001571 Hills Rd FRNT 165.00 DPTH 170.25 13,000 SCHOOL TAXABLE VALUE 13,000Fabius, NY 13063-9775 ACRES 0.74 FD005 Homer Fire 13,000 TO MEAST-0906063 NRTH-0997303DEED BOOK 476 PG-302FULL MARKET VALUE 13,402******************************************************************************************************* 24.00-01-22.000 ************6856 Grout Brook Rd24.00-01-22.000 314 Rural vac