Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

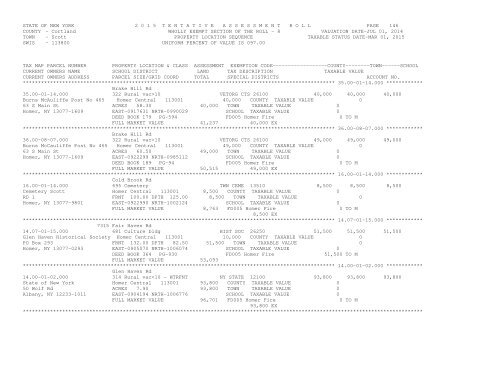

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 146COUNTY - <strong>Cortland</strong> WHOLLY EXEMPT SECTION OF THE ROLL - 8 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 35.00-01-14.000 ************Brake Hill Rd35.00-01-14.000 322 Rural vac>10 VETORG CTS 26100 40,000 40,000 40,000Burns McAuliffe Post No 465 Homer Central 113001 40,000 COUNTY TAXABLE VALUE 063 S Main St ACRES 58.30 40,000 TOWN TAXABLE VALUE 0Homer, NY 13077-1609 EAST-0917631 NRTH-0990029 SCHOOL TAXABLE VALUE 0DEED BOOK 179 PG-594 FD005 Homer Fire 0 TO MFULL MARKET VALUE 41,237 40,000 EX******************************************************************************************************* 36.00-08-07.000 ************Brake Hill Rd36.00-08-07.000 322 Rural vac>10 VETORG CTS 26100 49,000 49,000 49,000Burns McCauliffe Post No 465 Homer Central 113001 49,000 COUNTY TAXABLE VALUE 063 S Main St ACRES 60.50 49,000 TOWN TAXABLE VALUE 0Homer, NY 13077-1609 EAST-0922299 NRTH-0985112 SCHOOL TAXABLE VALUE 0DEED BOOK 189 PG-94 FD005 Homer Fire 0 TO MFULL MARKET VALUE 50,515 49,000 EX******************************************************************************************************* 16.00-01-14.000 ************Cold Brook Rd16.00-01-14.000 695 Cemetery TWN CEME 13510 8,500 8,500 8,500Cemetery <strong>Scott</strong> Homer Central 113001 8,500 COUNTY TAXABLE VALUE 0RD 1 FRNT 100.00 DPTH 125.00 8,500 TOWN TAXABLE VALUE 0Homer, NY 13077-9801 EAST-0922990 NRTH-1002124 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 8,763 FD005 Homer Fire 0 TO M8,500 EX******************************************************************************************************* 14.07-01-15.000 ************7315 Fair Haven Rd14.07-01-15.000 681 Culture bldg HIST SOC 26250 51,500 51,500 51,500Glen Haven Historical Society Homer Central 113001 10,000 COUNTY TAXABLE VALUE 0PO Box 293 FRNT 132.00 DPTH 82.50 51,500 TOWN TAXABLE VALUE 0Homer, NY 13077-0293 EAST-0905070 NRTH-1006074 SCHOOL TAXABLE VALUE 0DEED BOOK 364 PG-930 FD005 Homer Fire 51,500 TO MFULL MARKET VALUE 53,093******************************************************************************************************* 14.00-01-02.000 ************Glen Haven Rd14.00-01-02.000 314 Rural vac