Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

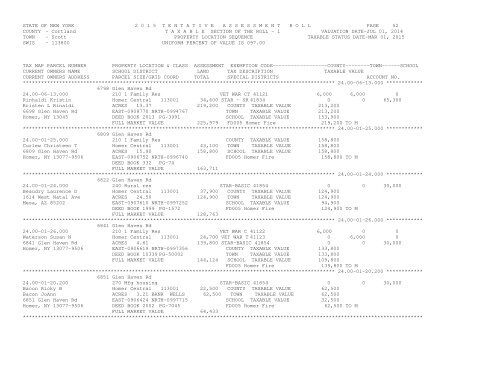

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 52COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-06-13.000 ************6798 Glen Haven Rd24.00-06-13.000 210 1 Family Res VET WAR CT 41121 6,000 6,000 0Rinhaldi Kristin Homer Central 113001 34,600 STAR - SR 41834 0 0 65,300Kristen L Rinaldi ACRES 13.37 219,200 COUNTY TAXABLE VALUE 213,2006698 Glen Haven Rd EAST-0908770 NRTH-0994767 TOWN TAXABLE VALUE 213,200Homer, NY 13045 DEED BOOK 2013 PG-3991 SCHOOL TAXABLE VALUE 153,900FULL MARKET VALUE 225,979 FD005 Homer Fire 219,200 TO M******************************************************************************************************* 24.00-01-25.000 ************6809 Glen Haven Rd24.00-01-25.000 210 1 Family Res COUNTY TAXABLE VALUE 158,800Curlew Christeen T Homer Central 113001 43,100 TOWN TAXABLE VALUE 158,8006809 Glen Haven Rd ACRES 15.90 158,800 SCHOOL TAXABLE VALUE 158,800Homer, NY 13077-9506 EAST-0906752 NRTH-0996740 FD005 Homer Fire 158,800 TO MDEED BOOK 332 PG-74FULL MARKET VALUE 163,711******************************************************************************************************* 24.00-01-24.000 ************6822 Glen Haven Rd24.00-01-24.000 240 Rural res STAR-BASIC 41854 0 0 30,000Beaudry Laurence D Homer Central 113001 37,900 COUNTY TAXABLE VALUE 124,9001614 West Natal Ave ACRES 24.50 124,900 TOWN TAXABLE VALUE 124,900Mesa, AZ 85202 EAST-0907610 NRTH-0997252 SCHOOL TAXABLE VALUE 94,900DEED BOOK 1999 PG-1572 FD005 Homer Fire 124,900 TO MFULL MARKET VALUE 128,763******************************************************************************************************* 24.00-01-26.000 ************6841 Glen Haven Rd24.00-01-26.000 210 1 Family Res VET WAR C 41122 6,000 0 0Waterson Susan N Homer Central 113001 24,700 VET WAR T 41123 0 6,000 06841 Glen Haven Rd ACRES 4.61 139,800 STAR-BASIC 41854 0 0 30,000Homer, NY 13077-9506 EAST-0906619 NRTH-0997356 COUNTY TAXABLE VALUE 133,800DEED BOOK 10339 PG-50002 TOWN TAXABLE VALUE 133,800FULL MARKET VALUE 144,124 SCHOOL TAXABLE VALUE 109,800FD005 Homer Fire 139,800 TO M******************************************************************************************************* 24.00-01-20.200 ************6851 Glen Haven Rd24.00-01-20.200 270 Mfg housing STAR-BASIC 41854 0 0 30,000Bacon Ricky B Homer Central 113001 22,500 COUNTY TAXABLE VALUE 62,500Bacon JoAnn ACRES 3.21 BANK WELLS 62,500 TOWN TAXABLE VALUE 62,5006851 Glen Haven Rd EAST-0906424 NRTH-0997715 SCHOOL TAXABLE VALUE 32,500Homer, NY 13077-9506 DEED BOOK 2002 PG-7045 FD005 Homer Fire 62,500 TO MFULL MARKET VALUE 64,433************************************************************************************************************************************