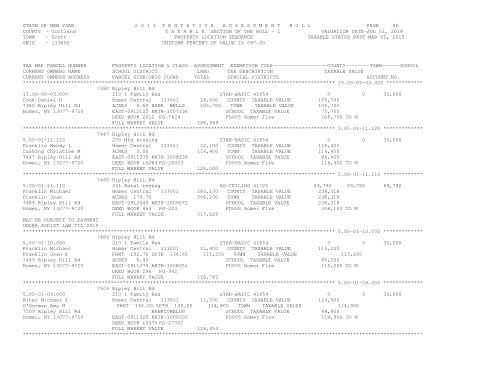

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 89COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 15.00-04-03.000 ************7235 Ripley Hill Rd15.00-04-03.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Frenia Joseph J Jr Homer Central 113001 20,500 COUNTY TAXABLE VALUE 122,4007235 Ripley Hill Rd ACRES 2.00 122,400 TOWN TAXABLE VALUE 122,400Homer, NY 13077-9719 EAST-0911620 NRTH-1004690 SCHOOL TAXABLE VALUE 92,400DEED BOOK 1998 PG-1131 FD005 Homer Fire 122,400 TO MFULL MARKET VALUE 126,186******************************************************************************************************* 15.00-04-02.000 ************7243 Ripley Hill Rd15.00-04-02.000 270 Mfg housing COUNTY TAXABLE VALUE 66,000Stevens Trust Richard C Jr Homer Central 113001 20,500 TOWN TAXABLE VALUE 66,000Renee Weeks ACRES 2.00 66,000 SCHOOL TAXABLE VALUE 66,00098 Owego St EAST-0911581 NRTH-1004987 FD005 Homer Fire 66,000 TO M<strong>Cortland</strong>, NY 13045 DEED BOOK 2012 PG-920FULL MARKET VALUE 68,041******************************************************************************************************* 15.00-05-09.120 ************7275 Ripley Hill Rd15.00-05-09.120 270 Mfg housing STAR-BASIC 41854 0 0 30,000Hapgood Harold W Homer Central 113001 20,500 COUNTY TAXABLE VALUE 107,9007275 Ripley Hill Rd ACRES 2.03 BANKCORELOG 107,900 TOWN TAXABLE VALUE 107,900Homer, NY 13077-9720 EAST-0911547 NRTH-1005747 SCHOOL TAXABLE VALUE 77,900DEED BOOK 2012 PG-1463 FD005 Homer Fire 107,900 TO MFULL MARKET VALUE 111,237******************************************************************************************************* 15.00-02-09.200 ************7310 Ripley Hill Rd15.00-02-09.200 240 Rural res COUNTY TAXABLE VALUE 173,500McNamara Robert W Homer Central 113001 77,900 TOWN TAXABLE VALUE 173,500McNamara Judith ACRES 28.29 173,500 SCHOOL TAXABLE VALUE 173,5007310 Ripley Hill Rd EAST-0912851 NRTH-1005919 FD005 Homer Fire 173,500 TO MHomer, NY 13077-9719 DEED BOOK 541 PG-43FULL MARKET VALUE 178,866******************************************************************************************************* 15.00-05-09.200 ************7311 Ripley Hill Rd15.00-05-09.200 270 Mfg housing STAR-BASIC 41854 0 0 30,000Thompson David J Sr Homer Central 113001 20,500 COUNTY TAXABLE VALUE 55,700Thompson Bonnie L ACRES 2.00 55,700 TOWN TAXABLE VALUE 55,700PO Box 253 EAST-0911564 NRTH-1005990 SCHOOL TAXABLE VALUE 25,700Homer, NY 13077-0253 DEED BOOK 2001 PG-2375 FD005 Homer Fire 55,700 TO MFULL MARKET VALUE 57,423******************************************************************************************************* 15.00-05-06.000 ************7356 Ripley Hill Rd15.00-05-06.000 270 Mfg housing STAR-BASIC 41854 0 0 30,000Guy Michael P Homer Central 113001 29,200 COUNTY TAXABLE VALUE 107,900Guy Jerri Ann ACRES 10.00 107,900 TOWN TAXABLE VALUE 107,9007356 Ripley Hill Rd EAST-0912185 NRTH-1006483 SCHOOL TAXABLE VALUE 77,900Homer, NY 13077-9720 DEED BOOK 1998 PG-685 FD005 Homer Fire 107,900 TO MFULL MARKET VALUE 111,237************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 90COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 15.00-05-03.000 ************7380 Ripley Hill Rd15.00-05-03.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Cook Daniel H Homer Central 113001 24,000 COUNTY TAXABLE VALUE 105,7007380 Ripley Hill Rd ACRES 6.60 BANK WELLS 105,700 TOWN TAXABLE VALUE 105,700Homer, NY 13077-9720 EAST-0912125 NRTH-1007136 SCHOOL TAXABLE VALUE 75,700DEED BOOK 2012 PG-7624 FD005 Homer Fire 105,700 TO MFULL MARKET VALUE 108,969******************************************************************************************************* 5.00-01-11.120 *************7447 Ripley Hill Rd5.00-01-11.120 270 Mfg housing STAR-BASIC 41854 0 0 30,000Franklin Wendy L Homer Central 113001 22,100 COUNTY TAXABLE VALUE 116,400Cushing Christine M ACRES 3.00 116,400 TOWN TAXABLE VALUE 116,4007447 Ripley Hill Rd EAST-0911335 NRTH-1008238 SCHOOL TAXABLE VALUE 86,400Homer, NY 13077-9720 DEED BOOK 10283 PG-26003 FD005 Homer Fire 116,400 TO MFULL MARKET VALUE 120,000******************************************************************************************************* 5.00-01-11.110 *************7465 Ripley Hill Rd5.00-01-11.110 241 Rural res&ag AG-CEILING 41720 69,782 69,782 69,782Franklin Michael Homer Central 113001 183,100 COUNTY TAXABLE VALUE 238,318Franklin Joan ACRES 179.70 308,100 TOWN TAXABLE VALUE 238,3187489 Ripley Hill Rd EAST-0912440 NRTH-1009072 SCHOOL TAXABLE VALUE 238,318Homer, NY 13077-9720 DEED BOOK 464 PG-203 FD005 Homer Fire 308,100 TO MFULL MARKET VALUE 317,629MAY BE SUBJECT TO PAYMENTUNDER AGDIST LAW TIL 2019******************************************************************************************************* 5.00-01-10.000 *************7489 Ripley Hill Rd5.00-01-10.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Franklin Michael Homer Central 113001 11,400 COUNTY TAXABLE VALUE 115,200Franklin Joan E FRNT 152.70 DPTH 136.65 115,200 TOWN TAXABLE VALUE 115,2007489 Ripley Hill Rd ACRES 0.45 SCHOOL TAXABLE VALUE 85,200Homer, NY 13077-9720 EAST-0911379 NRTH-1008951 FD005 Homer Fire 115,200 TO MDEED BOOK 296 PG-942FULL MARKET VALUE 118,763******************************************************************************************************* 5.00-01-09.000 *************7509 Ripley Hill Rd5.00-01-09.000 210 1 Family Res STAR-BASIC 41854 0 0 30,000Riter Michael P Homer Central 113001 11,700 COUNTY TAXABLE VALUE 114,900O'Gorman Amy M FRNT 150.00 DPTH 135.25 114,900 TOWN TAXABLE VALUE 114,9007509 Ripley Hill Rd BANKCORELOG SCHOOL TAXABLE VALUE 84,900Homer, NY 13077-9720 EAST-0911325 NRTH-1009302 FD005 Homer Fire 114,900 TO MDEED BOOK 10376 PG-27002FULL MARKET VALUE 118,454************************************************************************************************************************************